by Tony Wikrent

Economics Action Group, North Carolina Democratic Party Progressive Caucus

Strategic Political Economy

Is Capitalism a Threat to Democracy?In a sweeping, angry new book, “Can Democracy Survive Global Capitalism?” (Norton), the journalist, editor, and Brandeis professor Robert Kuttner... [argues] today’s political impasse is different from that of the nineteen-thirties. It is being caused not by a stalemate between leftist governments and a reactionary business sector but by leftists in government who have reneged on their principles. Since the demise of the Soviet Union, Kuttner contends, America’s Democrats, Britain’s Labour Party, and many of Europe’s social democrats have consistently tacked rightward, relinquishing concern for ordinary workers and embracing the power of markets; they have sided with corporations and investors so many times that, by now, workers no longer feel represented by them. When strongmen arrived promising jobs and a shared sense of purpose, working-class voters were ready for the message.

Economic Armageddon

[Bloomberg, via Naked Capitalism 4-5-20]

The same self-serving rentier parasites who were in charge in 2008-2009 are still in charge - another indication that USA political and economic systems are complete failures. They are unable to replace proven failed leadership with competent leadership. Not surprising that the professional class in the Democratic Party -- which declined the opportunity in 2009-2010 to uproot the failed leadership of Wall Street, and is now besieged by a reality of innumerable crisis -- responded to the challenge of Bernie Sanders, by desperately retreating to their Biden redoubt.

- Treasury Secretary Steven Mnuchin led a group of investors who purchased failed subprime mortgage lender IndyMac and ran the bank until its sale in 2015. Mnuchin is now leading President Donald Trump's economic response to the pandemic.

- Tim Geithner, President, Federal Reserve Bank of New York in 2009. CURRENT POSITION: President, Warburg Pincus

- Larry Fink, CEO, BlackRock Inc. in 2008. CURRENT POSITION: CEO, BlackRock Inc.

- Tom Montag, Head of Sales & Trading, Merrill Lynch & Co. in 2009. CURRENT POSITION:

- Chief Operating Officer, Bank of America Corp.

- Rodge Cohen, Chairman, Sullivan & Cromwell LLP in 2008. CURRENT POSITION: Chairman, Sullivan & Cromwell LLP

- Alan Schwartz, CEO, Bear Stearns Cos. in 2008. CURRENT POSITION: Co-Chairman, Guggenheim Securities LLC

- Gary Parr, Vice Chairman, Lazard Ltd. in 2008. CURRENT POSITION, Senior Managing Director, Apollo Global Management

- To which let me add: Joe Biden, vice-president of the United States in 2009. CURRENT POSITION, Democratic nominee for U.S. President

'Breadlines' Erupt Across America As Lockdowns Crush America's "Working Poor"

[ZeroHedge 4-10-20]

A third of American renters have not been able to pay their rents this month

The National Multifamily Housing Council (NMHC) found a 12-percentage point decrease in the share of apartment households that paid rent through April 5, in the first review of the effect of the COVID-19 outbreak on rent payments. The Tracker found 69 percent of households had paid their rent by April 5; this compares to 81 percent that had paid by March 5, 2020, and 82 percent that had paid by the same time last year.“Mortgage Borrowers Stop Making Payments With Economy Shut”

“The percentage of loans in forbearance grew to 2.66% as of April 1, according to the MBA’s Forbearance and Call Volume Survey. On March 2, the rate was 0.25%. For loans backed by Ginnie Mae, which serves low- and moderate-income borrowers, the rate jumped to 4.25%. The increase came as the U.S. economy largely shut down to help stem the spread of the coronavirus. The government is requiring lenders handling payments on federally backed loans to give borrowers grace periods of as much as six months at a time with no penalties. Loan servicers say they’ve been flooded with borrowers requesting help.”This Bailout Is Really Going to Screw Over Mom and Pop Businesses

But even though businesses have been applying for [Economic Injury Disaster Loans grants for more than a week, there is no sign that a single dollar has actually gone out the door yet. Unlike the Paycheck Protection Program loans, which are government-backed but made by private banks, the economic disaster program is handled directly by the Small Business Administration....

...Reddit’s small-business channel, which has become a touch point for business owners trying to navigate the bailout, has filled up with posts from people still waiting to hear back about the grants and who are convinced that none has gone out. Not one small-business owner I have talked to in the past week says they have received the cash yet, either. A spokeswoman for the Main Street Alliance, a small business group, told me in an email that “anecdotally based on what we’ve heard from our members—no one has received any money.” On Twitter, frustrated small-business owners even started a hashtag about the situation, #EIDLHOAX.

Once businesses do start receiving money, many are concerned it could be far less than what they anticipated. The SBA now says it will provide up to $10,000 for each applicant. And in an email bulletin sent Monday and posted to Reddit, the SBA’s Massachusetts field office announced that businesses would only receive $1,000 per employee and $10,000 max per grant. (It also said money would start being distributed this week, suggesting none of it had gone out yet.) I asked the SBA press team to confirm whether the information in the email is accurate, but they did not respond.

[Popular Information, via The Big Picture 4-10-20]

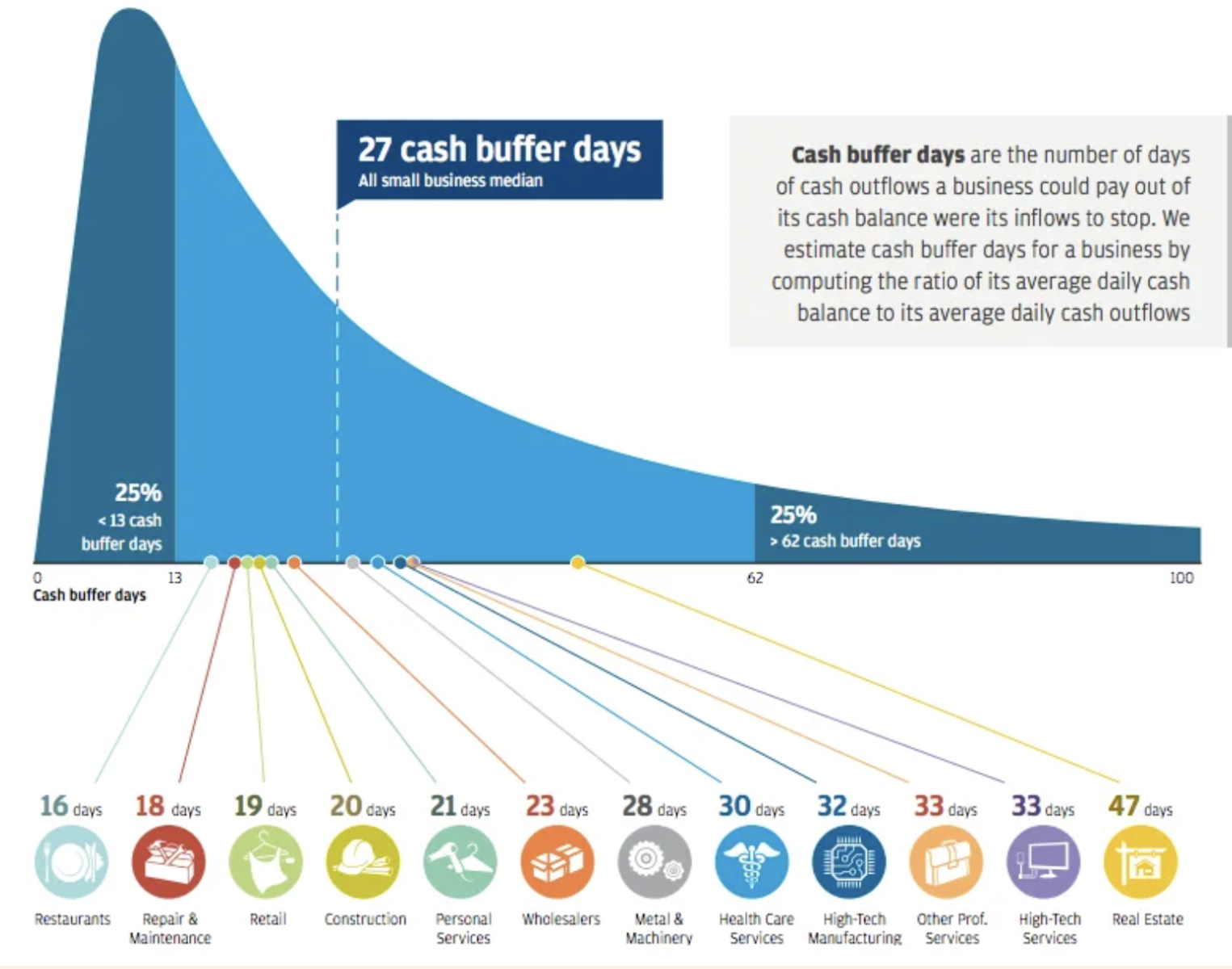

The coronavirus pandemic has devastated millions of small businesses. An April 3 survey found that 24% of small businesses have already temporarily shut down. Among those businesses still open, “40% report it is likely they will shut temporarily within the next two weeks.”....

One issue with the fund is that it’s too small. The total fund is “about half of what would be required to cover 2½ months of payrolls for every business in America with fewer than 500 employees,” according to one calculation. Other analysts say it would cost $1 trillion to support small businesses for three months....“There’s Going to Be Scandal Involved in This Bailout. It Is Unquestionable’

NC: Important. Transcript of a discussion between Bill Moyers and Neil Barofksy, former chief inspector general of the Troubled Assets Relief Program, on big corporate bailouts.

“The absence rate appears particularly high in schools with many low-income students, whose access to home computers and internet connections can be spotty. Some teachers report that fewer than half of their students are regularly participating.”

$1,200 Only Goes So Far. It’s Time to Abolish Debt

How Will Public Transit Survive the COVID-19 Crisis?

“Why the Wealthy Fear Pandemics”

“But as successive waves of plague shrunk the work force, hired hands and tenants ‘took no notice of the king’s command,’ as the Augustinian clergyman Henry Knighton complained. “If anyone wanted to hire them he had to submit to their demands, for either his fruit and standing corn would be lost or he had to pander to the arrogance and greed of the workers.’ As a result of this shift in the balance between labor and capital, we now know, thanks to painstaking research by economic historians, that real incomes of unskilled workers doubled across much of Europe within a few decades. According to tax records that have survived in the archives of many Italian towns, wealth inequality in most of these places plummeted. In England, workers ate and drank better than they did before the plague and even wore fancy furs that used to be reserved for their betters. At the same time, higher wages and lower rents squeezed landlords, many of whom failed to hold on to their inherited privilege. Before long, there were fewer lords and knights, endowed with smaller fortunes, than there had been when the plague first struck.”

Grover Norquist’s Dismantled State Struggles to Respond

How is Florida’s broken unemployment system hurting people? Let us count the ways....the emergency lending would be accessible to states and the District of Columbia, as well as cities with populations over 1 million residents and counties with populations over 2 million residents. The Treasury Department will use $35 billion from the stimulus package enacted in late March to cover any losses from states or cities that default.

Eligible kinds of debt include tax anticipation notes, tax and revenue anticipation notes, bond anticipation notes and “other similar short-term notes” with maturities no longer than 24 months. Generally, those kinds of notes allow governments to access a larger amount of money upfront in the form of debt instruments using estimations of future revenue. Each debt issuance will be subject to Fed review.

Total debt issuance will be capped at 20 percent of the “general revenue from own sources and utility revenue” of each government applying for the aid, based on fiscal year 2017, the Fed said.

Progressive policies into the breach

Canceling Student Loan Debt PetitionThe student loan justice.org is needs your help by your signing the “President Trump: Cancel Student Loans NOW“ petition. Please join student loan justice.org and the 211,000 (up from 161,000) signers of the petition calling for President Trump to prioritize canceling student loan debt. Doing such would cause many citizens burdened with debt to be more productive promoting economic growth.

A first-of-its-kind program that will deploy almost a thousand people across Massachusetts may be a small-scale test of what public health experts hope could eventually stamp out the coronavirus even before a vaccine becomes widely available.

Massachusetts Gov. Charlie Baker (R) said Friday that his state would join with Partners In Health, a Boston-based global health nonprofit, to turn staffers into contact tracers, the backbone of any robust public health effort to squelch a deadly disease.

Those contact tracers will interview people who have been infected with the coronavirus to determine who around them might also have been exposed....

Such a program aimed at bolstering national public health would be unprecedented in the history of the country. But as the economy nosedives into what could be a depression and millions lose their jobs in the space of a few days and weeks, a government-backed effort to get those people back to work does have a precedent, in Depression-era programs like the Works Progress Administration (WPA) and the Civilian Conservation Corps (CCC).

In their brief histories, the WPA and the CCC employed nearly 1 in 10 Americans, giving people a paycheck in the years between Franklin Roosevelt's election and the outset of World War II. In its first year, the WPA accounted for more than 6 percent of the nation's gross domestic product — the equivalent of about $1.3 trillion in today's dollars....

"We need an army of contact tracers in every community in the United States to find every contact to warn them to take care of themselves and not to infect others," said Tom Frieden, the former director of the Centers for Disease Control and Prevention who now runs the global health nonprofit Resolve to Save Lives. "Contact tracing is a core public health activity. It's bread and butter of public health."

We're now finding that it is a mistake to "find" economic efficiencies to be wrung out of this social necessity:

The Public Banking Institute sent an Open Letter to Congress detailing four immediate actions that will prevent financial catastrophe in our communities....

- Put real money into the real economy. At least $1,200 per month to all US adults as long as needed.

- Put money in people’s hands NOW. Get relief funds to people immediately by restarting Post Office Savings Accounts to direct deposit relief funds, and/or by using Treasury Direct accounts to direct deposit newly-issued Treasury dollar bills.

- Get money to the states. States can get 0% loans by forming their own public banks.

- Cancel debts held by the federal government, starting with student debts.

The actions listed above can be funded by tapping into the same money tree Congress and the Fed just used to fund a $6 trillion bailout for Wall Street and Corporate America. States and municipalities must also act now to take advantage of the Fed’s 0% rates by setting up their own public banks by emergency powers. These banks could provide the low-cost credit communities urgently need during this pandemic. Like Germany’s public bank KfW, they could grant 1% loans vs. the complex SBA programs charging 3.75%. Turning the central bank into a true public utility and establishing a stabilizing network of public banks via these emergency actions will save Main Street’s economy from disaster and build the publicly-owned, trustworthy financial infrastructure necessary to keep it healthy long term.

PBI Chair Ellen Brown says:Coronavirus: Spain to become first country in Europe to roll out universal basic income

“The same Congress that has insisted we cannot afford a universal basic income, Medicare for All, free state college tuition, and other critically needed programs has suddenly discovered that it has unlimited funds to ‘do whatever it takes’ to rescue corporations and the stock market. Meanwhile the individuals, local governments, and local businesses suffering the devastating consequences of the shutdown have essentially been left out of this bailout. But relief for all is possible, if the central bank is run as a true public utility. The same sort of Treasury-owned Special Purpose Vehicle (SPV) set up in the CARES Act to bail out businesses and financial institutions can be used to bail out the people and states. The facilities are already in place to issue relief funds immediately by direct deposit, and this can be done for as long as needed.”

[Independent, via Naked Capitalism 4-8-20]

Disrupting mainstream economics - Modern Monetary Theory

The Use and Abuse of MMTMichael Hudson, with Dirk Bezemer, Steve Keen and T.Sabri Öncü [via Naked Capitalism 4-10-20]

After being attacked by monetarists and others for many decades, MMT and the idea that running government budget deficit is stabilizing instead of destabilizing are suddenly gaining applause from the parts of the political spectrum that long opposed MMT: the banking and financial sector, especially the Republicans. But what is applauded is in many ways something quite different than the leading MMT advocates have long supported.

Modern Monetary Theory (MMT) was developed to explain the logic of running government budget deficits to increase demand in the economy’s consumption and capital investment sectors so as to maintain full employment. But the enormous U.S. federal budget deficits from the Obama bank bailout after the 2008 crash through the Trump tax cuts and Coronavirus financial bailout have not pumped money into the economy to finance new direct investment, employment, rising wages and living standards. Instead, government money creation and Quantitative Easing have been directed to the finance, insurance and real estate (FIRE) sectors. The result is a travesty of MMT, not its original aim.

By subsidizing the financial sector and its debt overhead, this policy is deflationary instead of supporting the “real” economy. The effect has been to empower the banking sector, whose product is credit and debt creation that has taken an unproductive and indeed extractive form....

At issue was the role of government in the economy. The major opponents of public enterprise and infrastructure, of budget deficits and market regulation, was the financial sector. “Austrian” and Chicago-style monetary theorists strongly opposed MMT, asserting that government budget deficits would be inflationary, citing Germany’s Weimar inflation of the 1920s, and Zimbabwe, and portraying government deficits (and indeed, active government programs and regulation) as “interference” with “free markets.”

MMTers pointed out that running a budget surplus, or even a balanced budget, absorbed income from the economy, thereby shrinking demand for goods and services and leading to unemployment. Without government deficits, the economy would be obliged to rely on private-sector banks for the credit needed to grow.

That occurred in the United States in the final years of the Clinton administration when it actually ran a budget surplus. But with a public sector surplus, there had to be a corresponding and indeed identical private sector deficit. So the effect of that policy was to leave either private debt financing or a trade surplus as the only ways in which economic growth could obtain the monetary support that was needed. This built in structural claims for interest and amortization that were deflationary, ultimately leading to the political imposition of debt deflation and economic austerity after the 2008 debt crisis.

If governments do not provide enough purchasing power by running budget deficits to enable the economy to grow, the role of providing money and credit will have to be relinquished to banks – at interest, and for purposes that the banks decide on (mainly, loans to buy real estate, stocks and bonds).The FT Says It’s Time for the Bank of England to Start Direct Funding of the Government: Modern Monetary Theory Has Won the Day

Yves Smith [Naked Capitalism 4-7-20]

Bank of England to finance UK government Covid-19 crisis spending Guardian, via Naked Capitalism 4-10-20]

Capitalism in the time of COVID

....This is exactly what happened during the last financial crisis: the New York Fed was put in charge of the bailout programs and then farmed them out to multinational banks like Goldman Sachs and JPMorgan Chase – who are among the largest shareowner owners of the New York Fed. In fact, JPMorgan Chase, while its Chairman and CEO, Jamie Dimon, was sitting on the Board of the New York Fed, signed a highly lucrative contract to serve as custodian for the New York Fed’s purchases of agency mortgage-backed securities, which currently total $1.45 trillion. That contract has now been in effect for more than 11 years as the Fed promised to unwind that program, but never did, and is now doubling down on it.

During the more than 11 years that the New York Fed has allowed JPMorgan Chase to hold $1.45 trillion of Fed assets, it has pleaded guilty to three criminal felony charges and is currently under another criminal probe by the U.S. Department of Justice for turning its precious metals desk into a racketeering enterprise.

Why Private Equity Is Cutting Doctor Pay and Organizing Our Pandemic Response

Wall Street’s Banks Could Profit by Millions on Coronavirus Deaths of Employees

Pam Martens and Russ Martens: April 7, 2020 [Wall Street on Parade]

How the Coronavirus Bailout Repeats 2008’s Mistakes: Huge Corporate Payoffs With Little Accountability

Too Big to Fail, COVID-19 Edition: How Private Equity Is Winning the Coronavirus Crisis

[Vanity Fair, via Naked Capitalism 4-10-20]

...among those angling for a federal handout is one of the wealthiest sectors of the American economy: private equity. These firms not only have a record $1.5 trillion in cash on the sidelines, waiting to be invested, but their CEOs are among America’s richest executives. So why should they be permitted to raid the federal Treasury in a time of crisis?

The reason is as simple as it is galling: while great private fortunes, such as that of Blackstone’s Stephen Schwarzman (net worth: $17.5 billion and Apollo’s Leon Black ($7.5 billion), have been made from private equity’s march through the world, its losses, to a remarkable degree, will belong to all of us. That’s because some of the major investors in private-equity funds are public pension plans; at Blackstone, roughly one-third of the firm’s money comes from retirement plans set up to provide for over 30 million working-class Americans, according to someone with knowledge of its portfolio. So if Blackstone’s investments crater, the teachers, firefighters, and health care workers who are counting on those investments to generate the returns necessary to pay their pensions will suffer....Resetting the Bomb: Another era of debt-fueled profiteering is ending with a bailout. How we’re institutionalizing the unfairness economy

Matt Taibbi [taibbi.substack.com]

A larger issue is conceptual. What’s the consequence of making the maintenance of prices in financial markets a “systemically important” end in itself?

America’s executive class in the last few decades has settled into a Ponzi-like pattern: borrow, inflate, strip assets, crash, get bailed out, start over. Both the profits and the size of the bag the rest of the country is left holding get bigger with each cycle.

In the last ten years buybacks, takeovers and other schemes made executives rich, but left companies cash-poor and leveraged to the hilt. When Covid-19 hit, corporate America could with sincerity claim it needed immediate aid to keep doors open and financial markets afloat.

But the scope of the rescue is as massive as it is in significant part because private-sector cash that might otherwise have buffered the damage had already been stripped out of the economy. As Marcus Stanley of Americans for Financial Reform puts it, “We’re starting to routinize the process of privatizing gains and socializing losses.”

The worse problem comes when companies not only spend all of their available resources on stock distributions, but borrow to fund even more distributions. This leaves companies with razor-thin margins of error, quickly exposed in a crisis like the current one.

“When companies spend billions on buybacks, they’re not spending it on research and development, on plant expansion, on employee benefits,” says Dennis Kelleher of Better Markets. “Corporations are loaded up with debt they wouldn’t otherwise have. They’re intentionally deciding to live on the very edge of calamity to benefit the richest Americans.”

It’s hard to overstate how much money has vanished. S&P 500 companies overall spent the size of the recent bailout – $2 trillion – on buybacks just in the last three years!

Banks spent $155 billion on buybacks and dividends across a 12-month period in 2019-2020. As former FDIC chief Sheila Bair pointed out last month, “as a rule of thumb $1 of capital supports $16 of lending.” So, $155 billion in buybacks and dividends translates into roughly $2.4 trillion in lending that didn’t happen....

...it’s had the result of promoting a generation of corporate leaders who are skilled at firing people, hustling public subsidies, and borrowing money to fund stock awards for themselves, but apparently know jack about anything else.

During a Covid-19 crisis where we need corporations to innovate and deliver life-saving goods and services, this is suddenly a major problem. “We’re seeing, these people don’t have the slightest idea of how to run their own companies,” says University of Massachusetts economist William Lazonick, whose substantial research on the buyback issue has been a cornerstone of the movement toward reform.

The Pandemic

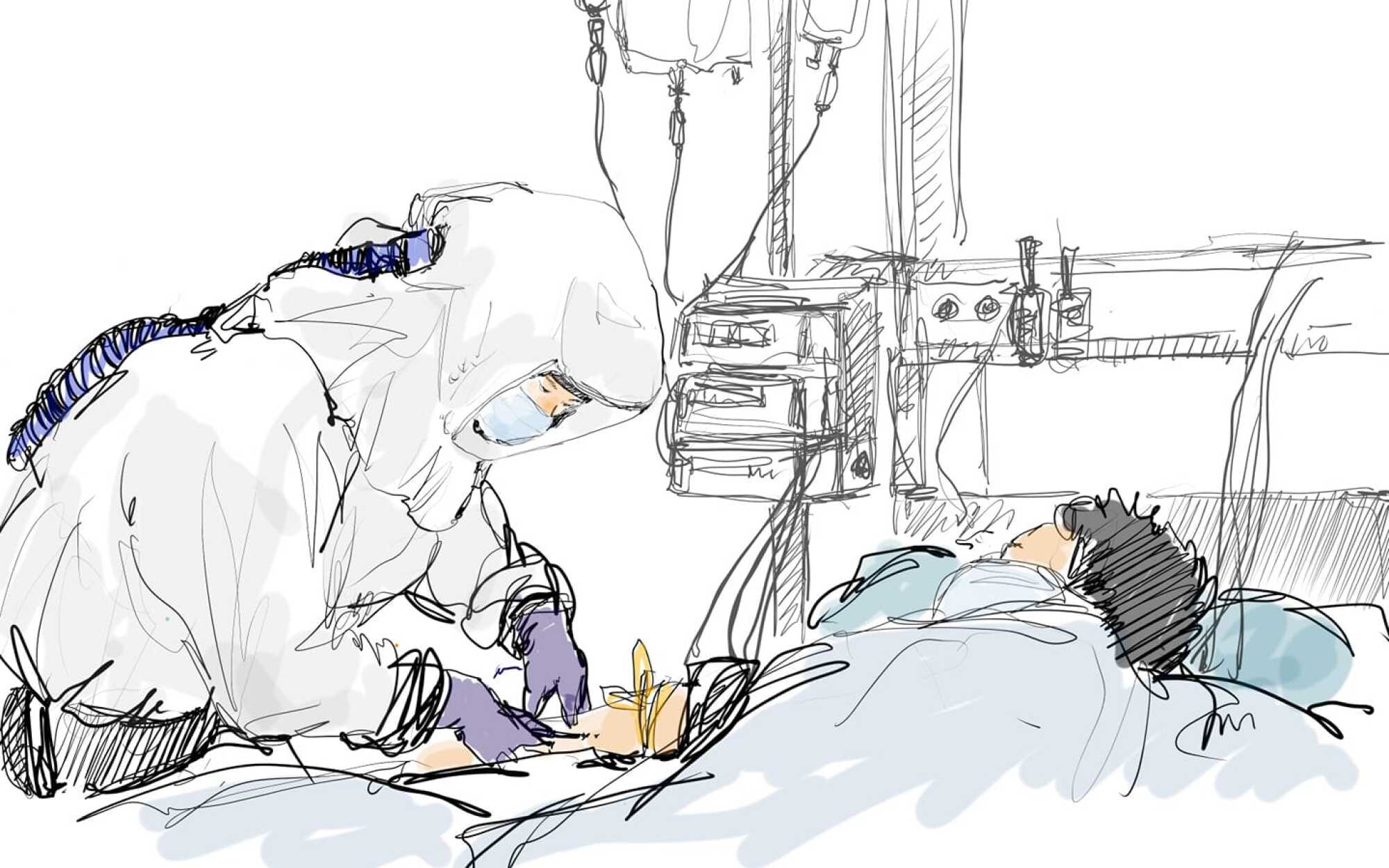

An ICU nurse sketches the heroes and fighters inside a coronavirus isolation ward

Earlier this year, Oh volunteered to be one of the nurses staffing an isolation ward for those stricken with COVID-19. He has since been caring for critically ill patients in cumbersome protective gear that has made unwieldy many of the tasks he once did with ease in his eight years as a nurse. And on his days off, the 34-year-old art school dropout-turned-nurse picks up his stylus and sketches intimate scenes of life and death as seen through his goggled eyes and felt through his gloved hands.... He wanted people to see what he saw, the grueling hours, the humanity, the sacrifice, the hushed toll at shift’s end.

Staggering Surge Of NYers Dying In Their Homes Suggests City Is Undercounting Coronavirus Fatalities

[Gothamist, via Facebook 4-7-20]

But another 200 city residents are now dying at home each day, compared to 20 to 25 such deaths before the pandemic, said Aja Worthy-Davis, a spokeswoman for the medical examiner’s office. And an untold number of them are unconfirmed.Axios-Ipsos Coronavirus Index: Rich sheltered, poor shafted amid virus

[Axios, via Naked Capitalism 4-5-20]

This sobering reality emerges from Week 3 of our Axios-Ipsos Coronavirus Index. The survey finds Americans with less education and lower incomes far more likely either to have to keep showing up at their workplaces — putting themselves at greater daily risk of infection — or more likely to have seen their work dry up.

“There are wide gaps by income class in both the risk posed by the virus, because of existing health conditions, and in levels of response to the risk of infection.” • With charts.This graph is especially stunning: it shows the differences in incidence of medical conditions by wealth distribution:

[The Hill, via Naked Capitalism Water Cooler 4-9-20]

“Up to 35 million Americans could lose their health insurance in the coming weeks as businesses lay off workers due to the economic hit from the coronavirus pandemic, according to a new study. The astonishing projection from Health Management Associates underscores the pandemic’s ripple effects from the economy into healthcare. The group said that the number of uninsured Americans could spike to 40 million people, a level unseen since before the Affordable Care Act became law in 2010. The study also estimated 23 million Americans could enroll in Medicaid, ensuring many would still receive insurance through other means. But 5 million Americans might still wind up uninsured.”

[Common Dreams, via Naked Capitalism 4-7-20]

Why nurses at DMC Sinai-Grace walked away from their jobs Sunday night

A Nurse Bought Protective Supplies for Her Colleagues Using GoFundMe. The Hospital Suspended Her.

[The Source, via Naked Capitalism 4-9-20]

“Clinical trials of new and old medications are ongoing. But right now, I am sorry to say there is no proven treatment for Covid-19 infection. It is therefore at least conceivable that putting patients on ventilators for Covid-19 pneumonia could be a bridge to nowhere. Now of course, hope springs eternal. The patient may recover on their own while we keep them alive with our machines. But this is not a risk-free wager. Dr. Paul Mayo, perhaps New York City’s most illustrious critical care doctor expressed the risks pithily: ‘putting a person on a ventilator creates a disease known as being on a ventilator.’ When we mechanically blow air into your damaged lungs faster and harder than humanly possible, ventilator-induced lung injury may result. Generally, for a person to tolerate the undertaking, we have to sedate them, leading to immobility and severe weakness. While sedated, the person cannot cough or clear their airway effectively, leading to superimposed bacterial pneumonia. This is an awful lot to survive. And in the case of Covid-19, the preliminary outcome data is rather dismal.”

A really illuminating YouTube on ventilators, and the (no doubt mostly well-meaning) efforts that confuse ventilators with pumps (hat tip Lefteris):

Grocery workers are beginning to die of coronavirus

“This moment demands a restoration of the national commitment to a richer conception of freedom: economic security and equality of opportunity. That’s why Times Opinion is publishing this project across the next two months, to envision how to turn the America we have into the America we need.”

It is a nation in which enduring racial inequalities, in wealth and in health, are reflected in the pandemic’s death toll. In Michigan, where the coronavirus hit early and hard, African-Americans make up just 14 percent of the state’s population but 40 percent of the dead. Jason Hargrove, who kept driving a Detroit city bus as the virus spread, posted a Facebook video on March 21 complaining about a female passenger who coughed without covering her mouth. He said he had to keep working, to care for his family. In the video, he told his wife he’d take off his clothes in the front hall when he got home and get right in the shower, so that she stayed safe. Less than two weeks later, he was dead....

Advocates of a minimalist conception of government claim they too are defenders of liberty. But theirs is a narrow and negative definition of freedom: the freedom from civic duty, from mutual obligation, from taxation. This impoverished view of freedom has in practice protected wealth and privilege. It has perpetuated the nation’s defining racial inequalities and kept the poor trapped in poverty, and their children, and their children’s children.

Creating new economic potential - science and technology

COVID-19: Tales from the Supply Chain

“One of the greatest benefits of additive manufacturing is that it allows companies to reduce the dependency on the supply chain, manufacture parts internally or make them on demand,” Joshi continued. “And this is what we’re asking our network and encouraging the industry to help us do right now—circumvent the supply chain to manufacture these PPE and life-saving devices as quickly as possible.”

Lonati SpA, a 3D Systems customer in Brescia, Italy, deployed a 3D Systems printer to 3D print more than 100 Venturi ventilator valves for respiratory machines, which are in short supply.

The Pinerolo, Italy facility produced more than 700 components in just one week, including disposable valves for emergency ventilator masks for an Italian hospital. The project was request at 11 a.m. local time, and after a new design was created, 30 parts were delivered to the hospital in just eight hours....National Labs Join Fight against COVID-19

[Machine Design Today 4-9-20]

Interesting compilation of some of the facilities and capabilities created by US taxpayers. Obvious question: will the technologies developed by these government facilities be used for public good, or will the rentiers of the professional management class find a way to extract private "profit" from them?

- U.S. Department of Energy’s (DOE) Lawrence Berkeley National Laboratory 's Advanced Light Source (ALS)

- Berkeley Lab’s Molecular Foundry

- National Energy Research Scientific Computing Center (NERSC)

- DOE's Energy Sciences Network (ESnet)

- Berkeley Lab’s Advanced Biofuels and Bioproducts Process Development Unit

- DOE's Joint Genome Institute (JGI)

- DOE's Agile BioFoundry

Information Age Dystopia

Collapse of Independent News Media

Politics

It’s Biden’s WorldBiden was one of the key architects of the bankrupty bill, which made it impossible to declare bankruptcy on student loans. The result of the bankruptcy bill is that millenials and zoomers who went to university and don’t have rich parents can’t own a house and many have decided they can’t afford families. They expect to live in poverty for decades as a result. (Not going to university means you can’t even apply for good jobs.)

Biden pushed hard for three-strikes laws, the drug wars, and so on. He is responsible for completely destroying entire generations of poor black men and gutting inner cities.

Biden has repeatedly tried to cut social security. He didn’t just vote for war with Iraq, he pushed the lie that Iraq had WMD, and worked hard to promote approval for the war.

He actively helped repeal Glass-Steagall, setting up the 2007/8 financial crisis that caused a ten-year long “recession” for ordinary people.

We live in Joe Biden’s world. Joe Biden was there every step of the way, creating a world in which young people live in poverty, poor black (and white) men are in prison, and in which the rich get richer and everyone else scrambles to even keep up....

...So when you see upset Sanders supporters, understand that they’re angry that people who voted Biden don’t seem to care if they die or live in poverty.“I’m a Bernie volunteer. Here’s how Joe Biden can win Bernie voters.”

....Biden was, everyone thought, on his last legs and had not campaigned or established a ground presence in many states. Then, in the days immediately before Super Tuesday, several of his opponents dropped out. Their endorsements and a raft of others carried him to victory.

This was a message to Bernie voters: "Fuck off. We would rather drag Joe Biden over the finish line, knowing that he is no longer mentally competent, than cede anything to the candidate who is winning your votes by fifty points or more."

....I know by this point you have all kinds of desperate or righteously angry appeals in mind. "Think about Trump’s racism! Think about the kids in cages!" Sorry, that shit doesn’t work anymore. This primary came down to one candidate who gave Strom Thurmond’s eulogy and another who — I know you are tired of hearing this — marched with Martin Luther King, Jr. It came down to one candidate who wanted to break up ICE and another whose boss built the cages that Trump filled with children. We know how you chose.

For various reasons, you believe that Joe Biden’s faults have been exaggerated, that Bernie Sanders is the real racist, that Obama’s militarization of border enforcement was fundamentally different from Trump’s....

The total number of volunteers on the text team is over thirty thousand. On a slow day, I sign up maybe a dozen people to join us as volunteers. Other texters have told me much the same. You can do the multiplication.

We lost anyway. We were not good enough. If you want to beat Trump, you will have to work harder than we did and rally more of your people to volunteer. Name recognition is enough to win a primary. It is not enough to win a general election. You need hundreds of thousands of people texting, making phone calls, knocking on doors. You cannot be satisfied with knocking on doors locally, either. We had people who spent every weekend busing into neighboring states. I know this would be harder for Biden voters, who are generally older than us and may, like Joe, have mixed feelings about busing. Have you ever met a Hmong or a Bhutanese person? We had organizers working with them. You have won the black vote, but you cannot take anyone else for granted....

You are not going to persuade anyone even by calling Biden the lesser evil: He was in power ten times longer than Donald Trump, and in that time his signal achievements in bipartisanship were a crime bill that imprisoned much of a generation of black men and a war that killed hundreds of thousands of civilians. The argument that Trump is worse depends on what you predict Trump will do in a second term, and no one is listening to your predictions anymore.

“Obama had a delicate task. Everyone knew whom he preferred, and yet he could not be seen as helping organize the massive party-wide show of force in favor of Biden that emerged from South Carolina through Super Tuesday. Obama’s aides forcefully reiterated that he was scrupulously not intervening. But some of his aides now concede that behind the scenes Obama played a role in nudging things in Biden’s direction at the crucial moment when the Biden team was organizing former candidates to coalesce around Biden.” .... “Released from his self-imposed neutrality, the former president will soon make the case for Biden that Biden has had trouble making himself.”Lambert Strether: “Neutrality,” for pity’s sake. Everybody knew what Obama wanted, and the article is full of details that prove it.

...The plan starts by mimicking what Denmark and the UK have done, which is to offer payroll support to firms to keep workers employed instead of offering welfare to the newly unemployed. But it also includes a firm crackdown on Wall Street and mergers, and inducements to begin making things in America again. In some ways, it is the outline of a New Deal-style arrangement, taking power from the financiers and returning it to private businesses, workers, and public institutions….

There are also more industrial policy-style components, like local content requirement rules for medicine and medical equipment, subsidies for firms who want to build industrial ecosystems domestically, and Federal-backed low interest lending for capital equipment financing.

No comments:

Post a Comment