by Tony Wikrent

Economics Action Group, North Carolina Democratic Party Progressive Caucus

Strategic Political Economy

Organizing for Survival in New York CityChina Spends $600 Billion To Trump America’s Economy

[Forbes, May 1, 2020]

Ten years from now, when economists mull the exact moment the U.S. ceded the future to China this week’s events are sure to top the list of time-stamp candidates.

This was the week, after all, when Chinese President Xi Jinping tossed another 4 trillion yuan, or $565 billion, at an economy taking devastating coronavirus blows....

Within the same 24 hours during which Xi’s announced a nearly $600 billion plan to build even more airports, railways and power grids, Senate Majority Leader McConnell gave the thumbs down to comparable upgrades to America’s economic hardware. “Infrastructure is unrelated to the coronavirus pandemic that we're all experiencing and trying to figure out how to go forward,” McConnell said.

Music to Xi’s ears. The trillions of dollars his government lavished on the “Made in China 2025” extravaganza is already positioning China to lead the future of artificial intelligence, automation, micro-processing, renewable energy, robotics, self-driving vehicles, you name it. And Trump made it easy for Xi. As China prepares for the global economy it will confront in 2025, Trump is making coal great again.Why Mitch McConnell Wants States to Go Bankrupt David Frum, April 25, 2020 [The Atlantic]

Note this is by former Bush Jr. speech writer Frum, so represents thinking inside the Republican party elites.

State bankruptcy is not some passing fancy. Republicans have been advancing the idea for more than a decade. Back in 2011, Jeb Bush and Newt Gingrich published a jointly bylined op-ed advocating state bankruptcy as a solution for the state of California. The Tea Party Congress elected in 2010 explored the idea of state bankruptcy in House hearings and Senate debates. Newt Gingrich promoted it in his run for the 2012 Republican presidential nomination.... A bankruptcy is not a default.... A default is a sovereign act. A defaulting sovereign can decide for itself which—if any—debts to pay in full, which to repay in part, which debts to not pay at all. Bankruptcy, by contrast, is a legal process in which a judge decides which debts will be paid, in what order, and in what amount....

Since 2010, American fiscal federalism has been defined by three overwhelming facts.

First, the country’s wealthiest and most productive states are overwhelmingly blue. Of the 15 states least reliant on federal transfers, 11 are led by Democratic governors. Of the 15 states most reliant on federal transfers, 11 have Republican governors.

Second, Congress is dominated by Republicans. Republicans controlled the House for eight of the last 10 years; the Senate for six. Because of the Republican hold on the Senate, the federal judiciary has likewise shifted in conservative and Republican directions.

A state bankruptcy process would thus enable a Republican Party based in the poorer states to use its federal ascendancy to impose its priorities upon the budgets of the richer states.

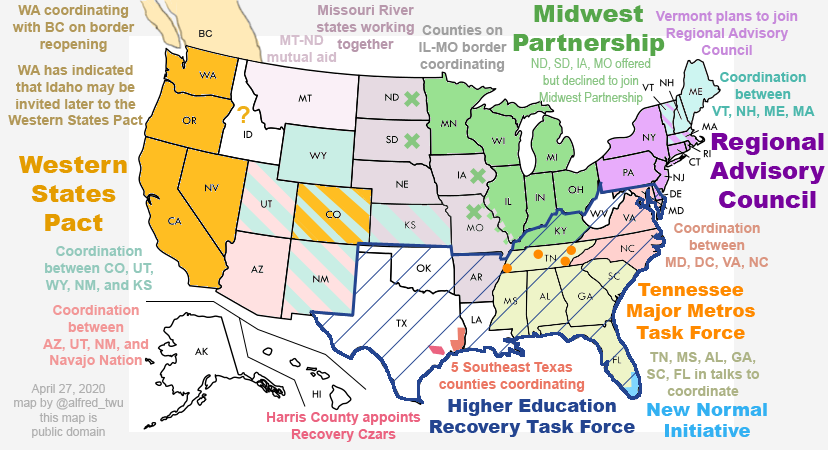

Regional compacts on #COVID19

[Twitter, via Naked Capitalism Water Cooler 4-28-20]

The fabric of the Union begins to unravel under the pressure of Trump's incompetence and Republican intransigence.

Grover and the Bathtub Barry Levinson [Huffington Post, December 6, 2017]

Grover Norquist, who was the forerunner of devalued English, continues to lead the charge in the 21st century. He continues to say his goal is to shrink government and then drown it in the bathtub. But what he is really saying is I want a revolution, I want to overturn this democracy and create a new government.... What is the metaphor? He said he wants to kill the government in a bathtub. The only substitute is overturn the government. He is a revolutionary like Lenin or Mao. He doesn’t believe in the system. He just doesn’t want to say it with as much clarity as they did....

If you just want to lower taxes is it necessary to drown the government in a bathtub? Simply say you want a lower tax code. Period. Drown the tax code, if you will. But he wants to drown the government of the United States. Kill what the founding fathers fought for....

He states his goals in devalued English. That way he remains respectable. Let me ask you a question: Norquist says he is trying to change the tone in the state capitals and turn them toward bitterness and partisanship. How do you interpret that? I’ll tell you. He doesn’t believe in a democracy because it’s obvious that he does not believe in an exchange of ideas. A democracy is based on the power of the people. He doesn’t believe in the people. What he is saying in using devalued English is I want absolute power and I have contempt for those who don’t agree. He uses the idea of state legislators as the shield for what he really wants. He wants power, control. Devalue the language, my friend. Make it murky. Remove clarity. Get attention. It’s the new form of lying.

The Pandemic

CLUSTER BOMBS Coronavirus map shows the 22 hotspots where cases could explode as eight states lift lockdownsThey can’t even manage proper testing for 100 Senators!? This is genuine failed state stuff.

As best I can see, the US has been coasting on institutions and infrastructure built primarily by the Lost, GI and Silent generations. Every generation after that has been drawing down the American patrimony. Almost nothing works properly that wasn’t built or at least started by those generations.

Modern elites, with a few exceptions, are simply rent extractors, financial elites competing to eat as much of the pie as possible.... But when the elites can’t even protect themselves? When they can’t even put together 100 tests for some of the most powerful people in the country? That’s insane. That’s straight failed state stuff.

Presymptomatic SARS-CoV-2 Infections and Transmission in a Skilled Nursing Facility (article)

Symptom-based screening alone failed to detect a high proportion of infectious cases and was not enough to control transmission in this setting.... A new approach that expands Covid-19 testing to include asymptomatic persons residing or working in skilled nursing facilities needs to be implemented now.

“[T]he degree to which doctors and scientists are, still, feeling their way, as though blindfolded, toward a true picture of the disease cautions against any sense that things have stabilized, given that our knowledge of the disease hasn’t even stabilized.” We have linked to most of the ways that doctors and scientists have been “feeling their way” as matters developed, but this is an excellent aggregation. A must-read.“Prevalence of SARS-CoV-2 Infection in Residents of a Large Homeless Shelter in Boston”

From the abstract: “A total of 147 participants (36.0%) had PCR test results positive for SARS-CoV-2. Men constituted 84.4% of individuals with PCR-positive results and 64.4% of individuals with PCR-negative results. Among individuals with PCR test results positive for SARS-CoV-2, cough (7.5%), shortness of breath (1.4%), and fever (0.7%) were all uncommon, and 87.8% were asymptomatic.”

John Burn-Murdoch @jburnmurdoch NEW: a lot of data on reported Covid deaths is highly suspect, so we’ve been looking into excess mortality — how many more people than usual have been dying around the world in recent weeks?

Jason lives in a city hostel established for homeless individuals who are in quarantine and isolation. He told me that the rules are strict and that all of his needs are being met without him having any problem adhering to isolation. Before getting sick, he had found freelance work and was living in a shelter. I came away from that conversation amazed to hear how people can thrive when their basic needs are met.RIP Dr. Lorna M. Breen, medical director emergency department at NewYork-Presbyterian Allen Hospital

NYT excerpt: "It was not clear why Dr. Breen would have taken her own life. She did not have a history of mental illness, her father said. But he said that when he last spoke with her, she seemed detached, and he could tell something was wrong. She had described to him an onslaught of patients dying before they could even be taken out of ambulances."

“Seattle’s approach to COVID-19 mirrored E.I.S.’s guidelines. New York’s did not.”

For more than a week, [infectious-disease specialist Dr. Francis] Riedo had been e-mailing with a group of colleagues who included Seattle’s top doctor for public health and Washington State’s senior health officer, as well as hundreds of epidemiologists from around the country; many of them, like Riedo, had trained at the Centers for Disease Control and Prevention, in Atlanta, in a program known as the Epidemic Intelligence Service. Alumni of the E.I.S. are considered America’s shock troops in combatting disease outbreaks. The program has more than three thousand graduates, and many now work in state and local governments across the country. “It’s kind of like a secret society, but for saving people,” Riedo told me. “If you have a question, or need to understand the local politics somewhere, or need a hand during an outbreak—if you reach out to the E.I.S. network, they’ll drop everything to help.”

Hong Kong seems to have given the world a lesson in how to effectively curb COVID-19. With a population of 7.5 million, it has reported just 4 deaths. Researchers studying Hong Kong’s approach have already found that swift surveillance, quarantine and social-distancing measures, such as the use of face masks and school closures, helped to cut coronavirus transmission — measured by the average number of people each infected person infects, or R — to close to the critical level of 1 by early February. But the paper, published1 this month, couldn’t tease apart the effects of the various measures and behavioural changes happening at the same time.

Working out the effectiveness of the unprecedented measures implemented worldwide to limit the spread of the coronavirus is now one of scientists’ most pressing questions. Researchers hope that, ultimately, they will be able to accurately predict how adding and removing control measures affects transmission rates and infection numbers. This information will be essential to governments as they design strategies to return life to normal, while keeping transmission low to prevent second waves of infection. “This is not about the next epidemic. It’s about ‘what do we do now’?” says Rosalind Eggo, a mathematical modeller at the London School of Hygiene and Tropical Medicine (LSHTM).Scientists were close to a coronavirus vaccine years ago. Then the money dried up.

[NBCNews, March 5, 2020]

For weeks, Hotez has been reaching out to pharmaceutical companies and federal scientific agencies — and even the Medical Research Council in the United Kingdom — asking them to provide the roughly $3 million needed to begin testing the vaccine's safety in humans, but so far none have done so.The two rules of neolioberalism: 1) Because, markets! 2) Go die.

"We've had some conversations with big pharma companies in recent weeks about our vaccine, and literally one said, 'Well, we're holding back to see if this thing comes back year after year,'" Hotez said.

“Op-Ed: Yes, the government can restrict your liberty to protect public health”

[Los Angeles Times, via Naked Capitalism Water Cooler 4-30-20]

“There have been very few Supreme Court cases involving the government’s power to deal with the spread of communicable diseases. The most relevant decision for today was issued in Jacobson vs. Massachusetts in 1905. In that case, the Supreme Court upheld the constitutionality of a state law requiring compulsory vaccinations against smallpox. The court declared, ‘Upon the principle of self-defense, of paramount necessity, a community has the right to protect itself against an epidemic of disease which threatens the safety of its members.’ The court explicitly rejected the claim that “liberty” under the Constitution includes the right of individuals to make decisions about their own health in instances where those decisions could endanger others. But the court also made clear that restrictions imposed by the government to control communicable diseases must have a ‘real or substantial relation’ to protecting public health. Under this standard, there is no doubt that quarantine, ‘shelter in place, and closure requirements are constitutional as a way of stopping the spread of COVID-19, even though they restrict freedom.”

Progressive policies into the breach

Here’s How to Cover Uninsured Americans During the Pandemic: Empowering Medicare to cover our health needs is comprehensive and cost-effective.Senator Bernie Sanders, April 28, 2020 [CommonDreams]

But there’s another, better way to guarantee that everyone in America gets all the health care they need, without cost, for the duration of the pandemic: Empower Medicare to pay all of the health care costs for the uninsured, as well as all out-of-pocket expenses for those with existing public or private insurance, for as long as this pandemic continues. Our Health Care Emergency Guarantee Act is more comprehensive than Trump’s vague proposal and less expensive than the Democrats’ COBRA expansion.

Let’s be clear: Even before this crisis began, 87 million Americans were uninsured or underinsured—struggling to get to a doctor when they needed to. Now the situation is much worse.

There is no doubt that the health care crisis we are facing right now is an emergency. Already, an estimated 9.2 million workers have lost their employer-sponsored insurance, and as many as 35 million people might lose coverage by the end of the crisis.

Can public banks rescue distressed states? Virtual public banking Town Halls

New York State Town Hall - Tuesday, May 5, 3:00pm ET | Facebook live:

The public is invited to join New York State Senator James Sanders Jr, fellow State Senators and Assembly Members, and panelists that include Public Banking Institute Advisory Board members Dr. Amara Enyia, Emma Chappell and Prof. Michael Hudson for a roundtable discussion, “Public Banking : An Alternative Solution to Restart the Economy Post COVID-19,” via Facebook live on Tuesday May 5th at 3:00pm.

NYC Town Hall - Thursday May 7, 6:30pm ET | virtual event

Statewide residents can join Public Bank NYC at 6:30pm ET on Thursday, May 7th for a timely and participatory virtual town hall “From Crisis to Recovery: NY's Fight for Public Banking.”

Colorado Public Banking Town HallWith Millions Unable to Pay for Housing Next Month, Organizers Plan the Largest Rent Strike in Nearly a Century

Newly formed Colorado Public Banking Coalition held an insightful virtual Town Hall this week that included PBI Chair Ellen Brown and long-time PBI advocate Earl Staelin as panelists. Attendance and registrations far exceeded expectations. The excellent presentation is now available on YouTube and the slides are available here. [watch the video]

Rent Crisis Worsening: Survey Indicates Half of Families Struggling to Pay May 1st Bills

The purpose of the federal stimulus isn’t to reward the deserving. It’s to prevent an economic collapse.

Los Angeles Offers Free Coronavirus Testing For All Residents

State governments could be short $650 billion over the next three years — well above what governors are currently seeking — according to a study by the Center on Budget and Policy Priorities, a left-leaning think tank....

The earlier round of state and local aid was targeted only to states and localities with a population of at least 500,000 residents. Pelosi has talked about providing three separate pots of money in a new package so that some of the future aid would be allotted to smaller cities and towns.

“With municipalities and counties, we’re going to have a separate account for them because many of them don’t really get what they need from the state,” she told CNN. “So we’re going to have separate direct support for townships even as low as 50,000 and below and this is a very big change.”

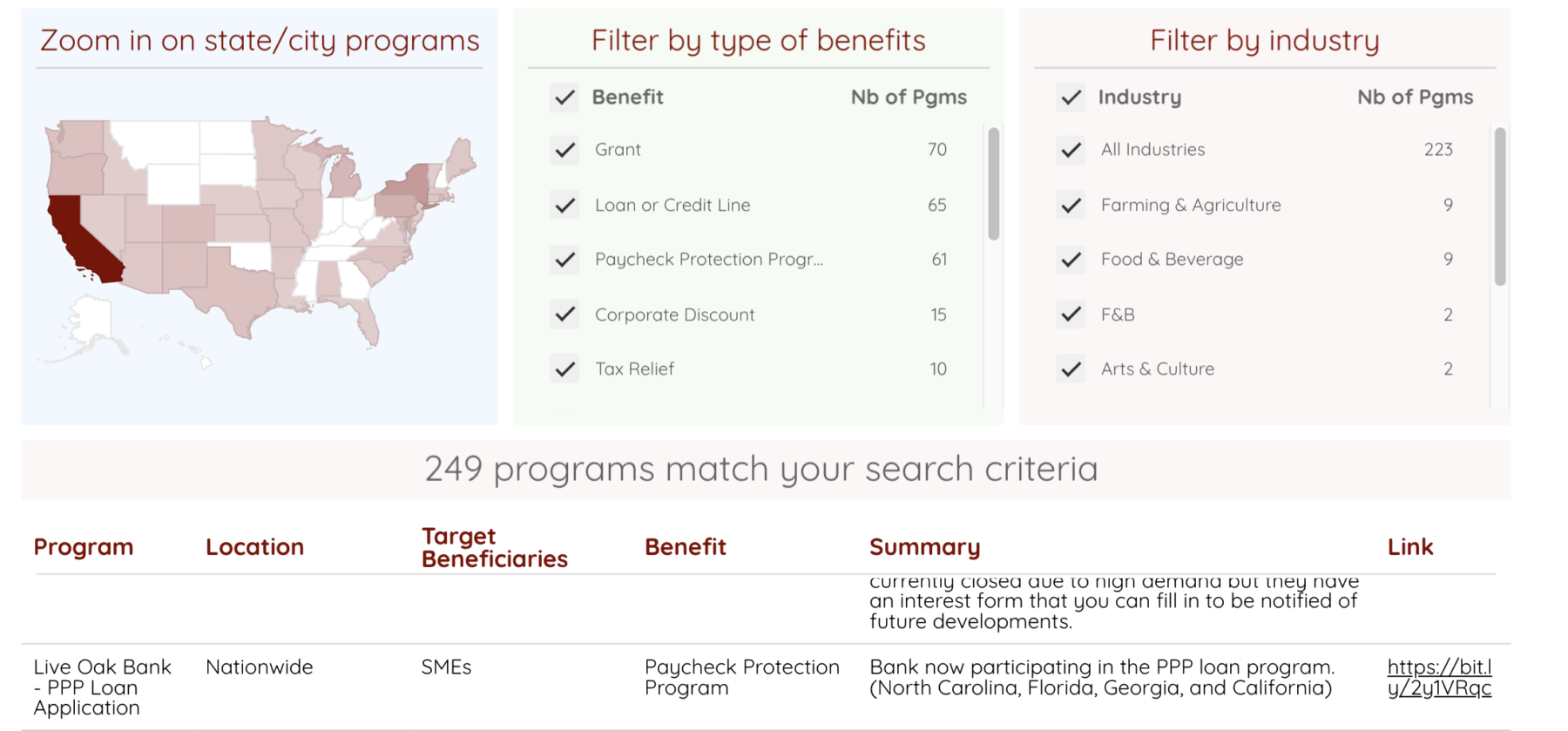

Barry Ritholtz, April 23, 2020 [The Big Picture]

...these are all local entities that can assist small firms on a regional basis. The national response is important, but lots of companies are already slipping through those cracks. Being able to research and tap into other sources of credit, loans and grants is potentially very significant to local businesses. A clearinghouse for assistance on a local basis could end up being a lifesaver for some firms.

Restoring Balance to the Economy

ICANN Board Withholds Consent for a Change of Control of the Public Interest Registry“After completing extensive due diligence, the ICANN Board finds that withholding consent of the transfer of PIR from the Internet Society (ISOC) to Ethos Capital is reasonable, and the right thing to do.”

A study on the effects of union density (union employees as a percentage of the total number of employees) published last week found that tax subsidies for Norwegian unions led to "substantial increases" in firm productivity and wages, increases that grew even larger the more productive a firm was or the more bargaining power a union had.

Researchers established a correlation between union density, wages, and productivity by first looking at how tax subsidies affect union membership. Using data collected by the Norwegian Tax Authorities and Social Services, the study examines the whole Norwegian population of workers, workplaces, and firms from 2001 to 2012.... They found that the higher the subsidy rate, the higher the rate of unionization and thus union density. The higher the union density, the higher the firm’s productivity, and the higher its workers’ wages.

Pam Martens and Russ Martens, April 28, 2020 [Wall Street on Parade]

....(2) Think Local.... (5) Check Out Credit Union Membership.... (6) Don’t Use Credit Cards from Corporations That Abuse You.... (9) Complain Loudly.... (10) Run for Office

(7) Brand Attacks: Chances are high that your local store owners don’t have a PAC and lobbyists on K Street working against your interests? Reward them with your business and starve the biggest, anti-consumer corporations until they get the message: if you want me to honor your brand, honor my right to representative government.

(8) Return the Courts to Workers: Many of the largest corporations force workers to sign away their rights to the nation’s courts as a condition of employment. It’s called mandatory arbitration and it’s an unfair process that is rigged to favor the corporation. If you interview for a new job, ask if the company has such a policy and walk away if they do. (See Judicial Apartheid: Wall Street’s Kangaroo Courts: Part I and Part II.)

Capitalism in the time of COVID19

Barofsky: Why the Small-Business Bailout Went to the Big Guys: The watchdog for the flawed 2008 Troubled Asset Relief Program explains how things went wrong again. [Bloomberg, via The Big Picture 5-1-20]Clearly, the government has failed to learn from its mistakes during the 2008-09 financial crisis. Back then, it also funneled money through the banks, encouraging them to use bailout funds to increase lending to smaller companies that had been frozen out of the banking system, and to provide relief to homeowners struggling under the weight of the foreclosure crisis.

Rather than follow the recommendations from oversight bodies to attach some strings to require or incentivize the banks to carry out its intended goals, the Treasury simply trusted that the banks, on their own initiative, would do so. Without any incentives, the banks instead used the funds to further their own goals, not those of the Treasury.

Although those lessons were discussed repeatedly in the aftermath of the financial crisis, including in my own agency’s oversight reports, the Treasury and the Small Business Administration took no heed of them when setting the rules for the current relief program. In fact, the incentives they did include only drove the banks to prioritize their most profitable and established customers over the little guys. The bigger the Paycheck Protection Plan loan, the bigger the fee.The unlikely alliance trying to rescue workplace health insurance

“Big businesses and powerful Democrats are aligning around a proposal to bail out employer health plans.”

Such an idea could hit the political sweet spot on Capitol Hill. Workplace plans, which covered an estimated 160 million Americans before the pandemic, remain popular. Democratic leaders in Congress know Republicans have little appetite for broadly expanding government coverage, and Biden has endorsed temporarily subsidizing workplace plans. Republicans, despite railing against insurer “bailouts” in Obamacare for years, are friendlier to employer-based insurance and may be more receptive to a deal that could prevent millions of people joining the Medicaid rolls.“A Potential COVID Treatment — If You Can Afford It”

“Amid a pharma lobbying blitz (detailed below), the question now is whether the government will do anything to make sure taxpayers are not fleeced on the price of a medicine that we the taxpayers funded. That’s right, as TMI reported almost two weeks ago, remdesivir isn’t some pure private-sector story from a corporation that deserves to make huge profits off a free-market innovation — on the contrary, the medicine was developed, in part, with public investments and publicly funded universities. The Clinton administration in 1996 repealed a federal rule requiring drug companies to offer taxpayer-funded medicines to consumers at a fair and reasonable price. You should re-read that piece, because you can bet this issue of pandemic profiteering will become more and more significant in the coming weeks.”

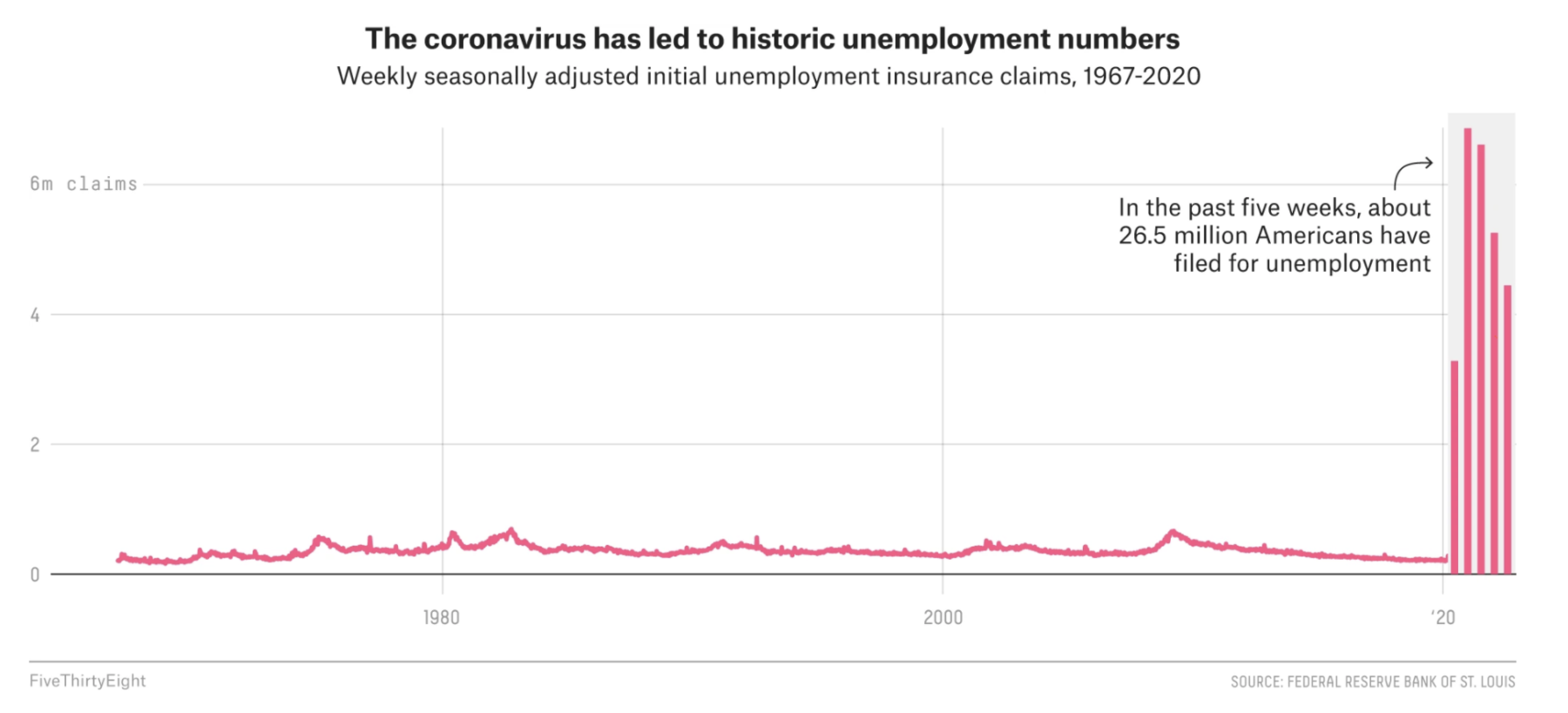

Economic Armageddon

A Staggering Toll: 30 Million Have Filed For UnemploymentAnother 3.8 million people filed claims for jobless benefits last week, according to the Labor Department. While that's down from the previous week's 4.4 million, a staggering 30.3 million have applied for unemployment in the six weeks since the coronavirus began taking a wrecking ball to the U.S. job market. That's roughly one out of five people who had a job in February.

Almost a third of U.S. pork capacity is down, the first big poultry plants closed on Friday and experts are warning that domestic shortages are just weeks away. Brazil, the world’s No. 1 shipper of chicken and beef, saw its first major closure with the halt of a poultry plant owned by JBS SA, the world’s biggest meat company. Key operations are also down in Canada, the latest being a British Columbia poultry plant.

While hundreds of plants in the Americas are still running, the staggering acceleration for supply disruptions is now raising questions over global shortfalls. Taken together, the U.S., Brazil and Canada account for about 65% of world meat trade.Nearly 900 at Tyson Foods plant test positive for coronavirus

“The Corporate Right Is Giving Us Two Choices: Go Back to Work, or Starve”

“There are two paths forward during this pandemic. The U.S. could rationally follow the science about the novel coronavirus, as complicated and incomplete as it is. This would necessitate putting much of the economy in hibernation until we have the capacity to immediately find anyone with Covid-19 and provide them with a safe place to stay in quarantine, while doing our best to keep everyone who has to work safe. For regular people to survive, we would need government action along the lines of that proposed by Sen. Bernie Sanders, I-Vt., and Rep. Pramila Jayapal, D-Wash.: guaranteeing no one goes hungry, direct emergency cash payments to everyone, Medicare covering all health costs. Alternately, we can follow the heart’s desire of the corporate right, and shove everyone back to work as soon as possible. The problem for the corporate right is that the force-everyone-to-risk-death concept is unpopular.”“Boeing CEO says ‘it will be years’ until global aviation returns to pre-pandemic levels”

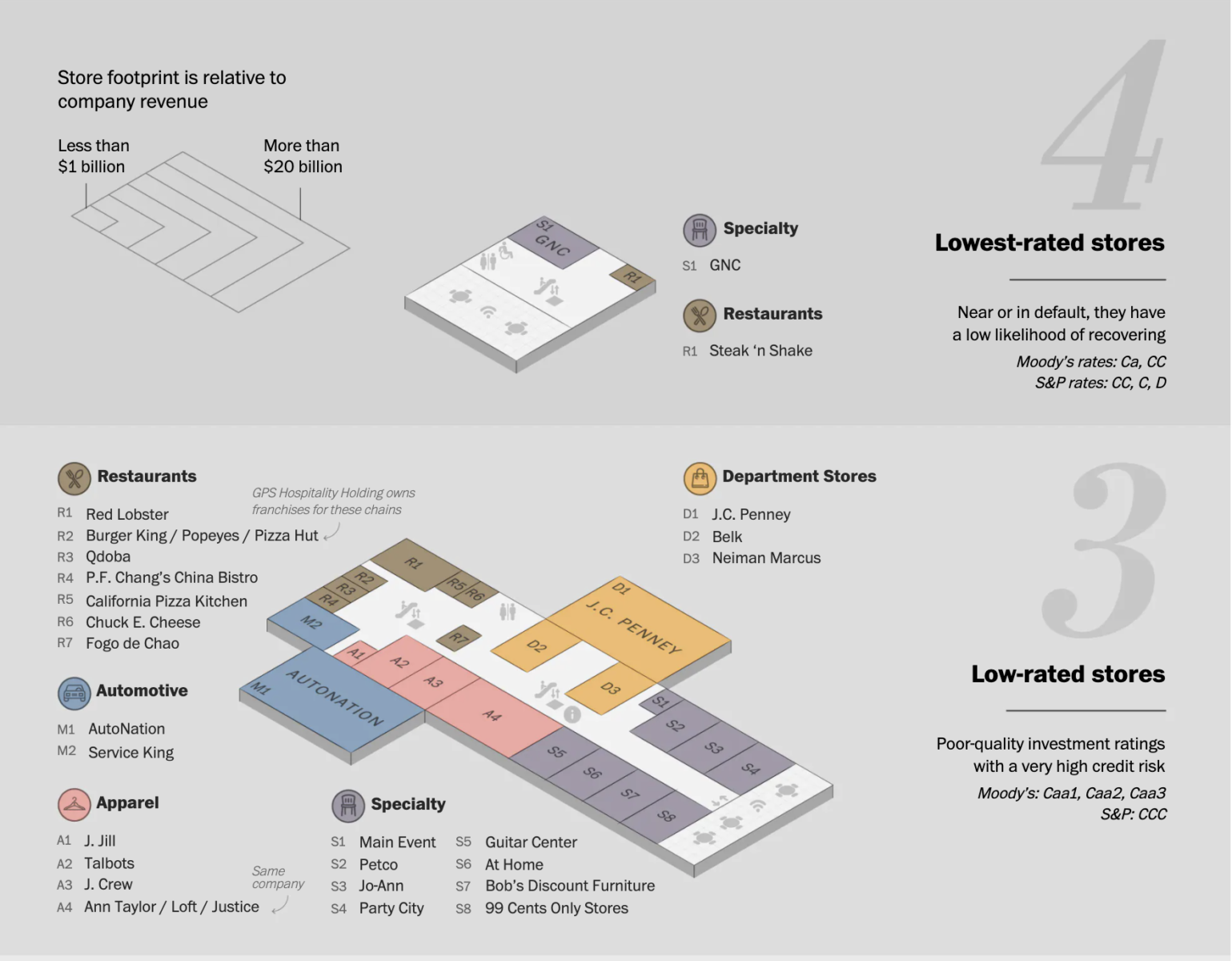

“Air traffic may not bounce back for two or three years, Boeing Co. BA-0.69% Chief Executive David Calhoun said, outlining the tough outlook for global aviation to the plane maker’s shareholders on Monday. ‘The health crisis is unlike anything we have ever experienced,’ Mr. Calhoun said at the annual meeting. ‘It will be years before this returns to pre-pandemic levels.’ Mr. Calhoun laid out the coronavirus pandemic’s toll on the industry: Global airline revenues set to drop by $314 billion this year. In the U.S., more than 2,800 planes idled. Passenger demand is down 95% from last year. ‘We are in an unpredictable and fast-changing environment, and it is difficult to estimate when the situation will stabilize,’ he added. ‘But when it does, the commercial market will be smaller and our customers’ needs will be different.'”“Is the Coronavirus going to take down any big companies?”

“The fix is already in. The Securities and Exchange Commission and the [Public Company Accounting Oversight Board (PCAOB)] have already huddled with the Big 4 audit firms more than once to discuss, together, how to address the risk the coronavirus pandemic has on their opinions on the financial statements of almost all of the public companies listed on U.S. exchanges…. I suspect the SEC and PCAOB have already given the stand down order — no going concern warnings— as they likely did in secret here in the U.S. during the financial crisis of 2008-2009, and as we found out that the the U.K government did.”The iconic brands that could disappear because of coronavirus

[Washington Post, via The Big Picture 4-30-20]

Medication Shortages Are the Next Crisis

Widespread critical-medication shortages are the next big crisis of the coronavirus pandemic. Some hospitals, including in New York, are running low on paralytic agents that are needed to safely intubate patients. Steve Corwin, the president and CEO of New York–Presbyterian, recently noted on MSNBC that his hospital is even running short on solutions needed for dialysis.... In addition to drugs for patients on mechanical ventilators, including sedatives such as etomidate, paralytics, and pain meds, we also need to fast-track the production of antibiotics such as azithromycin, cefepime, and others that we use to treat pneumonia.An FAQ on China PPE

Last week, Fred Rocafort (one of our international trade lawyers), Dan Pak (a VP of Procurement at a large East Coast hospital chain) and I put on a 90+ minute webinar on navigating PPE purchases from China. Based on the feedback we have received and the fact that a number of webinar companies have asked us to reprise it for them, we think it was a success. And by success, I mean only that those who attended left the webinar (though staying at home) with actionable information.

The company that put on the webinar — a leading legal webinar/seminar company — told us they had never put on an event where so many questions were asked. The webinar was about 45 minutes of the three of us talking and then another 45 minutes of us answering questions, but even that was not enough. We got so many questions that we promised to answer them here on the blog and we do that below.

The Carnage of Establishment Neoliberal Economics

What the Coronavirus Crisis Reveals About American Medicine[The New Yorker, via Naked Capitalism 4-28-20]

Or as Lambert Strether commented after this line from the article: “[T]he medical infrastructure of one of the world’s wealthiest nations fell apart, like a slapdash house built by one of the three little pigs.” "There are more than three pigs. And they aren’t little."

'It feels like nobody cares': the Americans living without running water amid Covid-19

A third of American households – about 120 million people – still risk having their water disconnected and racking up exorbitant fees, despite calls from a coalition of lawmakers and advocates to suspend all utility shutoffs until the country drags itself out of this unprecedented crisis. And while more than 600 localities and 13 states have mandated moratoriums on disconnecting residents since early March, some of these will soon expire as states reopen for business.

In Tennessee, where the energy burden is also very high, the governor has resisted calls for a statewide moratorium, claiming utility companies – like socially distancing residents – can be trusted to do the right thing.

Neil King@NKingofDC This is bonkers: Roughly half of all U.S. workers stand to earn more in unemployment benefits than they did at their jobs before the coronavirus pandemic brought the economy to a standstill.

‘Maybe… Pay People More,’ Says AOC as Data Shows Half of US Workers Could Make More From Unemployment Than Low-Wage Jobs

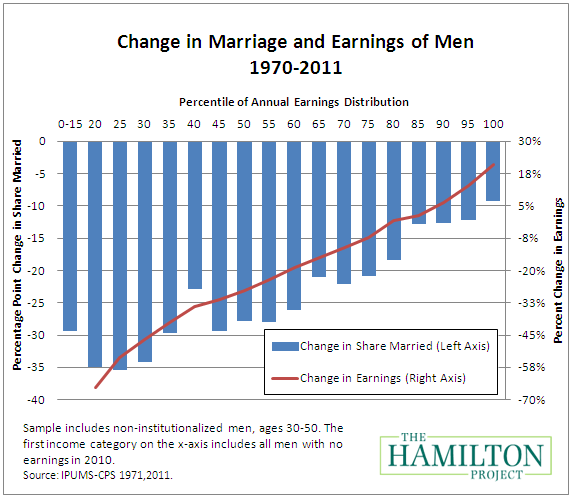

I wonder, has anyone researched the correlation between income and marriage rates?

See also Bureau of Census, U.S. Department of Commerce, “Millennial Marriage: How Much Does Economic Security Matter to Marriage Rates of Young Adults”

The Financial Literacy Delusion: We need honest narratives about the distribution of wealth

Financial literacy is silent about the need for decent working conditions, unemployment insurance, paid leave, a living wage. It also leaves unmentioned the subject of rising economic inequality marked by income volatility and unaffordable housing. Mounting student loan bills are presented as a problem of financial smarts, not skyrocketing college tuition. Instead, a financial literacy narrative endures which maintains that people are in debt because they spend their money on luxuries like lattes and avocado toast.“How economists are destroying life on Earth”

Steve Keen [Medium, via Naked Capitalism Water Cooler 4-28-20]

“We don’t just have a climate change threat to humanity. Neoclassical economics itself is an existential threat.”

[Bloomberg, via Naked Capitalism Water Cooler 4-28-20]

“It’s possible that stock market investors simply expect the economic recovery after the end of lockdowns to be swift and robust. But that’s looking increasingly unlikely. The U.S. has failed to suppress the epidemic, and lifting lockdowns is unlikely to bring people out of their houses as long as the threat of the virus remains. Meanwhile, business closures, mass unemployment and the collapse of global trade will weaken the economy for years to come. A more disturbing possibility is that investors have decided that the U.S. government will prioritize preserving stock market valuations regardless of what happens to the rest of the economy.”

Predatory Finance

Gundlach: Fed’s Corporate Bond Buying Program Is Illegal; Fed Says Program Isn’t OperationalPam Martens and Russ Martens, April 28, 2020 [Wall Street on Parade]

The use of the word “discount” throughout the Federal Reserve Act is the terminology for making a loan. The phrase that prohibits the Fed from accepting collateral that is based on “merely investments or issued or drawn for the purpose of carrying or trading in stocks, bonds, or other investment securities, except bonds and notes of the Government of the United States,” has been interpreted for the past 107 years to mean that the Fed is not allowed to encourage speculation in stocks and corporate bonds by accepting either as collateral. If the Fed is not allowed to accept stocks and corporate bonds as collateral, it would clearly follow that they are not to be purchased outright by the Fed either. As the statute makes clear, the only bond obligations that the Fed can accept are “bonds and notes of the Government of the United States.”

The real power, however, is being exercised by the Federal Reserve Bank of New York (New York Fed) with not so much as one vote by any elected representatives of the citizens of the U.S.

The speed at which the New York Fed, owned by multinational banks, can create trillions of U.S. dollars by pushing an electronic button and bring financial relief to the 1 percent on Wall Street stands in sharp contrast to the millions of mom and pop small businesses across America who are still waiting to see a dime in relief from an elected Congress, forcing a growing number of small businesses to close permanently and thus further consolidating money and power in the United States.

On September 17, 2019, months before any case of coronavirus COVID-19 had been discovered anywhere in the world, the New York Fed began pumping out hundreds of billions of dollars a week in super cheap loans to the trading houses of Wall Street, a group of 24 firms it calls its “primary dealers.” This action in the repo loan market was the first by the New York Fed since the financial crisis of 2008. By January 27, 2020, before one death had been announced in the United States from the virus, the New York Fed had pumped $6.6 trillion cumulatively in revolving loans to the trading houses of Wall Street. By March 14, the loan tally was more than $9 trillion and climbing.How Fed Intervention Saved Carnival: The cruise line asked hedge funds for cash before central-bank intervention reopened bond markets

[Wall Street Journal, via The Big Picture 4-30-20]

Unsanitized: Mortgage Servicers Trying to Steal Homes, Again

Why would telling borrowers they have to repay a lump sum help servicers? Presumably, knowing that they couldn’t repay in three months, borrowers would opt out of forbearance. They would then either a) scrape together enough money to pay the loan for a while, at which point servicers get paid, or b) cut their losses and go into foreclosure, at which point servicers get to assess all kinds of foreclosure fees and get paid MUCH MORE. The now eleven year-old study of why servicers prefer foreclosure to modification remains operative; the compensation structure hasn’t changed. Servicers get paid more from foreclosure, so they try to trigger it, steering borrowers away from better options to trap them.

I appreciate Calabria stepping out on this, and maybe raised awareness will stop a foreclosure crisis replay. But you will need oversight and enforcement; servicers are tricky, and borrowers aren’t given to read the FHFA website. As Christopher Peterson, former top CFPB official, told me: “It is a meltdown waiting to happen.”

Grover Norquist’s Dismantled State Struggles to Respond

Study: 71 percent of jobless Americans didn’t receive March unemployment benefitsThe Coronavirus Is Showing Members of the Professional Class That the Government Doesn’t Work for Them Either

[Ben Mathis-Lilley is Slate’s chief news blogger, via Naked Capitalism Water Cooler 4-29-20]

You can’t get unemployment benefits until you register for unemployment, and many people can’t register for unemployment, even if they’re calling the office hundreds of times a day, because state systems are overloaded. You can get your stimulus if the IRS already has a direct deposit account number for you—but if you didn’t get a refund this year or last year, it doesn’t have that number, and the website where you’re supposed to be able to enter it often just returns a message that says “payment status not available.” The same applies for small-business loans: Those who are eligible are supposed to apply through their existing banks, but your bank (or your boss’s bank) may not have even posted information on its website about how to apply before announcing that the window for applications had closed. And as far as monthly housing payments go, it turns out that for many customers of major banks what’s being offered isn’t deferment, wherein you skip payments now and add them on to the end of your agreement, but rather forbearance, wherein the money from any skipped payments is simply all due in a lump sum a few months from now, i.e., when you will almost certainly not have yet found a job that pays enough to have made up the income you just lost. If you’d like to speak to a representative of your bank about that, there might be one available if you’re willing to wait on hold for 16 or 17 years.

If you are fortunate enough to have not required the services of America’s social safety net recently, this may be surprising to you. If you have—perhaps by being offered an unaffordable health insurance plan via the federal COBRA program or the Obamacare exchanges after losing your private coverage—you will be less surprised. If you years ago made the dubious personal decision to be born into one of the bottom wealth quintiles in this country, where levels of socioeconomic mobility are lower than those in Portugal and Estonia, it was presumably not surprising at all.

That’s because government programs in the United States—even those supported by the purportedly pro-government party—are not designed to solve problems. Rather, they are designed to solve a given problem only to a degree—and that degree can’t require an amount of spending that would necessitate financial sacrifice on the part of high-income taxpayers. This is not a leftist conspiracy theory, but the overt position of the party’s leaders, who believe they will not be able to achieve crucial voting margins in upscale suburbs if they authorize too much taxation and spending....

Some voters accept this status quo because they believe the government can’t ever work. But the government works smoothly, responsively, and generously—and is continuing to do so, in crisis—for people and entities who are wealthy enough to hire lobbyists or have personal relationships with politicians. Large banks can borrow directly from the Federal Reserve at zero-percent interest, and they are receiving middleman fees for prioritizing their biggest clients in the “small” business lending program, which is how 71 companies large enough to have publicly traded stock received money through it. (The oil industry in particular did well.) For-profit chains of nursing homes have managed to already get laws passed that exempt them from being sued over the deaths of patients and staff members who received inadequate care and protective equipment. A provision in one of the stimulus bills lifted the cap on how much depreciation real estate investors can deduct, a benefit that only applies to individuals with more than $500,000 worth of non–real estate annual income—and which was made retroactive in a way that will allow them to claim benefits that apply to income earned two years before the coronavirus ever arrived.

To put it cynically, the job of much Democratic legislation is to make liberal voters of means feel good that something is being done for the less fortunate, not necessarily to actually do that thing.

Economics in the real world

Less Than a Third of the World Can Feed Itself From Local Crops, Says StudyDisrupting Mainstream Economics

“The U.S. has had sclerotic political leadership during this crisis. The U.S. is being offered the “choice” between Trump, 73, and Biden, 77. Its other major political players are Pelosi, 80, and McConnell, 78…. Trump of course bears most of the blame for the Covid-19 Crisis. But the Dems and liberal media also share a lot. Trump dithered for many crucial weeks after China’s CCP very belatedly shut down Wuhan on January 23, many weeks after the virus emerged… What were the Dems and liberal media doing during those crucial weeks? From December 18 to February 5 they culminated three years of wasting the nation’s time trying to impeach Trump for Russia- and Ukraine-gate, as the virus picked up steam. The Dems and liberal media held “debates” and primaries through March 17 in which Covid-19 was barely mentioned except in the context of Sanders’ Medicare for All, focusing instead on such issues as Bloomberg’s NDA’s (Biden’s opponents are now using a similar #MeToo attack).”

Corporate Media Deny Their Own Existence, Despite Driving Biden’s Primary Victory

If someone were to tell you that major and influential business sectors like the fossil fuel and health insurance industries simply don’t exist, or imply that major corporations like ExxonMobil and Cigna don’t try to manipulate public opinion and advance a political agenda in order to protect and maximize their profits, you might find it hard to contain your laughter.

But looking at corporate media’s coverage of corporate media, one gets the sense that anyone who dares to suggest that media corporations like Comcast-owned MSNBC, AT&T-owned CNN or News Corp–owned Fox News have their own commercial interests—which incentivize them to push pro-corporate politics—are kooky “conspiracy theorists.”

Colorado's Vote-by-Mail System Could Save the 2020 Election. Why Aren't More States Using It?

Adolph Reed Jr.: Here They Come Again-The Kind of Neoliberal Democrats Who Prefer Trump to Sanders

In the mid-1990s I reflected on how often it is liberals who enable, even abet, the rise of reactionary forces by accommodating them and treating them as legitimate, looking the other way at the dangerous aspects and implications of their agendas.... Mainstream liberals’ main criterion for assessing a military intervention is whether or not it can attain U.S. objectives neatly and with limited American casualties. Under Bill Clinton, George W. Bush, Barack Obama, and Donald Trump, they’ve supported and rationalized military adventurism and extrajudicial killing of non-combatants, among other horrors, in the Middle East and elsewhere....

This history of liberal support for authoritarianism and dictatorship is especially significant at this moment as a tide of authoritarian neoliberalism has been rising all over the world. Orbán in Hungary, Erdoğan in Turkey, Modi in India, Bolsonaro in Brazil, Salvini in Italy, Poroshenko in Ukraine, and for that matter Boris Johnson in the United Kingdom demonstrate that the neoliberal program of regressive transfer does not require popular democracy. Popular oversight instead has been a hindrance to regimes of neoliberalization since Reagan and Thatcher, and those pursuing such agendas have commonly sought to insulate their programs from popular democratic processes, behind special commissions and other unelected bodies.

Watching Speaker of the House Nancy Pelosi proudly applauding and then standing for a photo-op with Venezuelan fraud and third-rate coup-plotter Juan Guaidó during and after Trump’s 2020 State of the Union message...

The Dark Side

Tensions emerge among Republicans over coronavirus spending and how to rescue the economyWashington Post 4-25-20

“As we start thinking down the road in future iterations, my hope would be that it’s more fine tuning what we’ve already done rather than taking on big, aggressive new initiatives that are paid for by additional debt,” Senate Majority Whip John Thune (S.D.), the chamber’s No. 2 Republican, said in an interview. He warned that at some point, “we’re going to run out of capacity at the federal level.”

....In a conference-wide phone call Thursday morning, GOP senators broadly agreed to hold off on any new virus spending until lawmakers return to Washington on May 4, according to people on the call and those briefed on the conversation, who spoke on the condition of anonymity to describe the private discussion.

The self-inflicted derangement of the conservative intellectuals

[The Week, via Naked Capitalism 5-1-20]

Instead of the dittoheads learning a lesson in the limits that reality imposes on ideology, it's formerly thoughtful intellectuals who've gone into overdrive trying to force reality into pre-existing ideological frames, while also actively dismissing knowledgeable expertise and displaying contempt for the uncertainty confronting us all. In its place they substitute tribal loyalty and a nasty Social Darwinism. Self-described nationalists express no solidarity at all with members of their nation dying by the tens of thousands. Formerly thoughtful people have turned themselves into heartless hacks with no interest in seriously engaging with the real problems, challenges, and trade-offs the country confronts in the present crisis. It's incredibly ugly and disheartening.

Superb post.

ReplyDeleteYou share great data in this post.

mortgages in Washington DC