by Tony Wikrent

Economics Action Group, North Carolina Democratic Party Progressive Caucus

About a decade ago, mostly back in 2006 and 2008, we used to write a lot about a North Carolina multimillionaire congressman named Robin Hayes. The district he represented, NC-08, is now mostly NC-09, the one where a Trumpist candidate was caught rigging the ballots last year, causing the election to be voided.... Hayes was a freak. One of the reasons he lost so badly to Kissel in 2008 was because he accused then candidate Barack Obama of "inciting class warfare" and claiming that "liberals hate real Americans that work and accomplish and achieve and believe in God." That brought him a lot of attention and he not only denied that he ever said it, he also accused the media reporting his remarks "irresponsible journalism." Unfortunately for Rep. Hayes, someone made a tape. When that was released Hayes simple denied that he denied the statement. Kissel beat him by ten points.

Instead of just letting him quietly slip away into obscurity, the North Carolina elected him chairman of the state party, a two year term. They elected him again in 2016. Today Hayes was in court, having been indicted by a federal grand jury on a variety of charges for funneling bribe money to the re-election campaign of North Carolina Insurance commissioner Mike Causey.

It was actually wealthy entrepreneur and Republican Party mega-donor Greg Lindberg who was being investigated when the FBI stumbled upon Hayes. Lindberg would write $40 checks to the DCCC on the same day he wrote $500,000 checks to the Republican Party of North Carolina. He's contributed million of dollars to the GOP in recent years and was the state party's biggest single donor and is the money-bags behind the state's crooked Lt. Govenor, Dan Forest, who is running for governor next year.

Strategic Political Economy

This is long, for Taibbi, but an absolute must-read.

The 2016 campaign season brought to the surface awesome levels of political discontent. After the election, instead of wondering where that anger came from, most of the press quickly pivoted to a new tale about a Russian plot to attack our Democracy. This conveyed the impression that the election season we’d just lived through had been an aberration, thrown off the rails by an extraordinary espionage conspiracy between Trump and a cabal of evil foreigners.

This narrative contradicted everything I’d seen traveling across America in my two years of covering the campaign. The overwhelming theme of that race, long before anyone even thought about Russia, was voter rage at the entire political system.

The anger wasn’t just on the Republican side, where Trump humiliated the Republicans’ chosen $150 million contender, Jeb Bush (who got three delegates, or $50 million per delegate). It was also evident on the Democratic side, where a self-proclaimed “Democratic Socialist” with little money and close to no institutional support became a surprise contender.How the Media Got it Wrong on Trump and Russia

The Real Working Class Is Invisible to the Media

The media doesn’t talk much about working-class America. But when it does, it mainly has one thing to say about it: that it’s entirely white, male, and very right-wing. All those things are lies....

Central to this story is the decline of labor reporting, once a mainstay of major dailies. Today, by contrast, as Martin puts it: “A conference gathering of labor/workforce beat reporters from the country’s leading newspapers could fit into a single booth at an Applebee’s.” Of the country’s top twenty-five newspapers, he notes, a majority no longer covers the workplace/labor beat on a full-time basis, and the landscape for such reporting appears to be even bleaker on television (one 2013 survey cited by Martin, for example, reveals that only 0.3 percent of network TV news in the years 2008, 2009, and 2011 covered labor issues).Abigail Disney: What It’s Like to Grow Up With More Money Than You’ll Ever Spend

[The Cut, via The Big Picture 4-1-19]

In what ways did your dad change, other than having a jet?Actually, having a jet is a really big deal. If I were queen of the world, I would pass a law against private jets, because they enable you to get around a certain reality. You don’t have to go through an airport terminal, you don’t have to interact, you don’t have to be patient, you don’t have to be uncomfortable. These are the things that remind us we’re human....

How did the jet change your dad? It wasn’t just the plane, but it’s not a small thing when you don’t have to be patient or be around other people. It creates this notion that you’re a little bit better than they are. And for the past 40 years, everything in American culture has been reinforcing that belief. We say, “Job creators, entrepreneurs, these are the people who make America great.” So there are people walking around with substantial wealth who think that they have it because they’re better. It’s fundamental to remember that you’re just a member of the human race, like everybody else, and there’s nothing about your money that makes you better than anyone else. If you don’t know that and you have money, it’s the road to hell, no matter how much stuff you have around you....

They did a study at the Chronicle of Philanthropy years ago where they asked people who inherited money, “What amount of money would you need to feel totally secure?” And every single one of them, no matter what they had, named a number that was roughly twice what they inherited. So that’s what you need to know about money, right? If that is your primary measure of success or value in life, then good luck with that, because it will never feel good.

Thinking Beyond Monetary Policy and Banking Regulation to Manage the Next Economic Downturn [Roosevelt Institute, via Naked Capitalism 4-4-19]

Our corporate sector is broken. Corporations aren’t making productive investments or putting the more than $1 trillion of firm-level debt toward growth-inducing uses, such as research and development (R&D), capital investments, or better compensation for our workforce. Instead, they’re putting more and more funds, largely financed by debt, toward rewarding shareholders, which is reaching upwards of $2.9 trillion since 2012 through a combination of stock buybacks and takeovers of non-financial corporations....

... Irene Tung, from the National Employment Law Project (NELP), and I found that the restaurant industry spent more on payouts to shareholders, in the form of buybacks, than it made in profits—ultimately funding buybacks through debt and/or cash reserves. Buybacks actually totaled nearly 140 percent of net profits in the restaurant industry alone. “Leveraged buybacks”—the issuance of new corporate debt in order to fund stock buybacks—is more pervasive and contributes to the highly skewed economy we have today. McDonald’s, for example, could have paid each of its 1.9 million workers almost $4,000 more a year if the company redirected the money it spends on buybacks to workers’ paychecks instead....

Unless we fix our broken corporate sector—which means rectifying today’s high-profit, low-wage economy—banking regulation, securities laws, and monetary policy can only go so far. We need to think outside banking regulatory levers and instead implement solutions that encourage the kind of corporate behavior that prioritizes productive activities that grow the real economy—corporate behavior that supports higher wages, better jobs, and new business development, for example. To redirect our corporate sector to the productive, growth inducing activities we seek, we need to rein in corporate power by raising taxes on corporations, the financial sector, and capital; revamping our antitrust laws to break up concentrated and anticompetitive market power; and reforming the laws that govern corporate decision-making.

We also need policies to rebuild worker power. Workers are a key stakeholder within firms and across our economy at large, who play a critical role in generating corporate value. Bold policy solutions are necessary to rebalance economic power and ensure that workers—who are investing in companies with their own labor on a daily basis—have a voice in the firm and agency over their lives. This includes policies that give workers a say over how corporate boards are structured, including who sits on them. This also must include building countervailing power for workers by promoting workplace unionization, encouraging bargaining across industries, and protecting workers’ rights to engage in collective action—most notably, the right to strike.

[Splinter News 4-2-19]

....from a “business” perspective, it is fair to say that Lyft and Uber’s main function is to take money from the world’s savviest investors and use that money to offer everyone subsidized rides. Lyft lost nearly a billion dollars just last year, and Uber’s losses are even more staggering. And this is with the benefit of being able to exploit drivers by treating them as contractors rather than employees—something that could very well change one day, and which would raises costs considerably....

You do not need to be a financial genius to see that the only real path to profitability for Lyft and Uber is to raise prices so that rides actually bring in more money than they cost.... there are basically three possibilities, which we will list forthwith:

1) The Bad (For Uber and Lyft, Not Necessarily For Society) ScenarioAfter burning through literally tens of billions of dollars from venture capitalists and sovereign wealth funds and institutional investors and all the world’s smartest people, it finally becomes clear that these companies cannot reach profitability, because once they finally raise their prices high enough to allow them to make $$$, people are much less enthusiastic about calling a car....

2) The Medium ScenarioAfter putting the taxi industry out of business through clever and semi-dirty regulatory arbitrage, Lyft and Uber become, essentially, the taxi business all over again, as regulations and organized labor catch up to technology. This business is moderately profitable and stable but not really anything that would necessarily inspire all this, you know, hype. Congratulations, tech geniuses—you spent decades tearing down and then rebuilding the taxi business, arriving back where you began.

3) The Good For Uber and Lyft and Definitively Bad For Society ScenarioThe long-term plan of these companies succeeds: they destroy public transportation in America. Lured by cheap, subsidized rides, bus and subway ridership falls for years, leading governments to reduce and then more or less cease investment in new public transportation, which makes existing public transportation worse, creating a feedback loop that further incentivizes choosing Uber over the train. Once it becomes clear that public transportation has been crippled in major cities, ride-sharing companies can start raising their prices in peace, safe from competition. The companies will then at last become wildly profitable—by, in essence, extorting the public for transportation services that our dysfunctional government is not providing.

“Koch Brothers Launch Ads to Push Back on Warren’s Antitrust Campaign”

[Inside Sources, via Naked Capitalism 4-2-19]

“The Koch-backed Americans for Prosperity (AFP) just announced an ad campaign lampooning 2020 presidential hopeful Elizabeth Warren’s tech antitrust plan, begging senators not to make antitrust a political issue.’ Warren responds:

....a wide and deep-ranging distinction between "business" and "industry" and a broad view of the nature of "institutions."

Veblen discerned that the high command of the "institution" of modern capitalism was vested in the most powerful of financiers, who by controlling the flow of credit to important industries were able to manipulate them for their own ends... more directly concerned with the material contribution of society. In this high command was reflected most clearly and extremely the spirit of pure gain (monetary) or pecuniary profit, entirely abstracted from material efficiency or service.

On the other hand, the all-important "institution" making material progress was "technology," the state of the industrial arts.

The industrial arts, in Veblen's sense, were not only the arts proper but the habits, skills, transmission of skills, and the opportunity to develop and advance them. It was not physical capital or labor, let alone funds, which were to Veblen the great productive factor, but the cumulative growth of the technological habits of thought that comprised the machine process; without this intangible element physical instruments and labor would be of little use. Productivity was therefore an indivisible social phenomenon, not an individual one, a function of the given technology.

Economics in the real world

“Now the market finally knows: Ghawar in Saudi Arabia, the world’s largest conventional oil field, can produce a lot less than almost anyone believed. When Saudi Aramco on Monday published its first ever profit figures since its nationalization nearly 40 years ago, it also lifted the veil of secrecy around its mega oil fields. The company’s bond prospectus revealed that Ghawar is able to pump a maximum of 3.8 million barrels a day — well below the more than 5 million that had become conventional wisdom in the market.”113 Year Old Machine Shop

“Average Americans can’t afford a home in 70 percent of the country”

“Out of 473 U.S. counties analyzed in a report, 335 listed median home prices more than what average wage earners could afford, according to a report from ATTOM Data Solutions. Among them are the counties that include Los Angeles and San Diego in California, as well as Miami-Dade County in Florida and Maricopa County in Arizona. New York City claimed the largest share of a person’s income to purchase a home, according to the report. While average earners nationwide need to spend only about one-third of their income on a home, residents in Brooklyn and Manhattan must shell out more than 115 percent of their income. In San Francisco, residents must spend 103 percent, and in Hawaii’s Maui County, it takes 101 percent. Homes were found to be affordable in Chicago, Cleveland, Houston, Detroit and Philadelphia.”

“Elaborating on the trash left behind by workers, [Secretary Heather Wilson] told the House Appropriations Defense subcommittee later in the day that it was a ‘manufacturing discipline‘ issue on the assembly line where ‘we saw a breakdown.’ ‘If you drop a wrench you have to find a wrench,’ she said. ‘You have to wipe down surfaces so you don’t have pieces of aluminum that over time get in the midst of things and cause serious problems.’ The latest delivery halt was prompted after the service opened up some closed compartments, such as inside wings, and found flaws, she said without elaborating.”Lambert Strether: Sounds like a demoralized workforce, to me. I sure hope there aren’t loose wrenches sliding around inside the wings of civilian aircraft, because that would be bad.

More Boeing: “Pontifications: I don’t know what to make of this”

“One can’t help but think, a lot, about the two Boeing 737 MAX crashes and the facts that Boeing created the system, linked it to one sensor, not two, didn’t tell the airlines pilots about it, didn’t include it in pilot manuals, didn’t have a safety alert system as standard equipment, initially blamed the Lion Air pilots and reportedly lobbied Donald Trump not to ground the airplanes.” • And self-certified the system too, let us remember. More: “Four concurrent commercial airplane programs (the KC-46A being a hybrid between commercial and military) each had trouble. Two of their last four airplanes have been grounded by regulators. A third airplane had such poor quality control the customer stopped taking delivery. Three of the four were years late. What’s going on here? Boeing resources were clearly stretched too thin. Billions of dollars were going out the door in cost overruns. Were bad management decisions made by the bean-counting McNerney regime? Was there something systemic happening? Or just a run of bad luck and bad timing?”

Population Control Proceeding According to Plan

The National Center for Health Statistics reported that, between 2016 and 2017, US life expectancy dropped from 78.7 to 78.6 years. This marks the third consecutive year that life expectancy in the US has decreased. We have not had a drop like this since the 1918 flu pandemic.

Predatory Finance

According to JPMorgan’s 10K, it has sold credit derivative protection on $177 billion of “subinvestment grade” i.e., junk credits. When you sell credit protection, you are on the hook to pay the buyer if that entity goes belly up. When you are selling credit protection on subinvestment grade entities, it is far more likely that they could go belly up.

JPMorgan Chase will likely argue that they have also purchased boatloads of credit derivatives, which might be on the same entities, but there is no way for anyone to accurately predict if this mega bank has aligned these risks correctly. Even the bank admits that, writing in its 10K....

According to documents released by that Subcommittee, as of the close of business on January 16, 2012, JPMorgan’s Chief Investment Office held $458 billion notional (face amount) in domestic and foreign credit default swap indices. Of that amount, $115 billion was in an index of corporations with junk bond ratings, which the bank was not allowed to own. To get around that, according to the Office of the Comptroller of the Currency, JPMorgan “transferred the market risk of these positions into a subsidiary of an Edge Act corporation, which took most of the losses.”

....Citigroup has also produced alarm bells in its most recent 10K filing with the SEC. This is the same bank that received the largest taxpayer bailout in global banking history in 2008. It also received over $2 trillion cumulatively in secret revolving loans from the Federal Reserve from the end of 2007 to at least July 2010 because of its shaky condition. According to the OCC, as of December 31, 2018 Citigroup had $47 trillion notional amount of derivative exposure....

Another Wall Street mega bank is the Bank of America which owns the giant retail brokerage firm Merrill Lynch. According to the OCC, as of December 31, 2018 its bank holding company had $31.7 trillion in notional derivatives. This is how it explains its potential to blow up in its current 10K....

Then there is Goldman Sachs which owns the federally-insured, deposit-taking bank called Goldman Sachs Bank USA. According to the OCC, Goldman Sachs’ bank holding company has $42.3 trillion notional in derivatives. This is how Goldman explains what could go wrong in its current 10K....

And, finally, there is Morgan Stanley, which the OCC says holds $32 trillion notional in derivatives at its bank holding company. Morgan Stanley reveals in its latest 10K that some of the counterparties it is using for its derivative trades have below-investment-grade ratings — i.e., junk ratings.

There is one Federal agency that has repeatedly attempted to warn against the dangers to the safety and soundness of the U.S. Federally-insured banking system as a result of the interconnectedness of a handful of Wall Street megabanks and also from these megabanks concentrating their risks among the same counterparties.

In 2015, the Office of Financial Research (OFR), which was created under the Dodd-Frank financial reform legislation of 2010 to sound the alarm bells to regulators and the public on the buildup of systemic risks, released a study showing dangerous levels of interconnected risk among the mega banks on Wall Street.

The ETF Tax Dodge Is Wall Street’s “Dirty Little Secret”

One day last September an unidentified trader pumped more than $3 billion into a tech fund run by State Street Corp. Two days later that trader pulled out a similar amount.

Why would someone make such a large bet—five times bigger than any previous transaction in the fund—and then reverse it so quickly? It turns out that transfusions like these are tax dodges, carried out by the world’s largest asset managers with help from investment banks. The beneficiaries are the long-term investors in exchange-traded funds. Such trades, nicknamed “heartbeats,” are rampant across the $4 trillion U.S. ETF market, with more than 500 made in the past year. One ETF manager calls them the industry’s “dirty little secret.”

Typically, when you sell a stock for more than you paid, you owe tax on the gain. But thanks to a quirk in a Nixon-era tax law, funds can avoid that tax if they use the stock to pay off a withdrawing fund investor. Heartbeats come into play when there isn’t an exiting investor handy. A fund manager asks a friendly bank to create extra withdrawals by rapidly pumping assets in and out.“Wells Fargo CEO Tim Sloan steps down”

“The move amounted to an admission that the board erred three years ago by appointing another insider after the previous CEO, John Stumpf, resigned following revelations that Wells Fargo had opened potentially millions of unauthorized consumer accounts. Prior to becoming CEO, Sloan served as chief operating officer and head of the wholesale bank…. On the call, analysts tried unsuccessfully to get a direct answer to whether regulators had given Sloan the final push, or even whether the bank had been surprised by the most recent criticism from the Comptroller of the Currency.”

Deutsche Bank’s U.S. Unit Enabled a $150 Billion Laundromat

Top Democrat Proposes Annual Tax on Unrealized Capital Gains

Plan from Sen. Ron Wyden would treat increased value of long-term investments like income.“Wall Street Is Getting Cut Out of Bond Market It Long Dominated”

“The banks that have stood in the middle of the corporate bond market for decades are increasingly getting pushed aside. Eectronic marketplaces like MarketAxess Holdings Inc., Tradeweb Markets LLC and Liquidnet Holdings Inc. say that more of the company bond trades that happen on their platforms are between investors directly, without banks necessarily being involved. Known as all-to-all trading, this shift may weigh on revenues for banks that have long profited from being either buyers or sellers in just about every trade in the $9.2 trillion market.”

Now, a new study shows that not all evictions are created equal. Scholars at Georgia State University, in conjunction with a ProPublica journalist, examined “serial” eviction filings, or those done repeatedly by a landlord against a tenant. By comparing serial evictions to ordinary ones, the researchers found patterns of landlord behavior and intentions, some of which are reminiscent of the worst of the housing crisis a decade ago.

As a reminder, nearly half of Americans are “rent-burdened,” which means that they spend more than 30% of their income on rent. Homelessness is on the rise. Nationally, as many as one in seven children may have experienced eviction in the last decade. And, just as the foreclosure crisis disproportionately hit African-Americans, so does the eviction epidemic. Black women in Milwaukee, for example, were evicted at a rate three times their share of the population, and black renters in metro Seattle were evicted four times as frequently as whites there, according to earlier research.

Disrupting mainstream economics - Modern Monetary Theory

[Wall Street Journal, via Naked Capitalism 4-1-19]

Furzy: “MMT finally getting some recognition….WSJ still critical, and struggling to understand it!!” But you don’t have to get far in to read…groan…hyperinflation….

Disrupting mainstream economics

Economics Now Points Away From the Laissez-Faire ApproachWhat Has Produced Widening Economic Inequality And Stagnating Wages In America?

[DownWithTyranny 4-3-19]

The answer to the question in the title is simple: a change in political power dynamics in this country in favor of conservatives, primarily Republicans, but also the Blue Dogs and New Dems from the Republican wing of the Democratic Party. The 2020 presidential candidates who are credibly advocating real systemic changes to that dynamic-- basically Bernie, Elizabeth Warren and Marianne Williamson...

Restoring balance to the economy

[WaPo, via Naked Capitalism 4-3-19]

“...we should enact the Ending Too Big To Jail Act, which I introduced last year. That bill would make it easier to hold executives at big banks accountable for scams by requiring them to certify that they conducted a “due diligence” inquiry and found that no illegal conduct was occurring on their watch. This would force executives to look for wrongdoing or face prosecution for filing false certifications with the government. The proposal would also create a permanent and well-funded unit dedicated to investigating financial crimes.”

[Vice, via Naked Capitalism 3-31-19]

No patient left behind

McConnell to Trump: We’re not repealing and replacing ObamaCare“Wendell Primus, Pelosi’s senior health policy adviser and a long respected voice on health and domestic policy… dismissed Medicare for All during the private session as an unhelpful distraction, according to four people in the room and two people briefed on the meeting, and he expressed a need for more scrutiny of single-payer’s policy implications. Some of those six sources interpreted it as a request for data and economic analysis, but others saw it as a harder-edged invitation to discredit the idea, or at least amplify its risks.” • As I keep saying, preventing #MedicareForAll is the liberal Democrat leadership’s #1 policy goal. It doesn’t matter what they say in public, where they’re already walking back their putative support in any case.

Climate and environmental crises

“Global CO2 Emissions Hit an All-Time High in 2018; is a Hothouse Earth in our Future?”“Global energy-related emissions of carbon dioxide jumped by 1.7% in 2018, reaching the highest levels ever recorded, 33.1 metric gigatons, announced the International Energy Agency (IEA) last week. The United States’ CO2 emissions grew by 3.1% in 2018, reversing a decline a year earlier, while China’s emissions rose by 2.5% and India’s by 4%. The global CO2 growth rate was the highest since 2013. Global energy consumption rose 2.3% in 2018, nearly twice the average rate of growth since 2010, and was driven by a robust global economy as well as higher heating and cooling needs in some parts of the world…. The authors of the Hothouse Earth paper have given us a convincing argument that even strong action to control greenhouse gas emissions and limit global warming to 2°C may not be enough to prevent the destruction of a livable climate for humans. They applaud the significant progress that has been made in driving the renewable energy revolution and in slowing down population growth, but emphasize that ‘widespread, rapid, and fundamental transformations will likely be required to reduce the risk of crossing the threshold and locking in the Hothouse Earth pathway.'”

Canada warming twice as fast as the rest of the world, report says

In Norway, electric cars outsell traditional ones for the first time

Huge Global Study Just Smashed One of The Last Major Arguments Against Renewables

We just got some massive news in the ongoing drive to switch to renewable energy: scientists have identified 530,000 sites worldwide suitable for pumped-hydro energy storage, capable of storing more than enough energy to power the entire planet. Pumped-hydro is one of the best technologies we have for storing intermittent renewable energy, such as solar power, which means these sites could act as giant batteries, helping to support cheap, fully renewable power grids.... Added together, these hundreds of thousands of sites have the potential to store around 22 million Gigawatt-hours (GWh) of energy. It's more than enough to get the entire planet running on renewables, which is where we want to get to.

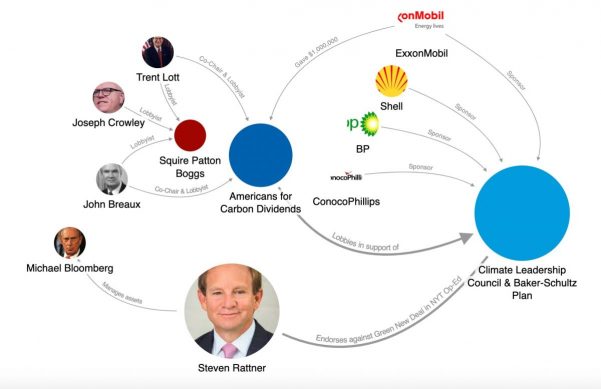

“Steven Rattner – the ex-Obama official, longtime private equity investor, and overseer of Michael Bloomberg’s vast wealth – is the latest big name establishment figure to go after the Green New Deal.” • Here’s a handy map of some of his connections:

“In 2016, Lockheed Martin Corp. won a nearly $500 million order for as many as a dozen of its hybrid-electric LMH-1 airships (operational in 2020 or 2021) from a buyer who plans to lease their 20-tons of freight capacity to Arctic oil and gas companies. Leasing an airship is cheaper than building new roads across permafrost melting due to climate change, and roughly seven times cheaper per ton than using heavy-lift helicopters. As China and the rest of the world extend their search for raw materials into ever-more remote regions, airships are likely to become crucial links in logistics chains.

Creating new economic potential - science and technology

“Last fall, our team of graduate students at the Yale School of Forestry & Environmental Studies conducted a cost-benefit analysis of solar development on farmland in Minnesota, and the results were illuminating. By developing projects as pollinator-friendly — the practice of planting deep-rooted grasses and wildflowers throughout a project site — solar developers have the potential to provide habitat for threatened pollinator species, restore important prairie ecosystems, and boost the crop yields of nearby fields. That’s right: Our model suggests a net gain in food production is possible when highly pollinator-dependent crops are grown near pollinator-friendly solar projects — even when accounting for the land taken out of production by the solar project. While unexpected, this result has sound basis in research and practice. Iowa State University research extending over 10 years has shown that prairie strips in agricultural areas increase the abundance of native pollinators while also decreasing runoff and increasing soil and nutrient retention; crop pollination scientists in New Jersey and Michigan have published peer-reviewed research showing that an increased abundance of wild pollinators boosts yields for specialty crops. Now we have the potential to add solar to the mix.”

The world is on track to increase its installed wind capacity by 50% over the next five years, as more than 300 gigawatts of new projects are slated to come online by 2023, says the Global Wind Energy Council. There is now an installed global capacity of about 591 GW.What it's like to climb a 300-foot turbine tower for the first time

Climbing a 300-foot turbine tower at an Invenergy project in Stanton, Texas, for the first time was difficult and frightening, writes John Schwartz, who visited the site while writing an article for The New York Times. Jake Thompson, who manages a wind farm near Stanton, said of his first climb, "I looked out at the top and decided that was going to be my career."

[Energy News Network, via American Wind Energy Association 4-3-19]

Maine Gov. Janet Mills has lifted the state's moratorium on new wind projects, but it's not clear how much time it will take for the industry to gain momentum again, says Maine Renewable Energy Association Executive Director Jeremy Payne. Two wind farms, one that would feature four turbines and another with 22, have been in the permitting stage since before the moratorium started, and a developer is mulling a 630-megawatt transmission line that could carry wind from Maine to Massachusetts.

Amtrak Engineering has set set a target of 10 years to eliminate the SOGR backlog, the railroad said, while noting that only some portions of that goal is likely to be reached. “While achieving a 10-year schedule for all asset types would likely require more support resources (manpower, equipment and track outages) than are realistically available, Amtrak is confident that some assets such as Track, can be accomplished in this period if adequate funding is available,” the railroad said in its report.

Amtrak says it will need “$3.33 billion per year to address SOGR across all the asset categories” during the next decade. The railroad also notes that when “assessing our forecast FY2019 to FY2024 capital funding there is a $17.6 billion shortfall in funding to begin to address SOGR,” Amtrak said. Complicating matters is that the money needed to address the SOGR “is in addition to the necessary $1.2 billion annual steady state investment required to prevent further infrastructure deterioration.”

New York City is aiming to raise up to $US 15bn to support Metropolitan Transit Authority (MTA) rail upgrades and repairs from a new road traffic congestion pricing programme, the first in the United States, which was confirmed in the state’s 2020 budget announcement on April 1.Work begins on new Indonesian rolling stock plant

A groundbreaking ceremony was held in Banyuwangi, Indonesia, on March 31 for state-owned rolling stock manufacturer PT Industri Kereta Api Indonesia’s (PT Inka) new plant where it will manufacture trains in partnership with Stadler.

[Machine Design Today 4-5-19]

A strong resilient alloy of tungsten survives tremendous heat and radiation, making it a good candidate for fusion reactors.Researchers Build Computer-on-a-Chip Prototype

[Machine Design Today 4-4-19]

Stanford researchers led an international team of engineers that figured out how to pack many functions of a computer onto a single chip, including processing circuits, memory storage, and a power supply.

Information Age Dystopia

Microsoft announces it will shut down ebook program and confiscate its customers’ libraries”

“Microsoft has a DRM-locked ebook store that isn’t making enough money, so they’re shutting it down and taking away every book that every one of its customers acquired effective July 1. Customers will receive refunds. This puts the difference between DRM-locked media and unencumbered media into sharp contrast. I have bought a lot of MP3s over the years, thousands of them, and many of the retailers I purchased from are long gone, but I still have the MP3s. Likewise, I have bought many books from long-defunct booksellers and even defunct publishers, but I still own those books. When I was a bookseller, nothing I could do would result in your losing the book that I sold you. If I regretted selling you a book, I didn’t get to break into your house and steal it, even if I left you a cash refund.” • Well, that’s why we need DRM, right?

“Two pseudonymous security researchers called GreenTheOnly and Theo recovered “hundreds” of wrecked Teslas from scrappers and junkyards and systematically investigated the data left behind on the cars…. Teslas are incredibly data-hungry, storing massive troves of data about their owners, including videos of crashes, location history, contacts and calendar entries from paired phones, photos of the driver and passengers taken with interior cameras, and other data; this data is stored without encryption, and it is not always clear when Teslas are gathering data, and the only way to comprehensively switch off data-gathering also de-activates over-the-air software updates for the cars, which have historically shipped with limited or buggy features that needed the over-the-air updates to fix them. Tesla has a history of being secretive about the data its cars collect.”The FCC Has Fined Robocallers $208 Million. It’s Collected $6,790

Disrupting mainstream politics

- "...Sanders’ campaign collected $18.2 million from 525,000 donors — most of them under age 39 — in the first quarter of 2019,"

- "...Buttigieg had raised some $7million from more than 158,000 donors,"

- "Sen. Kamala Harris of California disclosed numbers Monday that reflected strong nationwide support. She raised $12million from 138,000 donors nationwide.

- "Sens. Elizabeth Warren of Massachusetts and Kirsten Gillibrand of New York have so far avoided releasing information about the money they’ve raised, signaling the numbers are not robust."

“Show Us the Money”

“It’s not that others in the crowded primary field can’t raise big money. Glitzy fundraisers and corporate schmoozing are second nature to Democrats. But the senator from Vermont has thrown them a curveball. By refusing to cozy up with titans of industry and relying instead on ordinary working people to fund both of his presidential campaigns, he’s turned Democrats’ most reliable fundraising strategies into a political liability. Presidential hopefuls who lack Bernie’s sizable small-donor base are awkwardly contorting themselves to both meet their fundraising goals and win the favor of an increasingly progressive constituency.”

“[The app designers] were frustrated by what struck them as the outdated methods for canvassing supporters: get a list of registered voters and knock on doors, hoping to catch them at home. The whole nature of the enterprise seemed off. Ocasio-Cortez’s Bronx-Queens district is filled with busy working-class and young people, who move often, don’t spend tons of time at home, and rarely answer their phone. Her campaign—and her only hope of victory—was built around bringing underrepresented people into the system. Instead of taking a list and going off to find or call the people on it, DeGroot and Sussan thought it would make a lot more sense to go to places where large numbers of likely supporters gather—bars, churches, subway platforms—and be able to match them to the list right there.”“As it Works to Stifle Primary Challengers, DCCC Takes More Money from Corporate Lobbyists” [Sludge, via Naked Capitalism 4-4-19]

“The DCCC raised nearly $19 million in the first two months of this year, more money than it had raised by this point last election cycle, and the committee is relying more heavily on corporate lobbyists to collect checks. Lobbyists whose clients include health care, oil, gas, and coal interests, raised almost $440,000 for the DCCC in January and February, Federal Election Commission records show. Many of their clients oppose progressive priorities like a “Medicare for All” health-care system or a Green New Deal to mitigate climate change… This year, led by centrist Democratic Rep. Cheri Bustos of Illinois, the DCCC has already received almost as much money via donations bundled by corporate lobbyists than in all of 2017.”“America’s socialist surge is going strong in Chicago”

[Micah Uetricht, Guardian, via Naked Capitalism 4-4-19]

“Add them up and you’ve got at least five, maybe six democratic socialists who will be on the 50-member Chicago city council. Few major American cities have seen even a single socialist councilor in generations; the third-largest city in the US could soon have half a dozen. It’s the largest socialist electoral victory in modern American history. The socialists won by strong, straightforward campaigning on working-class issues. Rosa, for example, made his race a referendum on affordable housing in a rapidly gentrifying neighborhood, painting big real estate developers as the enemy and demanding rent control in the city.”

“How a Petty Tyrant Turned a Functional DSA Branch into a Church”

[Benjamin Studebaker, via Naked Capitalism 4-3-19]

“In the beginning, Pittsburgh was a great branch. As recently as six months ago, there were 1,000 dues-paying members. There were four elected officials in Pittsburgh who had won with the aid of the branch’s endorsement and hard work, and the branch was running a wide array of issue-based campaigns in the city on labor, housing, and more. The success of the branch in the 2017 elections led many more candidates to seek its support in 2018. Everything was looking up…. Today the chapter’s membership is decimated. Only around 50 members attended the February 2019 general meeting.”

The Dark Side

“You elected them to write new laws. They’re letting corporations do it instead.”“Each year, state lawmakers across the U.S. introduce thousands of bills dreamed up and written by corporations, industry groups and think tanks. Disguised as the work of lawmakers, these so-called ‘model’ bills get copied in one state Capitol after another, quietly advancing the agenda of the people who write them. A two-year investigation by USA TODAY, The Arizona Republic and the Center for Public Integrity reveals for the first time the extent to which special interests have infiltrated state legislatures using model legislation. USA TODAY and the Republic found at least 10,000 bills almost entirely copied from model legislation were introduced nationwide in the past eight years, and more than 2,100 of those bills were signed into law.”GOP base wakes up in Wisconsin

After Murdoch lost the bidding for the British government’s sole satellite broadcasting license, Thatcher again came to his rescue, looking the other way when he started a rival service, Sky Television, which beamed programming into Britain from Luxembourg. The bigger Murdoch’s empire became, the more power he had to clear away obstacles to further its expansion. His influence became an uncomfortable fact of British political life, and Murdoch seemed to revel in it. “It’s The Sun Wot Won It,” The Sun declared on its front page in 1992, after helping send the Tory leader John Major to 10 Downing Street by relentlessly smearing the character of his opponent, Neil Kinnock. (“Nightmare on Kinnock Street,” The Sun headlined a savage nine-page package that included a satirical endorsement from the ghost of Joseph Stalin.) Murdoch could switch parties when it suited his purposes and ably supported Britain’s “New Labor” movement in the 1990s: Conservatives at the time had proposed regulations that would have forced him to scale back his newspaper operations in order to expand further into TV.

Murdoch used the same playbook in the United States. In 1980, he met Roy Cohn — the former adviser to Senator Joseph McCarthy and a Trump mentor — who introduced him to Gov. Ronald Reagan’s inner circle. It was a group that included Roger Stone Jr., another Trump confidant and the head of Reagan’s New York operations, who said in a later interview that he helped Murdoch weaponize his latest tabloid purchase, The New York Post, on Reagan’s behalf in the 1980 election. Reagan’s team credited Murdoch with delivering him the state that year — Murdoch gave Stone an Election Day printing plate from The Post over a celebratory meal at the 21 Club — and his administration subsequently facilitated Murdoch’s entry into the American television market, quickly approving his application for American citizenship so he could buy TV stations too.

The Reagan administration later waived a prohibition against owning a television station and a newspaper in the same market, allowing Murdoch to hold onto his big metro dailies, The New York Post and The Boston Herald, even as he moved into TV in both cities. The administration of George H.W. Bush suspended rules that forbade broadcast networks to own prime-time shows or to profit from them. That move allowed Murdoch to build the nation’s fourth broadcastnetwork by rapidly filling out his schedule with shows from his newly acquired 20th Century Fox studio — “The Simpsons,” “21 Jump Street” — while also earning substantial profits from the production unit’s syndicated rerun hits like “M*A*S*H” and “L.A. Law.”

No comments:

Post a Comment