by Tony Wikrent

Economics Action Group, North Carolina Democratic Party Progressive Caucus

I tremble for my country when I reflect that God is just

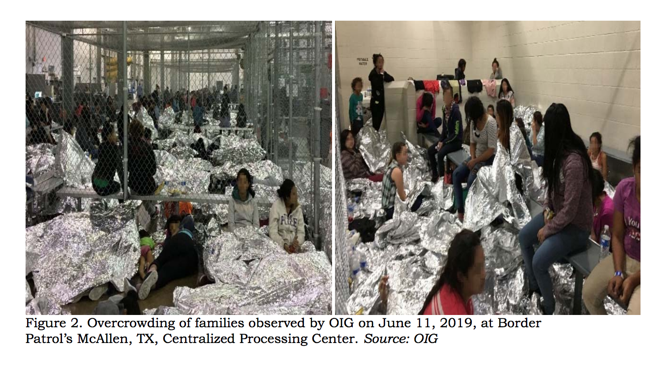

What a Pediatrician Saw Inside a Border Patrol Warehouse[The Atlantic, , via Naked Capitalism 7-5-19]

Dolly Lucio Sevier evaluated dozens of sick children at a facility in South Texas. She found evidence of infection, malnutrition, and psychological trauma.

At Ursula, however, the children Sevier examined—like the panting 2-year-old—were “totally fearful, but then entirely subdued,” she told me. She could read the fear in their faces, but they were perfectly submissive to her authority. “I can only explain it by trauma, because that is such an unusual behavior,” she said. Sevier had brought along Mickey Mouse toys to break the ice, and the kids seem to enjoy playing with them. Yet none resisted, she said, when she took them away at the end of the exam. “At some point,” Sevier mused, “you’re broken and you stop fighting.”

....Border Patrol has long maintained that it is not equipped to handle children, who are supposed to be transferred into the custody of the Office of Refugee Resettlement within three days. After that, many kids are housed in licensed child-care facilities that look more like the average public school than a jail. The federal government has attributed slow transfers to the sharp uptick in the number of migrants at the southern border; in May, 144,200 migrants were taken into custody—the highest monthly total in 13 years.

Days before Sevier’s visit, reports of poor conditions at a similar facility in Clint, Texas, drew outrage around the country. Kevin McAleenan, the acting head of the Department of Homeland Security, told reporters the outcry was based on “unsubstantiated allegations regarding a single Border Patrol facility.”

But his own agency’s watchdogs soon contradicted him—the problems are not restricted to Clint.

Predatory Finance

The British Virgin Islands is home to more than 400,000 companies that hold $1.5 trillion in assets.... Even though he helped get it up and running, Geluk doesn’t have permission to scan the whole database. In fact, only two people, a pair of unnamed employees of the BVI’s Financial Investigation Agency, are able to search the entire system, which holds details on about 600,000 owners who have directly or indirectly controlled companies here. It’s thought that roughly a third of all offshore companies globally are registered in the BVI....

The BVI’s place in the dark offshore economy was illuminated by the 2016 Panama Papers leak, in which 11.5 million documents from the law firm Mossack Fonseca were released by the International Consortium of Investigative Journalists. The disclosures sparked probes worldwide into money laundering, sanctions violations, and tax avoidance, and it didn’t pass without notice that more than half the companies outed in the leak were registered in the BVI. (The scandal should have been called the BVI Papers, more than a few people suggested.) It was clear from the disclosures that BVI regulation was inadequate, and that remains a concern today: Last year, BVI regulators conducted only four on-site inspections of financial firms.

Jerri-Lynn Scofield, June 30, 2019 [Naked Capitalism]

The Corporate Tax Haven Index provides one of those really rare glimpses of what actually happens underneath the bonnet of the global economy. It tells several disturbing stories…in what we can only describe as a full frontal assault on the national tax sovereignty of every country on the planet. That’s what they’re doing. They’re attacking the tax regimes of other countries. What it reveals is a really disturbing picture of international failure. We see the powerful European countries and especially Britain lying behind their clusters of tax havens and they have wrecked economies across the world and are now threatening social stability and democracy across the world.

But when countries like India say, no, that doesn’t work for us, we’re going our own way, then it gets very serious indeed. And the G20 simply cannot afford to ignore this any longer. So the road is open for the next steps. And of course the next steps are going to take us in the direction the Tax Justice Network has always been talking about. And that is in the direction of proper apportionment of profits to the countries where the profits are aligned with the economic substance. In other words, we’re moving towards unitary taxation and formula apportionment…And I think we should all welcome the opportunity now to create a framework for taxing multinational companies that suits the entire world, not just the most powerful countries in the world.Fed’s Stress Test: Should JPMorgan Chase Have Gotten a Second Chance?

Pam Martens and Russ Martens: June 28, 2019 [Wall Street on Parade]

How many second chances should a criminal recidivist get? JPMorgan Chase has logged in guilty pleas to three criminal felony counts in the past five years; it has a criminally-charged precious metals trader singing to the Feds currently as JPMorgan admits in regulatory filings that it’s under a new criminal investigation in that matter; the bank has paid $36 billion in fines for wrongdoing since the financial crash, including $1 billion for trading exotic derivatives in London with bank depositors’ money and losing at least $6.2 billion of those depositor funds (the London Whale scandal). And in just the past year it has proven that it’s “game on” for more regulatory fines and illicit profits. (See Could JPMorgan Chase Be Hit with a Fourth Felony Count for Rigging Precious Metals Markets?)

Despite all of this, yesterday the Federal Reserve announced that it had given JPMorgan Chase a second chance at passing the regulator’s stress test.Wall Street Banks, In Drag as Trade Associations, Fight Indictments for Manipulating Precious

Rebel Economist Breaks Through to Washington on How Shareholder Value Theory Rewards the Undeserving

Lynn Parramore [Institute for New Economic Thinking, via Yves Smith, July 2, 2019, Naked Capitalism]

Lynn Parramore: The shareholder value idea swept the country in the mid-‘80s, in large part through the work of economist Michael Jensen, hired by Harvard Business School in 1985 when you were there. From the start you have opposed it, a position that has gradually found supporters, including Jack Welch, former General Electric chief, who initially promoted shareholder value but later called it “the dumbest idea in the world.” Why is the idea so terrible and how did it take hold?

William Lazonick: Most economists — whether they’re right-wing conservatives or progressives— have deeply misunderstood how firms produce things and the societal role they play. They pass that misunderstanding on to millions of students every year. A lot talk as if “the market” is supposed to magically allocate all the resources in the economy. They don’t see that in reality, business enterprises do this all the time, by investing in research to create new products, for example.

Yet when most economists think of investments in the economy, they think of finance and what they call “capital flows” in the market. Through financial markets, money is supposed to flow to where it is needed. But that’s not the way things actually work! In a capitalist economy, large business enterprises invest in the ability to employ people, to produce things, and also to make profits — all very important economic activities.

Markets are really just the outcomes of these activities. Markets exist because you decide what products you want to buy from these firms, which jobs you want to seek. The markets for cars and for car designers and salespeople exist because we have firms allocating resources in the economy towards the making of automobiles.

It remains the mystery at the heart of Boeing Co.’s 737 Max crisis: how a company renowned for meticulous design made seemingly basic software mistakes leading to a pair of deadly crashes. Longtime Boeing engineers say the effort was complicated by a push to outsource work to lower-paid contractors.The Max software -- plagued by issues that could keep the planes grounded months longer after U.S. regulators this week revealed a new flaw -- was developed at a time Boeing was laying off experienced engineers and pressing suppliers to cut costs.

Increasingly, the iconic American planemaker and its subcontractors have relied on temporary workers making as little as $9 an hour to develop and test software, often from countries lacking a deep background in aerospace -- notably India.Airbus Widebodies Break Boeing’s Japan Dominance

Adrian Schofield [Aviation Week and Space Technology 7-5-19]

Health Care Crisis

‘Rising Enthusiasm for Medicare for All’ Has Provoked Dramatic Surge in Industry-Backed Lobbying: ReportAn analysis published Friday by the consumer advocacy group Public Citizen shows that "rising enthusiasm for Medicare for All has prompted industry to increase its lobbying against the proposal dramatically," suggesting that powerful healthcare interests perceive the movement to replace the nation's for-profit system "as a politically viable threat."

The new report—entitled Fever Pitch: Surge in Opposition Lobbying and Advocacy Validates the Credibility of the Medicare for All Movement (pdf)—reveals that "between the first quarter of 2018 and the first quarter of 2019, the number of organizations hiring lobbyists whose lobbying disclosure forms indicated that they worked on Medicare for All increased by nearly seven times, and the overall number of lobbyists hired increased ninefold."Red States that refused to expand Medicaid under the ACA are seeing their rural hospitals close down

Climate and environmental crises

Last Month Just “Obliterated” Temperature Records as The Hottest June to DateNASA just made a stunning discovery about how fracking fuels global warming

Scientists found a seaweed patch stretching from the Gulf of Mexico to Africa

The study authors call it the great Atlantic Sargassum belt, and suspect it’s likely the result of more nutrients, mainly nitrogen and phosphorus, running off the West Africa coast into the ocean in the winter. The belt is also being fed by the same nutrients, from fertilizer runoff and deforestation, running off into the Amazon River and into the ocean in the summer.

The sargassum responds to those extra nutrients like many plants would: It eats them, and grows. The bloom sizes also continue to grow every year because there are sargassum seeds left over from the previous summer.

Vancouver, Richmond Push to Hold Big Oil Accountable for Climate Damages

[Climate Liability News, via Naked Capitalism 6-30-19]

How Burnsville, Minnesota, cut its carbon emissions nearly 30 percent

[Yale Climate Connections, via Naked Capitalism 7-6-19]

Much of the reduction has come from improvements to the city’s water infrastructure. Energy efficient upgrades to wells, pumps, and water treatment plants have cut way back on the electricity used in treating and delivering water to residents.

The city also switched to LED lighting, has improved energy efficiency, and promotes composting, which can help reduce methane emissions from landfills.

Very technical analysis of an extremely misleading "economic" study purporting to show the cost of fighting climate change is too high to be practicable. Important to bookmark for future reference in rebutting opponents of the new economic golden age we are on the verge of creating with the Green New Deal.

“I’m Not Willing to Do That”: Trump Says He Won’t Take Climate Action Because It Would Threaten Corporate Profits

[The Independent, via Naked Capitalism 7-1-19]

“Saudi Arabia has successfully lobbied for a major climate change report to be scrubbed from international negotiations on limiting global temperature rise to 1.5C. The Saudis led a loose coalition of oil-producing nations, including the US, Russia and Iran, that objected to the science behind the UN’s Intergovernmental Panel on Climate Change (IPCC)…. The final UN report had just five watered-down paragraphs on IPCC findings, explaining that they were based on the “best science available” without including more concrete information on how countries should reduce emissions targets….. Other recent developments have hampered efforts to tackle climate breakdown, including the UN failing to agree a zero emission target and the release of a draft text from the G20 summit that looks to water down climate change targets.”

ClimateDenierRoundup [DailyKos 5-28-19]

The Center has come under increased scrutiny as larger awareness of fossil fuel funding for denial organizations has grown, borne of the ExxonKnew litigation. Back in 2010, Michaels admitted on CNN that something like 40% of his funding came from fossil fuels.

Creating new economic potential - science and technology

Shake Hands with a Mind-Controlled Robotic Arm[Machine Design News 7-5-19]

A team of researchers from Carnegie Mellon University, working with staff at the University of Minnesota, has made a breakthrough that could benefit paralyzed patients and those with movement disorders.

Disrupting mainstream economics

Busting Right-Wing Talking Point, ‘Groundbreaking’ Study Shows Federal $15 Minimum Wage Would Not Cause Job Losses in Low-Wage States“Immigration and African-American Employment Opportunities: The Response of Wages, Employment, and Incarceration to Labor Supply Shocks”

[National Bureau of Economic Research, via Naked Capitalism 7-1-19]

From the abstract: “Using data drawn from the 1960-2000 U.S. Censuses, we find a strong correlation between immigration, black wages, black employment rates, and black incarceration rates. As immigrants disproportionately increased the supply of workers in a particular skill group, the wage of black workers in that group fell, the employment rate declined, and the incarceration rate rose. Our analysis suggests that a 10-percent immigrant-induced increase in the supply of a particular skill group reduced the black wage by 4.0 percent, lowered the employment rate of black men by 3.5 percentage points, and increased the incarceration rate of blacks by almost a full percentage point.”Black workers are being left behind by full employment

The current fragmented, opaque, and deeply conflicted structure of the U.S. stock market as well as the structure of the giant Wall Street banks that interact in every imaginable way with capital formation in America, is not in the public interest, the national interest or in the interest of capitalism itself....

In a June 3 speech by Brett Redfearn, the Director of the Division of Trading and Markets at the Securities and Exchange Commission (who is, himself, legally ensnarled in this mess of a market), he described the U.S. market as follows: there are 13 stock exchanges that “collectively execute around 63 percent of volume in U.S. listed stocks but “no single exchange has even a 20 percent market share.” Then there are 32 Dark Pools, also known as “Alternative Trading Systems (ATSs)” which Redfearn politely describe as allowing “their participants to interact in a more discreet fashion.” In fact, the SEC and other regulators have repeatedly charged these secretive Dark Pools, which are owned by the biggest banks on Wall Street, with gaming the system. (See related articles below.) And yet, the Dark Pools continue to flourish under the nose of the SEC.... Add high-frequency traders and algorithms and artificial intelligence software to this mess and it’s easy to see that the iconic American stock market has been replaced with a Frankenstein’s monster version of stock trading....

Under one roof, Wall Street banks are now allowed to perform the following functions: the investment bank is allowed to put corporate mergers together or underwrite a new stock offering and collect millions of dollars in fees. Then the same bank’s research analyst frequently puts out a buy rating on the stock. That buy rating is then communicated to the thousands of retail stockbrokers (today known as financial advisors) that reside in the same bank’s brokerage firm, which feel intimidated into calling up their retail clients and suggesting they act on that “buy” recommendation. That same bank holding company is also allowed to own a giant commercial bank which holds upwards of one trillion dollars in deposits, the bulk of which are Federally-insured and backstopped by the U.S. taxpayer. Under existing law, some of those Federally-insured deposits can be used as gambling casino chips and used to make trades in high-risk derivatives.

Today, the Federally-insured commercial banks of four of the largest Wall Street firms are sitting on a powder-keg of $177 trillion in notional amount (face amount) of derivatives. That breaks down as follows as of March 31, 2019 according to the regulator of national banks, the Office of the Comptroller of the Currency: JPMorgan Chase has $59 trillion; Citibank has $51 trillion; Goldman Sachs Bank USA has $47 trillion; and Bank of America has $20 trillion. (See Table 3 in the Appendix of the OCC report here.)

Information Age Dystopia

“Confessions of a U.S. Postal Worker: ‘We deliver Amazon packages until we drop dead.'”[Gen, via Naked Capitalism 7-1-19]

“In mid-October, I spoke with a mail carrier who works at a midsize hub of the U.S. Postal Service in rural New England. As a rural carrier associate, they make just under $18/hour in a continuous, part-time position. During the week, the carrier says that between 75 and 80 percent of the packages they deliver are Amazon packages; on Sundays, when no letters are delivered, they deliver Amazon packages exclusively…”

They [the USPS] do a computer-generated route every Sunday, so you show up, and depending on who has ordered packages, they hand you a paper sheet of turn-by-turn directions of what the computer has generated as the most efficient route. It’s wildly inaccurate most of the time. I generally know some of these towns now, so I look at these directions, and I’m like “Well, that’s not even remotely the most efficient path.” But you just have to use it because you can get in trouble if you go off route.

In Wednesday’s opinion, Circuit Judge Jane Richards Roth, writing for a 2-1 majority of a three-judge panel, said Amazon may be liable in part because its business model “enables third-party vendors to conceal themselves from the customer, leaving customers injured by defective products with no direct recourse to the third-party vendor.”

Empire Death-Star self destructing

Congress Sniffing Around Botched McKinsey Studies Depicted as Impairing Intelligence AgenciesYves Smith [Naked Capitalism 7-3-19; from Politico originally]

For the past four years, the powerhouse firm McKinsey and Co., has helped restructure the country’s spying bureaucracy, aiming to improve response time and smooth communication.

Instead, according to nearly a dozen current and former officials who either witnessed the restructuring firsthand or are familiar with the project, the multimillion dollar overhaul has left many within the country’s intelligence agencies demoralized and less effective.

These insiders said the efforts have hindered decision-making at key agencies — including the CIA, National Security Agency and the Office of the Director of National Intelligence.

They said McKinsey helped complicate a well-established linear chain of command, slowing down projects and turnaround time, and applied cookie-cutter solutions to agencies with unique cultures. In the process, numerous employees have become dismayed, saying the efforts have at best been a waste of money and, at worst, made their jobs more difficult.

Disrupting mainstream politics

I interviewed Sen. Elizabeth Warren & asked how she will handle the Socialist framingThis isn’t about “a few bad eggs.” This is a violent culture. propublica.org/article/secret…

Democratic Party leadership insists on suicide

“Whose Side Is The DCCC On? Bustos Moves Against Progressive Candidates Kara Eastman, Dana Balter And Mike Siegel”[Down with Tyranny, via Naked Capitalism 7-1-19]

“[Blue Dog Cheri Bustos] is already proving herself the worst DCCC chair in modern history and has turned herself into the most hated Democrat among party activists, something that took Debbie Wasserman Schultz and Rahm Emanuel many years to accomplish when they held that title. The Republicans aren’t running anyone against her— why should they? She votes very conservatively and having someone as incompetent as she is head up the DCCC is a dream come true for them. The 50 seats the Democrats could take in 2020 will likely turn into a couple of dozen— at best— under Bustos’ guidance. (Maybe it’s just a coincidence, but Bustos isn’t running anyone against her Republican counterpart, Tom Emmer (R-MN), the incompetent head of the NRCC.”

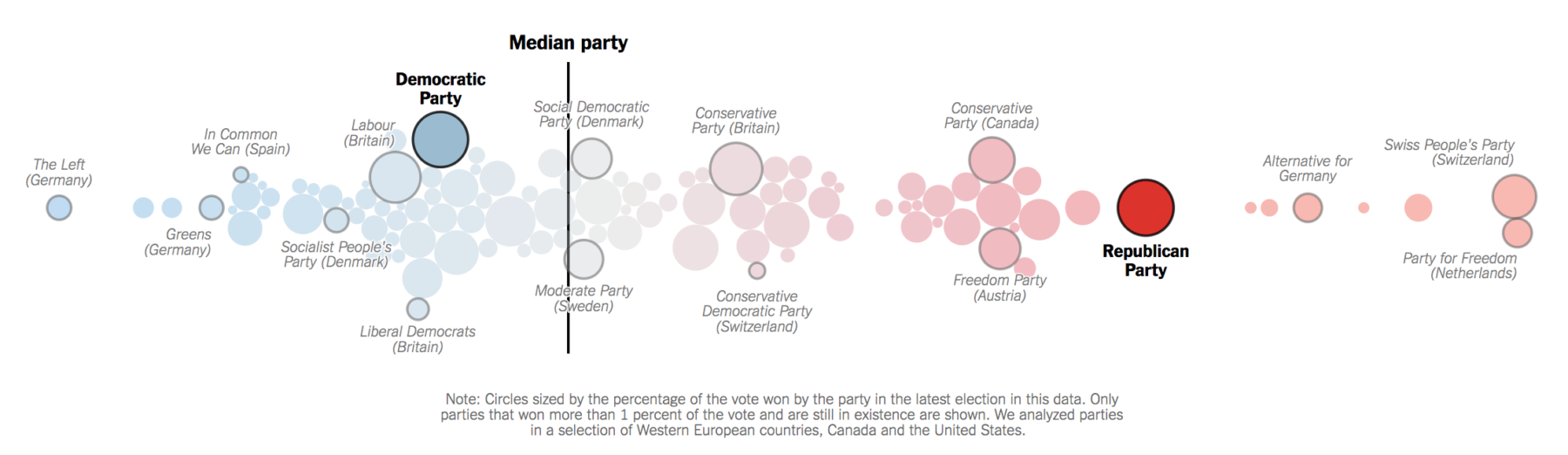

Where is America’s Political Center of Gravity?

Barry Ritholtz [New York Times, via The Big Picture 7-4-19]

Disrupting mainstream politics - British edition

The plot to keep Corbyn out of powerCorbyn takes Labour to ALL-TIME polling low: Just 18% would vote for the party in a general election as they slump to fourth place

:format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/18279463/Screen_Shot_2019_07_03_at_12.03.09_PM.png)

No comments:

Post a Comment