by Tony Wikrent

Economics Action Group, North Carolina Democratic Party Progressive Caucus

“Best Ever” Economy? How much credit does Trump deserve for the current state of the economy?

by Invictus, September 10, 2018 [The Big Picture]

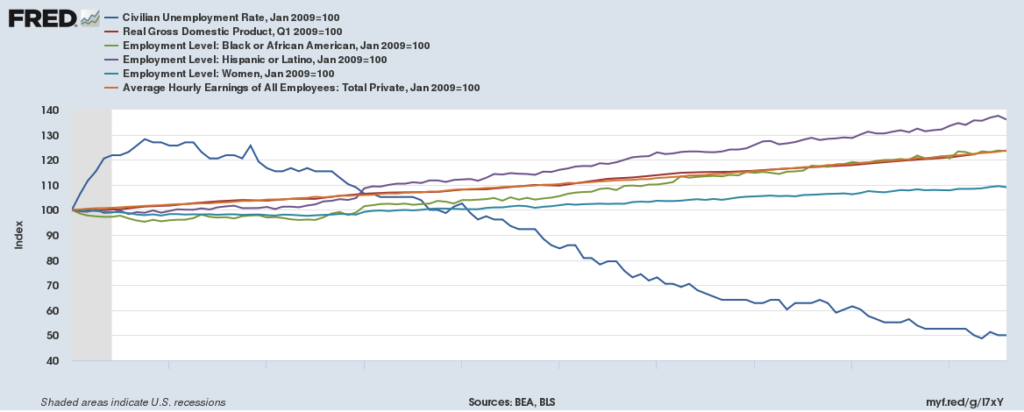

Conservative windbag Eric Bolling cited six economic indicators that purportedly show how great the USA economy is doing under Trump: Unemployment Rate, GDP, Wage Growth, Number of Blacks Employed, Number of Hispanics Employed, and Number of Women Employed, but provided no graphs nor data.

Well, let’s have a look at all six of the items Eric Bolling chose to highlight — all in one handy chart. The St. Louis Fed’s FRED service let’s us do this very easily. We can index all six metrics to 100 at January 2009, when Obama took office, and see how they’ve been doing since. If there’s been a significant improvement (or even reversal of a undesirable trend) since January 2017, it should be easily visible....

Have a look at this chart — it’s un-doctored, except I hid the x-axis labels showing the years. Can you determine when Trump took office? When his policies went into place? Where the Trump economic surge is? ....

The claim that Trump Economy is all that different from the Obama economy — for Civilian Unemployment, for Employment levels of Blacks or Hispanics or Women, for Real GDP or for nominal hourly wages — is unsupported by the actual BLS and BEA data. For the budget deficit, on the other hand, CBO reportsthe deficit is noticeably wider under Trump than what he inherited from his predecessor, and likely to get even worse.

The Real Cost of the 2008 Financial Crisis

In “Crashed: How a Decade of Financial Crises Changed the World,” the Columbia economic historian Adam Tooze points out that we are still living with the consequences of 2008, including the political ones. Using taxpayers’ money to bail out greedy and incompetent bankers was intrinsically political. So was quantitative easing, a tactic that other central banks also adopted, following the Fed’s lead. It worked primarily by boosting the price of financial assets that were mostly owned by rich people.

As wages and incomes continued to languish, the rescue effort generated a populist backlash on both sides of the Atlantic. Austerity policies, especially in Europe, added another dark twist to the process of political polarization. As a result, Tooze writes, the “financial and economic crisis of 2007-2012 morphed between 2013 and 2017 into a comprehensive political and geopolitical crisis of the post–cold war order”—one that helped put Donald Trump in the White House and brought right-wing nationalist parties to positions of power in many parts of Europe.The 2008 financial crisis upturned politics – and it’s not done yet

Yes, let’s wipe out Trump. But take neoliberal Democrats with him, too .

....liberal America’s pattern of electing corporate Democrats – rather than progressives – has been a big part of the problem that led to Trump and that continues to make America’s economic and political system a neo-feudal dystopia.

Pigs Want To Feed at the Trough Again: Bernanke, Geithner and Paulson Use Crisis Anniversary to Ask for More Bailout Powers

After a decade of writing about the crisis, we are now subjected to an orgy of yet more chatter with not much insight. It speaks volumes that the likes of Ben Bernanke, Timothy Geithner, and Hank Paulson are deemed fit to say anything about it, let alone pitch the need for the officialdom to have more bank bailout tools in a New York Times op-e titled What We Need to Fight the Next Financial Crisis.

The fact that they blandly depict crises that demand extraordinary interventions as to be expected confirms that greedy technocrats like them are a big part of the problem. Their call for more help for financiers confirms that they have things backwards. How about doing more to make sure that future crises aren’t meteor-killing-the-dinosaurs level events, and foisting more costs and punishments on the financiers who got drunk and rich on too much risk-taking? The first line of defense should be stronger regulations, including prohibition of certain activities.

As the Financial Times’ Martin Wolf pointed out in a recent crisis retrospective, the response of central bankers and financial regulators to the crisis was to restore the status quo ante, and not engage in root and branch reform, as took place in the Great Depression. But as we’ve pointed out, the response to the crisis represented the greatest looting of the public purse in history....

Bernanke was a true believer in the Great Moderation, the mid-2000s self-congratulatory mainstream economist view that they had produced the best of all possible worlds. Bernanke in fact continued the so-called Greenspan put which incentivized investors and bankers to take on financial risks, since they knew if anything bad happened, the Fed would rush to their rescue. The Fed, and Bernanke in particular, were badly behind the curve. In May 2007, Bernanke said that subprime was contained, and in July 2008, gave Fannie and Freddie clean bills of health.

Geithner, when he was head of the New York Fed, did acknowledge that the brave new world of slicing, dicing, and distributing risk might make it more difficult to manage a crisis, but then insisted that there was no way to roll the clock back. Linear projections of trends is naive but a great excuse for inaction. Geithner said nary a peep when banks who had just been bailed out gave a raised middle finger to the American public by paying their executives and staffs record bonuses in 2009 and 2010 rather than rebuilding their balance sheets.

...Recall that Paulson’s first TARP proposal was a mere 3 pages demanding $700 billion, more than the hard costs of the Iraq War, and even worse, put the Treasury beyond the rule of law with this provision:

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

At the time, we called it a financial coup d’etat.

Hyman Minsky's May 1992 The Financial Instability Hypothesis

[PDF from the Levy Institute, via Naked Capitalism 9-13-18]

Minsky is one of the few economists who resisted the glitzy lure of Wall Street's wealth, and insisted that almost all financial and economic modeling was fundamentally flawed because their underlying assumptions (such as rational self-interest) were just plain wrong. Almost all the economists who foresaw the 2007-2008 Global Financial Crash, were acolytes of Minsky. Lambert Strether exhorts: "You should read this in full; it’s short [10 pages], there’s not an equation in it, and the writing is insanely lucid."

The Policymakers Saved the Financial System. And America Never Forgave Them

by Neil Irwin, September 11, 2018 [New York Times, via Naked Capitalism 9-13-18]

The engineers of the response succeeded in their immediate goal, to preserve the financial system. But they — or, more precisely, they and their political leaders at the time — also left fissures that threaten to undermine the system they sought to preserve. The very underpinnings of modern capitalism are being questioned from all sides. A Republican administration has gleefully cast aside trade deals, for instance, and the energy among Democrats is around democratic socialism.Irwin writes that "The goal was not to try to reinvent Wall Street on the fly, but to keep the flow of capital coursing through the global economy," but never does he question the social utility and economic justice of that "flow of capital." The "very underpinnings of modern capitalism are being questioned" precisely because so little of the flow of capital no longer goes to assist to the development of new technologies, new companies, and new jobs that are economically progressive (in terms of actually creating new, generally shared economic progress). Instead, most of the flow of capital goes to speculation: over $5 trillion a day in the foreign exchange markets alone; nearly $700 billion daily in USA bond markets, and about $200 billion per day in USA stock markets. Compare these daily trading volumes to the approximately $74 billion in total USA venture financing for the entire year of 2017, or the $1,575.7 billion ($1.6 trillion) U.S. nonfarm businesses spent on new and used structures and equipment in the entire year of 2016. Just to emphasize the point: the foreign exchange markets move three times more money in one day than all USA businesses spend on new plant and equipment in an entire year, while the USA bond market by itself will move as much money in two days and two hours.

The one useful thing Irwin does is to remind us that the Tea Party was launched bwith a staged rant by CNBC "financial news" broadcaster Rick Santelli on the floor of the Chicago Mercantile Exchange. It's absolutely amazing to me that Tea Partiers have never evinced one iota of shame that they were propelled into political motion by a talking head speaking on the floor of a futures market, where a large chunk of foreign exchange trading takes place. And, of course, Irwin neglects to mention that Santelli's rant was staged.

Irwin ends with a section entitled, "How the crisis broke our politics," in which he paraphrases former Federal Reserve chairman Ben Bernanke whining that

longer-term trends — like stagnation in middle-class wages, social dysfunctions, rising mistrust in government and hostility to immigration — were a bigger explanation for the rise in a politics of extremes.The point is, Irwin completely fails to explore the connection between the "flow of capital" and "stagnation in middle-class wages" and "social dysfunctions." See, for example, Jacobin's recent article on financialization as The Latest Incarnation of Capitalism.

Ten Years After the Crash, We’ve Learned Nothing

Matt Taibbi [Rolling Stone, via Naked Capitalism 9-14-18]

New Study Confirms Offshore Earnings are Flowing into Stock Buybacks, Not Jobs and Investments

[Just Taxes, via Naked Capitalism 9-11-18]

For Over a Century, the New York Times Has Praised Big Bank Consolidation

By Pam Martens and Russ Martens: September 13, 2018 [Wall Street on Parade]

A Proposed Alternative to Corporate Governance and the Theory of Shareholder Primacy

by John R. Ellerman and Ira T. Kay, September 12, 2018 [Harvard Law School Forum on Corporate Governance and Financial Regulation, via Naked Capitalism 9-13-18]

On Senator Elizabeth Warren’s proposed Accountable Capitalism Act.

What is shareholder primacy? For the past 30 years, shareholder primacy has been the most fundamental concept practiced in U.S. corporate law and governance. Shareholder primacy asserts that shareholders have the priority interest in their corporation’s economics and governance: shareholders are the principals on whose behalf the agents (management) of the corporate enterprise serve. Shareholder primacy instructs the Board of Directors to manage the corporation to maximize shareholder wealth.... The proposed Accountable Capitalism Act is a dramatic departure from the corporate governance model currently practiced by U.S. corporations.

Nancy Pelosi Promises That Democrats Will Handcuff the Democratic Agenda If They Retake The House

By David Dayen, September 4 2018 [The Intercept]

Meta: “We’re Measuring the Economy All Wrong”

“A team of academic economists — Gabriel Zucman, Emmanuel Saez and Thomas Piketty (the best-selling author on inequality) — has begun publishing a version of G.D.P. that separates out the share of national income flowing to rich, middle class and poor. For now, its data is published with a lag; the most recent available year is 2014. But the work is starting to receive attention from other academics and policy experts [including Senators Chuck Schumer and Martin Heinrich]…. ‘As someone who advises policymakers, I can tell you there is often this shock: ‘The economy is growing. Why aren’t people feeling it,” [Heather Boushey, who runs the Washington Center for Equitable Growth] says. ‘The answer is: Because they literally aren’t feeling it.’ ….. It’s worth remembering that the current indicators are not a naturally occurring phenomenon. They are political creations, with the flaws, limitations and choices that politics usually involves.”

“Since dark money changed politics as we know it in the post-Citizens United era, the top 15 dark money groups have spent more than $600 million in secret money in our elections”

[Issue One, via Naked Capitalism 9-12-18]] (report).

NY Senate: “Six of eight ex-IDC senators lose primary bids”

[Times-Union, via Naked Capitalism 9-14-18]

“Progressive activists successfully wrested the Democratic nominations away from six former members of the Senate Independent Democratic Conference in primaries on Thursday, including the conference’s former leader, Jeff Klein…. The outcome marked a stunning epilogue to the rogue group formed by Klein in 2011, after Democrats lost the chamber, and the initial four members worked, with the tepid support of Gov. Andrew M. Cuomo, in conjunction with the Senate Republicans. In 2013, when Democrats made up a numerical majority, the renegade Democrats enabled Republicans to maintain control of the Senate.”

Population race: India to overtake China ‘in 3 to 5 years’

Asia Times staff, September 11, 2018 [Asia Times]

According to a report by the National Health and Family Planning Commission, the nation’s net population growth for the first eight months of this year was only 4.1 million. This puts the largest nation in the world close to being overtaken by India.

India’s population expanded by some 14 million during the same period, to a size that is closer than ever to its rival: India’s 1.336 billion versus China’s 1.339 billion as of September 9, 2018, according to estimates by the United States Census Bureau’s World Population Clock.

[CBS, via Naked Capitalism 9-11-18]

[NPR, via Naked Capitalism 9-11-18]

My first vial of insulin cost $24.56 in 2011, after insurance. Seven years later, I pay more than $80. That's nothing compared with what Alec was up against when he turned 26 and aged off his mother's insurance plan.

Smith-Holt says she and Alec started reviewing his options in February 2017, three months before his birthday on May 20. Alec's pharmacist told him his diabetes supplies would cost $1,300 a month without insurance — most of that for insulin. His options with insurance weren't much better.

Alec's yearly salary as a restaurant manager was about $35,000. Too high to qualify for Medicaid and, Smith-Holt says, too high to qualify for subsidies in Minnesota's health insurance marketplace. The plan they found had a $450 premium each month and an annual deductible of $7,600.

"At first, he didn't realize what a deductible was," Smith-Holt says. She says Alec figured he could pick up a part-time job to help cover the $450 per month.

Then Smith-Holt explained it. "You have to pay the $7,600 out of pocket before your insurance is even going to kick in," she remembers telling him. Alec decided going uninsured would be more manageable. Although there might have been cheaper alternatives for his insulin supply that Alec could have worked out with his doctor, he never made it that far.

He died less than one month after going off of his mother's insurance....

Before the early 1920s, Type 1 diabetes was a death sentence for patients. Then, researchers at the University of Toronto — notably Frederick Banting, Charles Best and J.J.R. Macleod — discovered a method of extracting and purifying insulin that could be used to treat the condition. Banting and Macleod were awarded a Nobel Prizefor the discovery in 1923.

For patients, it was nothing short of a miracle. The patent for the discovery was sold to the University of Toronto for only $1 so that live-saving insulin would be available to everyone who needed it.

Today, however, the list price for a single vial of insulin is more than $250. Most patients use two to four vials per month (I personally use two). Without insurance or other forms of medical assistance, those prices can get out of hand quickly, as they did for Alec.

Depending on whom you ask, you'll get a different response for why insulin prices have risen so high. Some blame middlemen — such as pharmacy benefit managers, like Express Scripts and CVS Health — for negotiating lower prices with pharmaceutical companies without passing savings on to customers. Others say patents on incremental changes to insulin have kept cheaper generic versions out of the market.

For Nicole Holt-Smith, as well as a growing number of online activists who tweet under the hashtag #insulin4all, much of the blame should fall on the three main manufacturers of insulin today: Sanofi of France, Novo Nordisk of Denmark and Eli Lilly and Co. in the U.S.

The Secret Drug Pricing System Middlemen Use to Rake in Millions

By Robert Langreth, David Ingold and Jackie Gu, September 11, 2018 [Bloomberg, via Naked Capitalism 9-11-18]

To probe what middlemen make, Bloomberg examined the prices of 90 of the best-selling generic drugs used by Medicaid managed-care plans. In 2016, the drugs made up a large portion of Medicaid’s spending on generics.

Markups on these commonly prescribed generic drugs are growing, with huge markups on some well-known medicines, Bloomberg found. For the 90 drugs analyzed, which includes more than 500 dosages and formulations, PBMs and pharmacies siphoned off $1.3 billion of the $4.2 billion Medicaid insurers spent on the drugs in 2017.

Missing wages, grueling shifts, and bottles of urine: The disturbing accounts of Amazon delivery drivers may reveal the true human cost of ‘free’ shipping

[Business Insider, via Naked Capitalism 9-11-18]

Does ‘right to work’ imperil the right to health? The effect of labour unions on workplace fatalities. National Bureau of Economic Research., via Naked Capitalism 9-13-18]

In total, [right to work (RTW) laws have led to a 14.2% increase in occupational mortality through decreased unionisation.

[Pew, via Naked Capitalism 9-11-18]

Tech: “Congress Is Clueless About Google’s Biggest Problem”

[Bloomberg, via Naked Capitalism 9-10-18].

“Lanier’s insightful point is that this [free service for data] model may also be a natural route to disaster, for a disconcertingly simple reason. Facebook, for example, makes money by helping advertisers target messages — including lies and conspiracies — to the people most likely to be persuaded. The algorithms looking for the best ways to engage users have no conscience, and will simply exploit anything that works. Lanier believes that the algos have learned that we’re more energized if we’re made to feel negative emotions, such as hatred, suspicion or rage. ‘Social media is biased not to the left or the right,’ as he puts it, ‘but downward,’ toward an explosive amplification of negativity in human affairs. In learning how to best to manipulate people, tech algorithms may inadvertently be causing mass violence and progressive social degradation.”

Here’s How Your Unique Behavioral Psychological Profile Is Being Used to Manipulate You

[Alternet, via Naked Capitalism 9-15-18].

Another reason, if you must use Facebook, to muddy your profile.

Joint Russia-China military maneuvers in Pacific showcase Chinese military technology

By Stephen Bryen September 7, 2018 [Asia Times, via Naked Capitalism 9-11-18]

While Russia could long count on selling China key aerospace equipment, complete fighter planes – including the powerful Su-35 – and jet engines, China is now introducing types of weapons, especially stealth aircraft, that Russia cannot afford to produce or even support technologically.

Chinese industry is advertising that it has perfected a jet engine, the Xian WS-15, for its Chengdu J-20 Stealth fighter that previously was using a stopgap Russian-made NPO Saturn AL-31F power plant. The WS-15 in pre-production testing in China makes use of single crystal fan blade technology for the hot section of the engine.

Single crystal castings are made from powdered metal alloys that are cast into shapes and treated in special furnaces and form the core technology for high powered turbine engines – the technology is closely guarded as a secret in the United States

The Northern Sea Route and its Impact on World Trade

[Valdai Club, via Naked Capitalism 9-13-18]

16 of UK’s largest van fleets to go electric: 18,000 electric vans by 2028

by Sami Grover, September 7, 2018 [Treehugger, via Naked Capitalism 9-10-18]

California Mandate for 100% Clean Energy by 2045 Signed Into Law

“The climate change mandate forces utilities to incrementally ditch fossil fuels in favor of renewable electricity and joins the Golden State with Hawaii as the only states wholly committed to a zero-carbon energy sector. [Governor Jerrry] Brown says Senate Bill 100 puts California in line with the goals of the United Nations Paris Agreement and prepares the state for the “existential threat” of climate change.” ª Kevin DeLeón, the author of the bill, is running for Senate (he supports Medicare for All).

“People think of beekeeping as a rural pursuit, but honeybees can thrive in urban areas. Comprehensive studies on urban beekeeping are limited, but data in specific geographies from Boston to London suggest that bees actually do better in cities than in rural areas…. ‘The levels of pesticides and fertilizers is much higher in a rural setting because of people treating their crops or in suburban areas,’ Peterson-Roest says. ‘Everybody has to have the best-looking lawn, and they spray for those dandelions and want to make sure that their yard is weed-free. But nobody is spraying the abandoned lots and the organic gardens.’… Urban environments also provide diversity in food sources for bees,

The Bezzle: “Why Tesla’s Autopilot Can’t See a Stopped Firetruck”

[Wired, via Naked Capitalism 9-10-18]

“These systems are designed to ignore static obstacles because otherwise, they couldn’t work at all…. This unsettling compromise may be better than nothing, given evidence that these systems prevent other kinds of crashes and save lives. And it’s not much of a problem if every human in a semi-autonomous vehicle followed the automakers’ explicit, insistent instructions to pay attention at all times, and take back control if they see a stationary vehicle up ahead.” [Lamber Strether comments: If I have to pay attention at all times, why don’t I just drive?]People have been told for over a decade now not to use their cell phones and drive at the same time. And the results? I can just imagine the public reaction to not being able to snooze or smooch while your "semi-autonomous vehicle" drives you to your next accident scene. This is classic IT-think: nothing can be done about the software, so the users will have to adjust and adapt.

It’s Now Possible To Telepathically Communicate with a Drone Swarm

by Patrick Tucker, September 6, 2018 [Defense One, via Naked Capitalism 9-12-18]

The work builds on research from 2015, which allowed a paralyzed woman to steer a virtual F-35 Joint Strike Fighter with only a small, surgically-implantable microchip. On Thursday, agency officials announced that they had scaled up the technology to allow a user to steer multiple jets at once.

“As of today, signals from the brain can be used to command and control … not just one aircraft but three simultaneous types of aircraft,” said Justin Sanchez, who directs DARPA’s biological technology office, at the Agency’s 60th-anniversary event in Maryland.

More importantly, DARPA was able to improve the interaction between pilot and the simulated jet to allow the operator, a paralyzed man named Nathan, to not just send but receive signals from the craft....

It’s another breakthrough in the rapidly advancing field of brain-computer interfaces, or BCIs, for a variety of purposes. The military has been leading interesting research in the field since at least 2007,. And in 2012, DARPA issued a $4 million grant to build a non-invasive “synthetic telepathy” interface by placing sensors close to the brain’s motor centers to pick up electrical signals — non-invasively, over the skin.

But the science has advanced rapidly in recent years, allowing for breakthroughs in brain-based communication, control of prosthetic limbs, and even memory repair.

The divide between mainstream macro and MMT is irreconcilable – Part 1

by Billy Mitchell, September 10, 2018 [Billy Mitchell, via Naked Capitalism 9-12-18]

These accounting frameworks and fiscal rules are designed to give the (false) impression that the government is financially constrained like a household – that is, in context, has to either raise taxes to spend or issue debt to spend more than it raises in taxes.

MMT strips way these veils of neo-liberal ideology that mainstream macroeconomists use to restrict government spending.

We learn that these constraints are purely voluntary and have no intrinsic status. This allows us to understand that governments lie when they claim they have run out of money and therefore are justified in cutting programs that advance the well-being of the general population.

By exposing the voluntary nature of these constraints, MMT pushes these austerity-type statements back into the ideological and political level and rejects them as financial verities.

Mainstream macroeconomics does no such thing. It holds these voluntary institutional structures out as intrinsic financial constraints.

1. Governments are financially constrained.

2. That means to spend the government must tax, which have negative consequences on work and investment incentives.

3. Spending more than it taxes (deficits) leads to a new ‘funding’ decision.

4. They recognise that the deficit could be funded by ‘money printing’ but claim this would be inflationary.

5. So the best option (among the two evils) is to issue debt, which pushes up interest rates and crowds out private spending.

6. There is a very real possibility that any stimulus from the deficit spending will be wiped out by the crowding out.

That is mainstream macroeconomics and it is not possible to spin it any other way.

To give you are guide, the best-selling macroeconomics textbook is Macroeconomics (currently 9th edition) by Greg Mankiw [George W. Bush's chief economic adviser].

4. “Some economists believe that to pay for these commitments, we will need to raise taxes substantially as a percentage of GDP … Other economists believe that such high tax rates would impose too great a cost on younger workers. They believe that policymakers should reduce the promises now being made to the elderly of the future and that, at the same time, people should be encouraged to take a greater role in providing for themselves as they age.”

9. Unemployment is not due to real wage rigidity but rather arises from a systemic failure to provide enough jobs. That failure arises due to inadequate spending in the economy. When the non-government sector’s spending and saving decisions are made and executed, if there is a deficiency then it means the fiscal deficit is too low. Entrenched mass unemployment is a political choice made by governments.

10. “unemployment results when the real wage remains above the level that equilibrates labor supply and labor demand. Minimum-wage legislation is one cause of wage rigidity. Unions and the threat of unionization are another.”

This is core mainstream macroeconomics and is fed into the policy-making process on a daily basis.

It drives narratives, policy choices, how government departments and central banks are run (at least at the political level) and it is fed continuously, albeit in different (more simpler) language to the general population on a daily basis.

Why Did The New Yorker Want Steve Bannon To Headline Their Festival?

by Ian Welsh, September 4, 2018 [IanWelsh.com]

So, Bannon was due to headline a New Yorker festival. People became upset and now he isn’t.

Why was he invited in the first place?

I’m not one of those who’ll argue that Bannon isn’t smart. He is. Very much so. But there are plenty of very smart, and indeed smarter people on the left. Chomsky has never headlined for the New Yorker, and he’s a straight up genius.

Bannon was invited because what the alt-right/fascists want is something centrists can live with. Fascists are big believers in corporations. Under the Nazis executive wages soared. They crushed unions and depressed wages. They managed unemployment by choosing entire classes of people to make non-people, and the rest of the population mostly got a job.

All of this is stuff that centrists can live with. High executive compensation, pro-corporate policies, keeping unions and the left down.

Remember, always, that Jews weren’t killed first. Socialists and anarchists were.

So the bottom line is that centrists are OK with fascists because fascists are pro-corporate and executive wealth....

On the other hand, the left wing is hostile to large corporations and high executive compensation. At the least the left would highly regulate corporations and break many of them up, while slapping on c.90% marginal tax rates and punitive estate taxes.

At the most, some left wingers would nationalize corporations whole sale and redistribute wealth, or they might force employee ownership of corporations or some version of that.

All actual left-wingers would end the obscene over-pay part in corporate America.

Left-wingers are an existential threat to centrists because centrists are, substantially, supporters of the status quo. How America and the world is (or was before Trump) is essentially good to them. The parts of the status quo that right wingers want to overthrow don’t hurt centrists. The parts of the status quo that left wingers want to overthrow do.

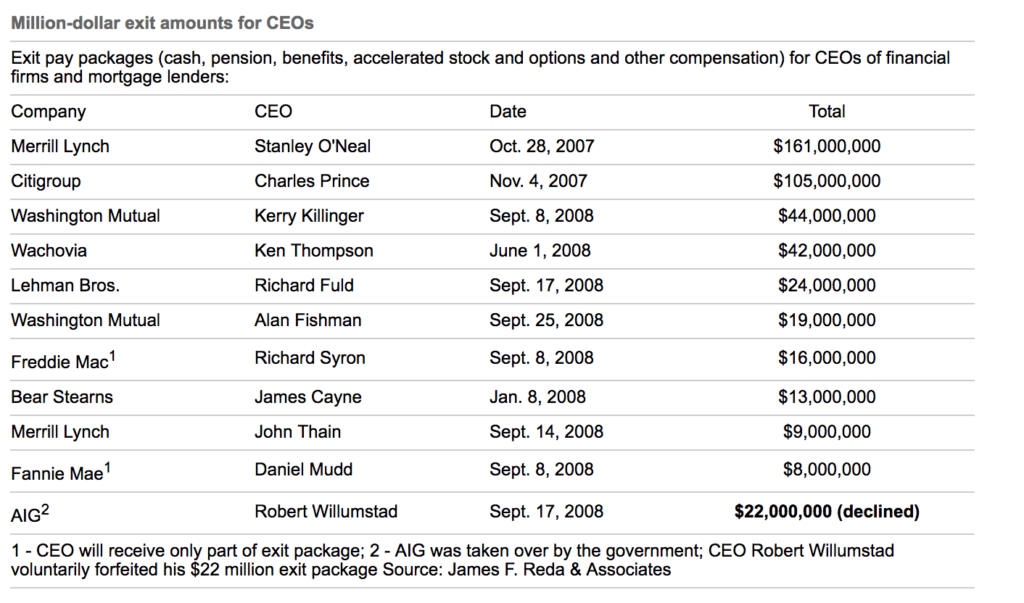

....The center prefers the center. But they’ll always choose the right over the left on anything that even slightly smells of economics, because they want to retain their wealth and the right will allow that and the left won’t.And I add this table to emphasize Welsh's point:

Source for table: Crimes Were Committed, by Barry Ritholtz, September 12, 2018 [The Big Picture]

This is the introduction to Ritholtz's reflections on the 2007-2006 GFC, and is well worth reading. In this first part, Ritholtz discusses why no executives were ever prosecuted.

No comments:

Post a Comment