This past month I made a concerted effort to read the major reports to Congress submitted by First Secretary of the Treasury Alexander Hamilton. These reports are the foundation documents of the USA economy. And no, the USA economy was not based on the ideas of British imperial economist Adam Smith, whose ideas Hamilton flatly rejected in his reports.

The Second Report on the Further Provision Necessary for Establishing Public Credit was submitted to Congress on December 13th, 1790, and is often referred as The Report on a National Bank. In one section, where Hamilton explains the best structure for a central bank, he propounds a system of proportional shareholder representation in which no one "person, copartnership, or body politic" was allowed more than 30 votes, no matter how many shares they owned. Since this was a Founding Father prescribing a system of corporate ownership that was entirely at odds with the business management ideas of shareholder value, profit maximization, private equity, etc., etc., that have predominated for around the past half century, I was amazed when I began checking various biographies of Hamilton and found that none had pointed to this important fact.

Hamilton's plan of shareholder voting, if it had been extended beyond the central bank to other corporations, would have hampered, if not entirely crippled, the corporate raiders who destroyed tens of thousands of USA industrial facilities--beginning in the 1960s "go-go" years of mergers and acquisitions; the 1970s through 1990s "leveraged buyout" pirates like Michael Milkin and Kohlberg Kravis and Roberts; and contemporary "private equity" scammers like Peter G. Peterson's and Stephen A. Schwarzman's Blackstone Group; David Rubenstein's and Caspar Weinberger's Carlyle Group; Leon Black's Apollo Global Management; and Mitt Romeny's Bain Capital.

Hamilton agreed that larger shareholders should have a larger vote, but he clearly saw the danger that "a few principal Stockholders" could seize control of "the power and benefits of the Bank." Hamilton knew that to preserve the new experiment in republican self-government, any such dangerous concentration of economic power would have to be guarded against . Hamilton wrote:

“A vote for each share renders a combination, between a few principal Stockholders, to monopolise the power and benefits of the Bank too easy. An equal vote to each Stockholder, however great or small his interest in the institution, allows not that degree of weight to large stockholders, which it is reasonable they should have, and which perhaps their security and that of the bank require. A prudent mean is to be preferred.”But how to maintain the economic equality required to maintain republican government? Clearly, under a system of "one share, one vote," large concentrations of wealth could easily procure control of the bank. Accordingly, Hamilton proposed that no shareholder should have more than thirty votes:

“XI. The number of votes, to which each Stockholder shall be entitled, shall be according to the number of shares he shall hold in the proportions following, that is to say, for one share and not more than two shares one vote; for every two shares, above two and not exceeding ten, one vote; for every four shares above ten and not exceeding thirty, one vote; for every six shares above thirty and not exceeding sixty, one vote; for every eight shares above sixty and not exceeding one hundred, one vote; and for every ten shares above one hundred, one vote; but no person, copartnership, or body politic, shall be entitled to a greater number than thirty votes.”This is what Hamilton's scheme of shareholder representation looks like:

# of shares # of votes

1 1

2 1

3 2

4 2

5 3

6 3

7 4

8 4

9 5

10 5

11 5

12 5

13 5

14 6

15 6

16 6

17 6

18 7

. . . . .

22 8

. . . . .

26 9

. . . . .

30 10

. . . . .

36 11

. . . . .

42 12

. . . . .

48 13

. . . . .

54 14

. . . . .

60 15

. . . . .

68 16

. . . . .

76 17

. . . . .

84 18

. . . . .

92 19

. . . . .

100 20

. . . . .

110 21

. . . . .

120 22

. . . . .

130 23

. . . . .

140 24

. . . . .

150 25

. . . . .

160 26

. . . . .

170 27

. . . . .

180 28

. . . . .

190 29

. . . . .

200 30

. . . . .

300 30

. . . . .

1,000 30

. . . . .

10,000 30

. . . . .

100,000 30

. . . . .

1 million 30

Hamilton’s scheme of shareholder representation, had it been applied to all corporate ownership, not just a national bank, or banks in general, would have prevented the corporate raiders of the past half century who deindustrialized the USA, broke unions, looted pension funds, closed factories and relocated them overseas. This financial malfeasance has destroyed the USA working class--which now suffers declining life expectancy--and is now robbing the middle class of a better future It is not just fair, but vitally important, to infer that Hamilton was strongly opposed to anything like the "financial engineering" and "private equity" of today. And he certainly would have rejected Milton Friedman's, Michael C. Jensen's and William H. Meckling's ideas of maximizing profit and shareholder value.

Note also that Hamilton's scheme is clearly unfavorable to increasing concentrations of economic wealth. Holding 12 shares gives the holder only one half the number of votes. Holding 36 shares gives only one third. Holding over 100 shares gives only one fifth. Holding 1,000 shares gives the holder only 30 votes, or a mere 3/100 the number of votes. Holding 10,000 shares or one million shares, and the holder still gets only 30 votes. The more vampire-wealth held, the less weight each share of vampire-wealth is allowed. Here we see Hamilton carefully balancing the republican need for economic equality with the need to avoid alienating owners of wealth, even vampire-wealth.

If you want to see more such concentrations of wealth, just follow the links for each outfit listed on Wikipedia's list of Largest private equity firms by PE capital raised.

Throughout the reports, Hamilton explicitly wrote that the primary goal was to promote the general welfare and the public interest. In discussing the problem of a bank’s directors, officers or stockholders who may fear that “an extension of capital” to new enterprises may cause “a diminution of profits,” Hamilton wrote that “the interest and accommodation of the public” must be held superior “to the interest, real or imagined, of the Stockholders.” Hamilton expounded on this particular concern a year later, in Section VII of his December 1791 Report to Congress on the Subject of Manufactures, where he wrote

"Experience teaches that men are often so much governed by what they are accustomed to see and practice, that the simplest and most obvious improvements, in the most ordinary occupations, are adopted with hesitation, reluctance, and by slow gradations….

The apprehension of failing in new attempts is, perhaps, a more serious impediment. There are dispositions apt to be attracted by the mere novelty of an undertaking; but these are not always the best calculated to give it success. To this it is of importance that the confidence of cautious, sagacious capitalists, both citizens and foreigners, should be excited. And to inspire this description of persons with confidence, it is essential that they should be made to see in any project which is new—and for that reason alone, if for no other, precarious—the prospect of such a degree of countenance and support from government, as may be capable of overcoming the obstacles inseparable from first experiments.

Hamilton's discussion of the need for active government measures to counteract the natural inclination to do business "the way we've always done it," is followed in the Second Report on Credit by what can only be considered another broadside against the idea of shareholder value:

“It is true, that unless the [interests of the shareholders] be consulted, there can be no bank (in the sense at least in which institutions of this kind, worthy of confidence, can be established in this Country) but it does not follow, that this is alone to be consulted, or that it even ought to be paramount. Public utility is more truly the object of public Banks, than private profit. And it is the business of Government, to constitute them on such principles, that while the latter [private profit] will result, in a sufficient degree, to afford competent motives to engage in them, the former [public interest] be not made subservient to it.” [Emphasis added.]Elsewhere, Hamilton wrote that “…such a Bank is not a mere matter of private property, but a political machine of the greatest importance to the State.”

While there obviously must be enough profit in establishing and operating a bank to make it an attractive business enterprise, at the same time Hamilton saw that the maintenance of republican principles of government requires that all concentrations of wealth and economic power be rendered subservient to the general welfare. To ensure the public interest was always paramount, Hamilton prescribed another safeguard on the proposed bank's power:

V. The capacity of the corporation to hold real and personal estate shall be limited to fifteen millions of Dollars, including the amount of its capital, or original stock. The lands and tenements, which it shall be permitted to hold, shall be only such as shall be requisite for the immediate accommodation of the institution....In Hamilton's plan, the bank would be allowed to only own such property as it required to actually operate as a bank. It would not be allowed to own other banks and other companies. It would not be allowed to own its own trading portfolio. Imagine how this restriction would have prevented the rise to power of the new robber barons like the late deficit scold Peter Peterson, or 2012 Republican presidential nominee Mitt Romney. It would have prevented Wall Street's domination of the rest of the economy. And, the USA political scene would undoubtedly look much different, and much more beneficent, than it does today.

It should also be noted--given that many doctrinaire leftists and many historically ignorant progressives condemn Hamilton for having designed a capitalist system that favors the rich and the powerful--that the first example in USA history of a corporation stepping far beyond its charter was the Manhattan Company, which was formed in 1799 for the stated purpose of building a fresh water supply system for the southern part of Manhattan Island. This was a ruse: the company quickly became a highly profitable competitor to the Bank of New York, which had been established in June 1784 by a group led by Hamilton. The Manhttan Co. merged with Chase National Bank in 1955 to form the Chase Manhattan Bank, which in turn acquired J.P. Morgan Bank in 2000 to become the current JPMorgan Chase & Co. The animating spirit behind the deceitful Manhattan Company was Aaron Burr, who murdered Hamilton in a contrived duel in 1804.

Another safeguard Hamilton imposed was the mandated rotation of bank directors and officers to prevent the emergence of cabals and old boy networks. “The argument in favour of the principle of rotation is," Hamilton wrote, that it lessens "the danger of combinations among the Directors [intended] to make the institution subservient to party views, or to the accommodation... of any particular set of men..."

“When it is considered, that the Directors of a Bank are not elected by the great body of the community, in which a diversity of views will naturally prevail, at different conjunctures, but by a small and select class of men, among whom it is far more easy to cultivate a steady adherence to the same persons and objects; and that those Directors have it in their power so immediately to conciliate, by obliging the most influential of this class, it is easy to perceive, that without the principle of rotation, changes in that body can rarely happen, but as a concession which they may themselves think it expedient to make to public opinion.”Finally, in accord with his argument that a bank was much more important as an instrument of public good, than merely as a machine of private profit. Hamilton argued that the government should be able to thoroughly inspect the financial posture and strength of the bank at any time of the government's choosing.

“There is one thing, however, which the Government owes to itself and to the community; at least to all that part of it, who are not Stockholders; which is to reserve to itself a right of ascertaining, as often as may be necessary, the state of the Bank, excluding however all pretension to controul… If the paper of a Bank is to be permitted to insinuate itself into all the revenues and receipts of a country; if it is even to be tolerated as the substitute for gold and silver, in all the transactions of business, it becomes in either view a national concern of the first magnitude. As such the ordinary rules of prudence require, that the Government should possess the means of ascertaining, whenever it thinks fit, that so delicate a trust is executed with fidelity and care. [Emphasis added.]It may be objected that these restraints on corporate power and safeguards of the public interest were devised by Hamilton only for the central bank he proposed, and not for all corporations. It should therefore be understood that capitalism, at this time, did not really exist. At least, the word as used today did not come into general usage until after the 1850s and the publication of Marx's Capital. More specifically, the corporate form of economic organization did not become widespread until after general acts of incorporation began to be adopted by state legislatures in the 1820s. And, Hamilton's plan for the Bank of the United States was informed by his experience in creating and directing the Bank of New York. More to the point, was the example of the Bank of North America (chartered by the Pennsylvania legislature in 1781), which had been “‘all but crippled’ during the 1790s because a few powerful borrowers had monopolized its funds,” according to Henry Hansmann & Mariana Pargendler in the January 2014 Yale Law Journal.

But the crucial historical consideration is that Hamilton was building a nation and a republican form of government from scratch, with only the historical examples of monarchical, oligarchic, and despotic forms of economic organization as possible guides. From these historical examples the only certain desideratum was that economic concentrations of wealth must be restrained. The history of Great Britain and especially the British East India Company, was a constant reminder of how economic power can arrogate political power to itself, and use political power to further expand its holdings of vampire-wealth. At the same time, Hamilton realized that concentrations of wealth must not be so fettered and repressed that the quickening impulse of the profit motive is stifled. Thus the unusual scheme of shareholder representation, which would undoubtedly be anathema to today's captains of pirated industry such as Sheldon Adelson, Eddie Lampert, Robert Mercer, Nelson Peltz, and T. Boone Pickens. All the poison pill provisions of the 1980s and 1990s were unable to stop the looting and asset stripping of USA industrial companies. Imagine how much easier it would have been to protect industry from predatory finance if the most votes a shareholder could ever have was 30, no matter how many shares of a company's stock they amassed.

This again shows that the modern doctrine of shareholder value is directly contrary to the design for republican political economy, and inimical to the continuation of republicanism. The second great tragedy of American history, after slavery, is that capitalism has replaced republicanism. Yet there remains echoes of republican ideals in the body politics: this is why the majority of Americans feel things are going the wrong way, and resent the emergence of a new a new ruling class of corporatist oligarchs.

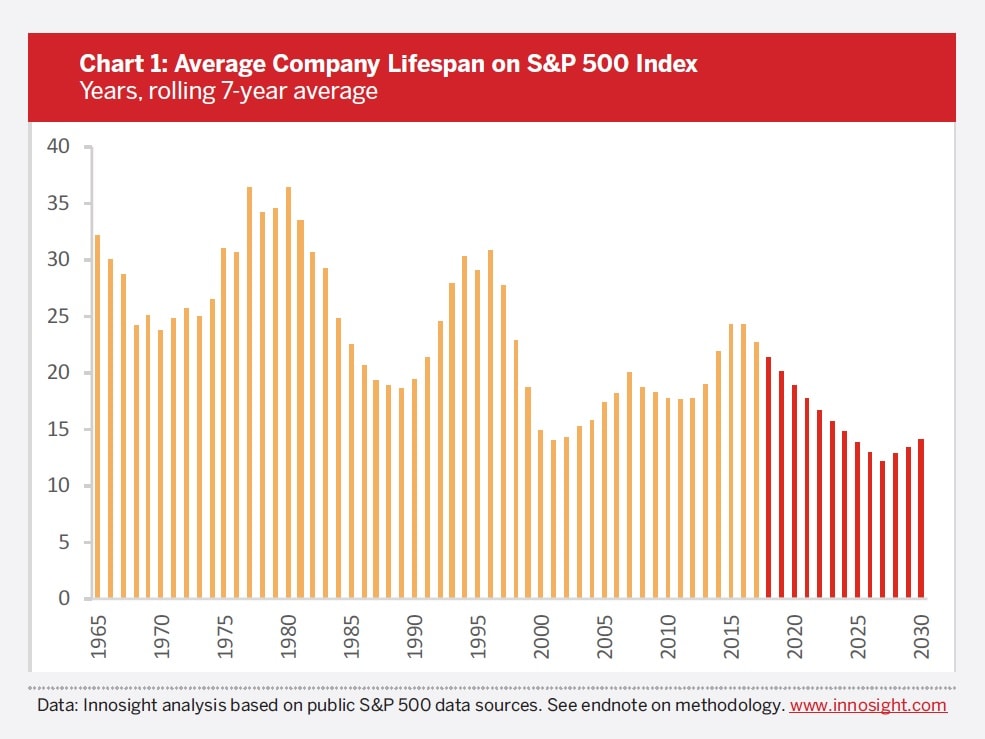

In great irony is that as economic power becomes increasingly concentrated, the USA is becoming less, not more, capitalistic: According to the 2018 Corporate Longevity Forecast, by Innosight, the average age of USA companies is now half what it was in the 1970s. In 1964, the average age of companies listed on the Standard and Poors 500 stock market index was 33 years. This average age had fallen to 24 years in 2016, and is now projected to fall to just 12 years within the next decade.

And, from another study, in 2013:

From Will capex come back? UBS Investment Research, by Andrew Cates, January, 10, 2013, page 3.

Graph is from Ian Hathaway and Robert E. Litan, Declining Business Dynamism in the United States: A Look at States and Metros, The Brookings Institute, May 2014.

USA capitalism has evolved in a direction that would have outraged Alexander Hamilton. Just look at Kohlberg Kravis and Roberts, the leveraged buyout corporate raiders that have poured tens of millions of dollars into the Republican Party and movement conservatism in the past three decades. KKR's $25 billion purchase of RJR Nabisco in 1989 was flagged by at least one Wall Street insider as being far above fair market value; the transaction only made sense when consideration was given to the opportunities provided for laundering of dirty money by RJR Nabisco's high-volume sales of consumer goods. This is a crucial point most Marxists and others on the left miss: USA capitalism in the past half century has fallen under the control of a ruling class that, in outlook, intent, and effect, is basically criminal, not entrepreneurial. This ruling class is not a legacy of Hamilton's program for nation building; it is, rather, a throwback to the slave-trading, opium-peddling ruling merchant class of the British empire, which has never discarded its innate hatred for the idea of republican self-government.

This was an excellent piece, Tony.

ReplyDelete