by Tony Wikrent

Economics Action Group, North Carolina Democratic Party Progressive Caucus

Strategic Political Economy

Why so much direct public investment?

Lessons for Green New Deal

- Private sector unwilling/unable to bear risk, especially in newer industries

- Decarbonization may call for large direct investment by public sector as opposed to shifting private investment via prices/subsidies

- Public role largest in new industries/technologies

Third lesson: Full employment is powerful force for redistribution

- Public role not just to provide resources, but to solve coordination problems and to bear risk

- 1940s saw the largest compression of incomes in US history as in most advanced countries

- Lowest paid groups (African Americans, agricultural workers) gained most

Summary - Three lessons from wartime mobilization:

- Very little direct redistribution - all about labor market

- Rapid economic transitions require larger role for direct public investment

- Output, employment are more elastic than conventional estimates of potential assume

Predatory Finance

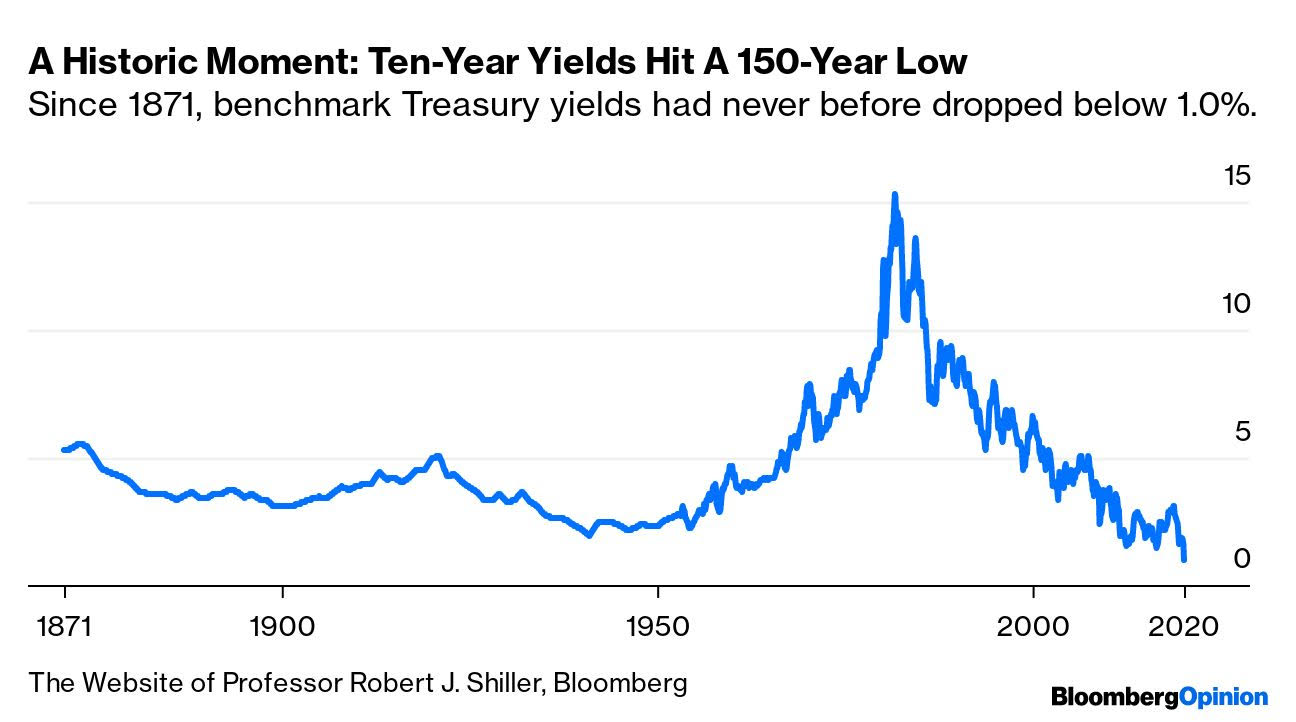

Alexander Hamilton’s Creations Are in Uncharted Territory: The slide below 1% suggests the Fed has lost control and has troubling implications for the long-term economic outlook.John Authers, March 4, 2020 [Bloomburg, via The Big Picture 3-5-20]

...what happened on Super Tuesday in the bond market was truly historic. The G-7’s finance ministers and central bankers talked in the morning, produced a statement that the market found disappointing, and then the Federal Reserve announced an emergency interest rate cut.... An emergency cut is intended to deal with extreme financial conditions....

The long-term outlook is now of drawn-out deflationary stagnation. We can see this from another amazing development — the drop in the 30-year yield to a negative level in real terms. In other words, its yield is less than the average inflation rate that can be derived from the inflation-linked bond market. Nothing like this has ever happened before:

Demand for Fed’s Repo Loans Surges Past $100 Billion a Day as 10-Year Treasury Hits Lowest Rate in 149 Years

On top of that, at 8:45 a.m. that very morning, the New York Fed had pumped $100 billion in 1-day repo loans into the trading houses on Wall Street, $8.6 billion short of what the trading houses had sought to borrow. Even at the peak of the repo loan crisis that began on September 17, 2019 and through the end of January 2020, the Fed had never pumped out $100 billion in 1-day repo loans on a single day. Yesterday, the Fed pumped out another $100 billion in 1-day repo loans against demand for $111 billion – further evidence that Wall Street firms are in need of liquidity.

This is the first time since the financial crisis of 2008 that the Fed has been making repo loans to Wall Street. The Fed is also purchasing $60 billion a month in U.S. Treasury bills, which many folks on Wall Street consider the fourth round of quantitative easing (QE). The Fed deployed QE1, QE2, and QE3 following the 2008 financial collapse on Wall Street to further ease interest rates on top of cutting its Fed Funds rate to the zero-bound....

The 10-year U.S. Treasury note has lost 37 percent of its yield in the past 10 days. For the first time in 149 years, it is trading below a yield of one percent. This morning at 8:58 a.m. it was trading at a yield of 0.9456.

The Great Depression is considered the worst financial crisis in the history of the United States. The financial collapse in 2008 is ranked second to that. And yet during the Great Depression which spanned the 1930s, the 10-year yield was in the 2 to 3 percent range.

That statistic alone strongly suggests that despite the Fed secretly throwing $29 trillion cumulatively to bail out Wall Street banks and their derivatives following the crash of 2008, the United States has never actually returned to a self-sustaining economy.

The Carnage of Establishment Neoliberal Economics

The Dairy Farm of Your Imagination Is Disappearing: Falling prices and factory-farm competition are taking out family farms by the thousands.The tradition of bartering goes back to before the Spanish introduced money, but became crucial for native Colombians’ diet after a 2011 free trade deal with the United States. The indigenous soon found out that no trade deal is free when the government banned the commercial use of non-patented seeds.

This blanket ban included endemic food crops that are part of the diet of indigenous communities’ diet who wouldn’t dare patent a seed they believe belongs to Mother Earth. In order to preserve their diet and prevent the extinction of endemic crop species, indigenous nations throughout Colombia strengthened their bartering practices in response.Most Americans Point to Circumstances, Not Work Ethic, for Why People Are Rich or Poor

[Pew Research Center, via The Big Picture 3-3-20]

How Hard Will the Robots Make Us Work?

[The Verge, via Naked Capitalism 3-2-20]

“An automation crisis has already arrived. The robots are here, they’re working in management, and they’re grinding workers into the ground. The robots are watching over hotel housekeepers, telling them which room to clean and tracking how quickly they do it. They’re managing software developers, monitoring their clicks and scrolls and docking their pay if they work too slowly. They’re listening to call center workers, telling them what to say, how to say it, and keeping them constantly, maximally busy. While we’ve been watching the horizon for the self-driving trucks, perpetually five years away, the robots arrived in the form of the supervisor, the foreman, the middle manager. These automated systems can detect inefficiencies that a human manager never would — a moment’s downtime between calls, a habit of lingering at the coffee machine after finishing a task, a new route that, if all goes perfectly, could get a few more packages delivered in a day. But for workers, what look like inefficiencies to an algorithm were their last reserves of respite and autonomy, and as these little breaks and minor freedoms get optimized out, their jobs are becoming more intense, stressful, and dangerous.”

“The University of California, Santa Cruz, issued termination letters on Friday to 54 graduate students who have been waging a months-long strike for a cost-of-living-adjustment amid soaring rents. The firings came as graduate students at the University of California, Davis, and University of California, Santa Barbara, began their own cost-of-living strikes in solidarity. One of their demands is that all UC Santa Cruz graduate workers who participated in strike activities be restored to full employment status. The 54 UC Santa Cruz graduate students who received termination letters on Friday are just a fraction of the 233 graduate student instructors and teaching assistants who have refused to submit nearly 12,000 grades from the fall quarter since December. This month, the students’ grading strike expanded, as teaching assistants refused all teaching duties and research assistants refused additional work. Some classes and office hours have been canceled because of the strike.”

Health Care Crisis

‘Why Are We Being Charged?’ Surprise Bills From Coronavirus Testing Spark Calls for Government to Cover All Costs“Public Health and Law Experts Issue Guidelines for U.S. Response to Coronavirus Transmission” [Yale Law School] (open letter), via Naked Capitalism 3-4-20]

“‘This is a test of our society’s basic principles of fairness. It will be a disgrace if social status and income determine whether a person can get care or follow public health guidelines,’ said Scott Burris, the Director of Temple Law School’s Center for Public Health Law Research.”

An unprecedented shift in human population is one reason why more diseases originate in Asia and Africa. Rapid urbanization is happening throughout Asia and the Pacific regions, where 60% of the world already lives. According to the World Bank, almost 200 million people moved to urban areas in East Asia during the first decade of the 21st century....

Migration on that scale means forest land is destroyed to create residential areas. Wild animals, forced to move closer to cities and towns, inevitably encounter domestic animals and the human population. Wild animals often harbor viruses; bats, for instance, can carry hundreds of them. And viruses, jumping species to species, can ultimately infect people.

Eventually, extreme urbanization becomes a vicious cycle: More people bring more deforestation, and human expansion and the loss of habitat ultimately kills off predators, including those that feed off rodents. With the predators gone – or at least with their numbers sharply diminished – the rodent population explodes. And as studies in Africa show, so does the risk of zoonotic disease.California orders insurers to waive out-of-pocket costs for coronavirus testing

[Economic Policy Institute, March 5, 2010]

Climate and environmental crises

Landmark Win in ‘Fight for Habitable Future’ as Jury Refuses to Convict Climate Activists Who Presented Necessity DefenseOffshore oil and gas accidents, deaths spike amid Trump administration’s regulatory rollbacks

Russian Arctic shipping up 430 percent in three years

Creating new economic potential - science and technology

“Down on the Farm That Harvests Metal From Plants”

“On a plot of land rented from a rural village on the Malaysian side of the island of Borneo, the group has proved it at small scale. Every six to 12 months, a farmer shaves off one foot of growth from these nickel-hyper-accumulating plants and either burns or squeezes the metal out. After a short purification, farmers could hold in their hands roughly 500 pounds of nickel citrate, potentially worth thousands of dollars on international markets. Now, as the team scales up to the world’s largest trial at nearly 50 acres, their target audience is industry. In a decade, the researchers hope that a sizable portion of insatiable consumer demand for base metals and rare minerals could be filled by the same kind of farming that produces the world’s coconuts and coffee.”NASA drops mind-blowing 1.8 billion-pixel Mars landscape panorama that might make you cry

[CNET, via Naked Capitalism 3-5-20]

[American Wind Energy Association, 06 March 2020]

The Virginia Senate today passed the Virginia Clean Economy Act, after the House of Delegates approved the bill yesterday. Governor Ralph Northam is now clear to join leaders in the General Assembly in allowing the state’s energy system to unlock the enormous economic and environmental potential renewable energy sources can bring to the Commonwealth.

The Virginia Clean Economy Act will create a state renewable energy portfolio system (RPS) program, similar to those already implemented in 29 other states, Washington, DC and Puerto Rico. The Virginia RPS requires that 30% or more of Virginia’s electricity comes from renewable energy sources by 2030. By 2050, the Act requires that 100% of Virginia electricity will be zero-emissions – a goal Governor Northam advocated for during his election campaign.

The Act includes measures to harness wind and solar power, expand consumer ownership through rooftop solar, and reduce energy waste through mandatory efficiency standards. Notably, the legislation also includes a 5.2-gigawatt offshore wind target, one of the largest state commitments to offshore wind to date and one with the potential to power up to 1.5 million Virginia homes.AWEA: Wind Energy Now Top Source of Renewable Electricity

[American Wind Energy Association, 27 February 2020]

Wind energy is now the top source of renewable electricity generation in the country according to the U.S. Energy Information Administration, surpassing hydroelectric generation in 2019 for the first time in history. Annual wind generation totaled 300 million megawatt hours (MWh) in 2019, exceeding hydroelectric generation by 26 million MWh.

Politics

“Why Southern Democrats Saved Biden”Mara Gay [New York Times, via Naked Capitalism 3-6-20]

(Gay was the lone member of the Times Editorial Board to endorse Sanders.)

My friends in New York, many of them Elizabeth Warren or Bernie Sanders supporters who see Mr. Biden as deeply uninspiring, were mystified. But after traveling through the South this past week, I began to understand. Through Southern eyes, this election is not about policy or personality. It’s about something much darker. Not long ago, these Americans lived under violent, anti-democratic governments. Now, many there say they see in President Trump and his supporters the same hostility and zeal for authoritarianism that marked life under Jim Crow….

“People are prideful of being racist again,” said Bobby Caradine, 47, who is black and has lived in Memphis all his life. “It’s right back out in the open.”

....Joe Biden is no Barack Obama. But he was somebody they knew. “He was with Obama for all those years,” Mr. Caradine said. “People are comfortable with him.” Faced with the prospect of their children losing the basic rights they won over many generations, these voters, as the old Chicago political saw goes, don’t want nobody that nobody sent.

They were deeply skeptical that a democratic socialist like Mr. Sanders could unseat Mr. Trump. They liked Ms. Warren, but, burned by Hillary Clinton’s loss, were worried that too many of their fellow Americans wouldn’t vote for a woman.”Lambert Strether comments: "it’s not clear why the Democrat Establishment hands control over the nomination to the political establishment in states they will never win in the general; the “firewall” in 2016 didn’t work out all that well, after all. As for Jim Crow, we might do well to remember that Obama destroyed a generation of Black wealth his miserably inadequate response to the foreclosure crisis, and his pathetic stimulus package kept Black unemployment high for years longer than it should have been. And sowed the dragon’s teeth of authoritarian reaction as well."

[Twitter, , via Naked Capitalism 3-6-20]

If someone does not yet understand that Wall Street is a principal mechanism by which the one percent loot the rest of the country, they simply do not want to understand, and should not be counted as a political ally.

No comments:

Post a Comment