by Tony Wikrent

Economics Action Group, North Carolina Democratic Party Progressive Caucus

Economic Armageddon

Coronavirus batters US economy as 6.65 million file for unemployment last week[The Guardian April 2, 2020]

Some 3.3 million had filed for unemployment the previous week, bringing total claims to 9.95 million for the two weeks.US Labor Market Update

Len Kiefer April 3-2020

Click through to his animated gif graph, which helps visualize the catastrophic economic convulsion we are in. It takes a few seconds to get to the stunning, shocking end.

http://lenkiefer.com/img/charts_2020_04_03/claimsSA_2020_04_03.gif

Jobs Aren’t Being Destroyed This Fast Elsewhere. Why Is That?

Emmanuel Saez and Gabriel Zucman [NYT, via Naked Capitalism 4-1-20]

This dramatic spike in jobless claims is an American peculiarity. In almost no other country are jobs being destroyed so fast. Why? Because throughout the world, governments are protecting employment. Workers keep their jobs, even in industries that are shut down. The government covers most of their wage through direct payments to employers. Wages are, in effect, socialized for the duration of the crisis.

Instead of safeguarding employment, America is relying on beefed-up unemployment benefits to shield laid-off workers from economic hardship. To give just one example, in both the United States and Britain, the government is asking restaurant workers to stay home. But in Britain, workers are receiving 80 percent of their pay (up to £2,500 a month, or $3,125) and are guaranteed to get their job back once the shutdown is over. In America, the workers are laid off; they must then file for unemployment insurance and wait for the economy to start up again before they can apply for a new job, and if all goes well, sign a new contract and resume working....

This situation for laid-off workers would be bad enough if it were not aggravated by a second American peculiarity. As they are losing their jobs, many workers are also losing their employer-provided health insurance — and now find themselves faced with the Kafkaesque task of obtaining coverage on their own.

One option involves continuing to be covered by one’s former employer, a program known as COBRA. It is prohibitively expensive: Participants have to bear the full cost of insurance, $20,500 per year on average. Another option is to go shopping for a plan on the Affordable Care Act insurance exchange, where one is faced with a bewildering choice between plans like Blue Shield’s Bronze 60 PPO (with a deductible of up to $12,600 per year) and Aetna’s Silver Copay HNOnly (with a $7,000 deductible and up to $14,000 in annual out-of-pocket expenses). The last option is to join the ranks of the uninsured, a catastrophic solution during a pandemic. There are reports that people have already died of Covid-19 because they refused to go to the hospital, worried about bills, or because they were denied treatment for lack of insurance.Red April: What happens on the first of the month when residents, restaurants, and retail stores don’t pay rent?

Henry Grabar [Slate, March 27, 2020]

The astonishing job loss hints at the revenue crisis in restaurants, where data from Open Table shows restaurant reservations declining 100 percent in the United States since last year, and in retail, where many stores have been forced to close indefinitely. According to a 2016 JPMorgan study, the median independent retailer has enough cash to last 19 days; the median independent restaurant has enough for 16 days.

Residents alone owe $40 billion for the month. Retail and restaurants owe something on the same scale. April 1 will bring contract chaos when thousands of leaseholders decide not to pay, pushing a tide of unpaid debts from lessees to owners to banks—and sometime soon, a flood of litigation back from banks to owners to lessees.

Weirdly enough, the April rent strike is being led by Bolshevik institutions like Mattress Firm, Subway, and the Cheesecake Factory. On March 18, Cheesecake Factory CEO David Overton asked landlords for patience and help—and announced the restaurant would not be paying rent in April. Mattress Firm has told its landlords the same. And Subway declared the pandemic a force majeure, a legal term for an unforeseen event that voids contract obligations.... Pandemic surprise: When it comes to contract-breaking and collective action, chains are lawyered up and ready for Red April....

The data backs this up: Between 10 and 15 percent of Americans say they could not handle an emergency $400 expense, according to the Federal Reserve. A survey from the University of Chicago reported that a third of adults couldn’t cover necessities after missing one paycheck. One in 4 tenant families pays more than half its income in rent, and the rate is higher in high-rent, high-wage cities like New York and San Francisco, where service-sector jobs have vanished overnight....

Rent strikes are relatively rare in the U.S. and are mostly reserved for slumlords who don’t provide services like heat or extermination. But they have an important history: A wave of rent strikes in New York beginning after the First World War led to the nation’s first rent control law. That those strikes were a political and practical success, the historian Robert Fogelson observed in The Great Rent Wars, was thanks to strong support from the then-powerful Socialist Party, as well as the role of women whose domestic social life was perfect for daytime organizing.COVID-19: FORCE MAJEURE EVENT?

Shearman and Sterling

The CARES Act’s aid to state and local governments isn’t enough to shield vital public services from the coronavirus shock

[Economic Policy Institute March 27, 2020]

NEARLY 60 PERCENT OF U.S. WORKERS WON'T BE ABLE TO MEET THEIR BASIC FINANCIAL NEEDS UNDER ONE-MONTH CORONAVIRUS QUARANTINE, SURVEY SHOWS

[Newsweek 4-1-20]

[Business Recorder, via Naked Capitalism 4-2-20]

Grover Norquist’s Dismantled State Struggles to Respond

[Vanity Fair, via Naked Capitalism 4-2-20]

Trump’s latest tonal and tactical shift (and almost certainly not the last) was driven by several factors, both personal and political. Trump learned that his close friend, 78-year-old New York real estate mogul Stan Chera, had contracted COVID-19 and fallen into a coma at NewYork-Presbyterian. “Boy, did that hit home. Stan is like one of his best friends,” said prominent New York Trump donor Bill White. Trump also grew concerned as the virus spread to Trump country. “The polling sucked. The campaign panicked about the numbers in red states. They don’t expect to win states that are getting blown to pieces with coronavirus,” a former West Wing official told me. From the beginning of the crisis, Trump had struggled to see it as anything other than a political problem, subject to his usual arsenal of tweets and attacks and bombast. But he ultimately realized that as bad as the stock market was, getting coronavirus wrong would end his presidency. “The campaign doesn’t matter anymore,” he recently told a friend, “what I do now will determine if I get reelected.”This is why Biden and the national leadership of the Democratic Party are so painfully vulnerable to being outflanked on their left. Trump is basically a showman who excels at playing a crowd. That's why there are wild swings in what his policies are and why there have been so many resignations from his administration. He goes into one meeting, and hears most people say one thing, then he goes into another meeting and hears most people say something else. Trump not moored by any principles other than what his immediate circle of sycophants embody and regurgitate. The effect on his actual policies is that they tend to track the popular mood of the American people, hence Trump is a populist. But there is some lag because of conservative / libertarian ideological rigidity and opposition, which of course pulls Trump's populism in a reactionary direction. In these crises, people are increasingly demanding an active role by government in stopping the epidemic, and stopping the economic collapse. If that means expanding medicare, that's where Trump and his policies will be pulled. And as many leftists have noted, the American people actually poll strongly supportive of progressive policies, basically for expanding the role of government in promoting the General Welfare. BUT this is not true of the national leadership of the Democratic Party, which is so dependent on its wealthy donor base of market economy liberals. So, Trump can easily run to the left of Biden and the Democrats and win the election. How will Biden and Democratic leaders respond?

Coronavirus Is A Defining Test And American Government Is Failing It

[Huffington Post 3-27-20]

Democrats have come to expect Republicans to prioritize the financial interests of the wealthy over public health. But this is not a Republican bill. Not a single Senator in either party voted against it. And not even progressive stalwarts stood up to make a public case for a different approach. Despite all the talk in the 2020 primary about “revolution” and “blood and teeth,” when the most severe crisis for working people in a generation arrived, Sens. Bernie Sanders (I-Vt.) and Elizabeth Warren (D-Mass.) decided instead to quietly follow their leaders. The fiercest lions of the left acted like mewling kittens.

The pervasiveness of this leadership vacuum suggests we are witnessing not only a failure of will, but a breakdown in our political system. In a fascinating interview with Rolling Stone this week, Patrick Wyman ― a historian of late Roman and medieval crises ― argues that the great calamities of the past did not wreak havoc on their own. Instead, they exposed existing social fragilities, shattering what had slowly weakened in the lead-up to the disaster.

Donald Trump and this virus are only the proximate causes of our coming misery. A society that has devoted itself to escalating inequality is becoming ungovernable. The Senate bill represents the model of government that former Vice President Joe Biden wooed many Democratic voters with during the 2020 primary. It’s bipartisan, filled with compromise. Everyone seems to have had an ”epiphany” about working together and getting things done.

But what it has done is grotesque. Our government is so committed to serving the wealthy few that it cannot respond effectively even to a once-in-a-century crisis for the unmonied millions.“Pelosi Floats New Stimulus Plan: Rolling Back SALT Cap”

[New York Times, via Naked Capitalism Water Cooler 3-31-20]

“Speaker Nancy Pelosi suggested the next package include a retroactive rollback of a tax change that hurt high earners in states like New York and California. A full rollback of the limit on the state and local tax deduction, or SALT, would provide a quick cash infusion in the form of increased tax rebates to an estimated 13 million American households — nearly all of which earn at least $100,000 a year.”Lambert Strether notes: "Nice to see Pelosi focusing on property owners, not wage workers. Clarifying about where she sees her base."

Media Silent as Poll Workers Contract Covid-19 at Primaries That DNC, Biden Campaign Claimed Were Safe

[FAIR, via Naked Capitalism 3-30-20]

Florida GOP Realizes Deliberately Impoverishing the Unemployed Has Downsides

By Eric Levitz, April 3, 2020 (New York Magazine, Intelligencer]

Insurers knew the damage a viral pandemic could wreak on businesses. So they excluded coverage.

Florida GOP Realizes Deliberately Impoverishing the Unemployed Has Downsides

By Eric Levitz, April 3, 2020 (New York Magazine, Intelligencer]

When Republican Rick Scott became its governor in 2011, Florida already had one of the stingiest unemployment-insurance systems in the country.... As a result, businesses in Florida pay an average yearly unemployment-insurance tax of $50 per employee — the lowest rate in the country, and less than one-fifth of the national average.

[Now] Florida is completely unequipped to process the deluge of unemployment-insurance claims that the coronavirus pandemic has set off.... Under ordinary circumstances, Florida Republicans might be unbothered by all this; after all, as some of them admitted in interviews with Politico, the system is doing exactly what their party designed it to do — minimize the number of jobless Floridians who can access state aid, so as to minimize business owners’ tax obligations.

But this is an election year. So Republican governor Ron DeSantis and his allies are worried that their inability to get federal aid into the hands of needy workers could cost Donald Trump reelection: “It’s a sh– sandwich, and it was designed that way by Scott,” said one DeSantis advisor. “It wasn’t about saving money. It was about making it harder for people to get benefits or keep benefits so that the unemployment numbers were low to give the governor something to brag about.”

....One might think that, after this vivid demonstration of the Florida GOP’s malign indifference to the well-being of working people, the Sunshine State would be certain to go blue this November. But then again, this is a state whose disproportionately elderly voters elected Rick Scott as their governor, a man who oversaw the largest Medicare fraud in history; watched him transfer wealth from the middle class to the rich for eight years; and then promoted him to the Senate in 2018.

[Washington Post, via Naked Capitalism 4-3-20]

Why Congress’ Plan to Save Your Favorite Restaurant Might Fail

[Slate, March 26, 2020]

[Bloomberg, April 2, 2020, via Facebook]

Congress Failed to Make Cash Assistance Universal. Now Local Governments Must Step Up

[The Appeal, via Naked Capitalism 4-1-20]

Bailouts for the Rich, the Virus for the Rest of Us

by Rob Urie [CounterPunch 3-27-20]

It's so much easier for an airline exec to apply for $32 billion in bailout money than for a random poor person to apply for food stamps.

Matt Stoller [Twitter, via Naked Capitalism 3-31-20]

“Sebelius, Looking Back At ACA, Says The Country’s Never ‘Seen This Kind Of Battle'”

Why Congress’ Plan to Save Your Favorite Restaurant Might Fail

[Slate, March 26, 2020]

For the sake of speed, Congress chose to build on an old program run by the Small Business Administration that guarantees loans made by private banks. (Why would banks make loans the government will probably just wipe away? Because they’re getting paid commissions to do the underwriting.) This may be a faster way to get money out the door than creating a new lending program from scratch, since most small businesses already have some kind of banking relationship. But it’s still not entirely clear how quickly the effort will scale, and if it takes too much time, many restaurants and shops risk failing while they wait for help; according to the JPMorgan Chase Institute, only half of small businesses have enough cash to survive for 27 days without new revenue.

The biggest cause for worry, however, might simply be the insufficient sums of money available through the program.

First, the loans aren’t that large. Businesses will be permitted to borrow amounts up to 2.5 times the size of their average monthly payroll. They can spend that cash on wages, salaries, rent, mortgage interest, or utilities and still qualify for forgiveness, so there’s flexibility to cover key costs. But it’s only a couple months’ worth of help that won’t be enough to tide them over if this crisis lingers.

Second, the overall pot of money just isn’t that big. The government can make $349 billion in loans under the main program. Including the bill’s other help, the total help available to small businesses is $377 billion. As George Washington University economist Steven Hamilton and others have pointed out, that’s about half of what would be required to cover 2½ months of payrolls for every business in America with fewer than 500 employees, which are the program’s main targets (some larger firms, like midsize restaurant chains, are eligible too)....

Given all the uncertainty around this rescue effort, it would probably be smart for more places to follow the lead of cities like New York and Los Angeles, which have put a moratorium on commercial evictions. That will give small businesses time to apply for aid and hopefully stabilize themselves. Local governments could halt other debt collections. A federal freeze on small-business debt might have been a good idea too, but unfortunately never really seems to have been on the table.U.S. Doubles Small-Business Loans’ Rate to 1% After Lenders Balk

[Bloomberg, April 2, 2020, via Facebook]

The Small Business Administration has bumped up to 1% the interest rate lenders may charge small businesses under a $350 billion U.S. relief program after lenders complained that the previous approved rate of 0.5% was below even their own cost of funds.Running the small business rescue through the banking system may allow for a faster response, but it all hinges on the extent to which bankers are motivated by civic virtue instead of self interest. Given that the past half century has been ruled by free market doctrines explicitly based on self interest, I immediately thought something like was going to happen.

U.S. Treasury Secretary Steven Mnuchin and Small Business Administration Administrator Jovita Carranza released additional guidelines for the program just a few hours before it is expected to become widely available Friday. Banks and other lenders that are key to carrying it out had said they lacked guidance on how to complete the loans, including what documentation is required from borrowers and how to verify it.

Congress Failed to Make Cash Assistance Universal. Now Local Governments Must Step Up

[The Appeal, via Naked Capitalism 4-1-20]

How to Handle $350 Billion in Loans? No One Knows

[Bloomberg, March 27, 2020]

America's small business bailout is off to a bad start

[Axios, April 3, 2020]

COVID-19: Winners and Losers

[Bloomberg, March 27, 2020]

America's small business bailout is off to a bad start

[Axios, April 3, 2020]

COVID-19: Winners and Losers

[Baseline Scenario, via Naked Capitalism 4-2-20]

Amazon will be a big winner, of course. A large proportion of the population, particularly among the affluent, already reflexively shopped for everything at Amazon. (I used to, but now I try to find things elsewhere first, basically for political reasons.) The pandemic is pushing more people to try to fulfill all of their consumer needs online, and they aren’t going to stop when the coast clears.

More generally, big chains will expand their domination over the economy. Tens of thousands of small businesses will vanish, never to return, wiped out by weeks or months of zero revenues. Large corporations will have the capital to swoop in and steal their customer base. Family-owned restaurants will be replaced by national chains. Sporting goods stores will be replaced by Dicks. Electronics shops, if there are any left, will be replaced by Best Buy. Bookstores … well, there aren’t many of those left, anyway.

The other winners will be private equity funds with the nerve to buy assets on the cheap. After the financial crisis, investment funds bought up single-family homes in foreclosure, becoming some of the nation’s largest landlords. This time, the bargains will be found in small businesses desperate for capital and commercial real estate hammered by defaulting tenants.

The business sector will become more concentrated. Inequality will increase. The fundamental trends that have reshaped the American economy over my lifetime will accelerate. The survival of capitalism depends on a large enough proportion of the population having a stake in its survival. For how much longer?

Bailouts for the Rich, the Virus for the Rest of Us

by Rob Urie [CounterPunch 3-27-20]

Where are the bailouts for the people? $1,200 checks against $30,000 bills for being treated for coronavirus? Why isn’t providing healthcare for all of the people the primary objective of the bailouts?

....When Mr. Trump uttered ‘our country wasn’t built to be shut down,’ one could be forgiven for asking whose country he was talking about and why it can’t be shut down? The country that most of us inhabit has been in the process of being shut down for some four decades through outsourcing, privatization, austerity and cuts to the social safety net.

One of the truths spoken aloud in a moment of political panic is that the Federal government can create as much money as it cares to and spend it any way that it sees fit. Neel Kashkari, President of the Minneapolis Federal Reserve, reconfirmed this truth. This reframes poverty, student debt, inadequate healthcare, Social Security shortfalls and austerity as political choices, not facts of nature. It also means that the thousands of workers being sent to early deaths from coronavirus could just as easily be saved.

....Most readers probably don’t know this, but the Federal Reserve began re-bailing out Wall Street early last Fall, well before the coronavirus hit. Why this matters is that it indicates that nothing was fundamentally fixed through earlier bailouts.... This gets to the nature and structure of the economy that is being ‘saved.’ The problem in a pandemic is that no one is producing the stuff that money could otherwise buy. Mr. Trump and Congress can wish large amounts of money into existence. But doing so only produces the money, not the stuff to buy. And without the stuff to buy, money is worthless. So it’s fair to say that workers create the wealth that Wall Street exists to redistribute upwards.

But consider this in the context of the current bailouts. Donald Trump, Congress and the Federal Reserve wish trillions of dollars into existence and they decide how it gets allocated. The already rich and connected— financial speculators, corporate executives and other oligarchs, get most of it. This gives them the power to buy the stuff that workers produce. Workers receive enough to not starve for a couple of weeks, and then it’s back to work to die in the pandemic. And here’s the punchline: it has always been like this. Poverty and want are political choices.

It's so much easier for an airline exec to apply for $32 billion in bailout money than for a random poor person to apply for food stamps.

Matt Stoller [Twitter, via Naked Capitalism 3-31-20]

“Sebelius, Looking Back At ACA, Says The Country’s Never ‘Seen This Kind Of Battle'”

[Kaiser Health News].

[ROVNER:] Now it’s 10 years later, the law is more popular than ever. And yet there are still some big problems in the nation’s health care system, including levels of cost sharing, surprise bills, so that even people who do have insurance are worried about costs when accessing care. Why didn’t the Affordable Care Act fix everything?

[SEBELIUS:] Frankly, it probably would have been better to be a government takeover of health care. We got blamed for it. And yet we really didn’t do that. We ran most of this through the private system. So costs are still blossoming out of control. We’ve talked about how the public option would have been a lever for that, which we don’t have. Surprise billing wasn’t even an issue until investment bankers began buying specialty practices and figuring out, Oh, there’s a new way to make money.

And, I also think, often the Affordable Care Act is blamed for employers shifting massive costs onto their employees in employer-based health care plans, which weren’t really tampered with by the Affordable Care Act. That was always to be left alone. So we own all the bad.

Lambert Strether: "So, ten years later, Sebelius admits that the 2009 ACA critique by single payer advocates was correct in every respect. And yet, single payer is not a policy supported by serious people in the Beltway, and its advocates have no seats at the table. It’s just like Iraq, where everyone responsible for that debacle has more power than ever!"

Progressive policies into the breach

There was always a way to pay for the programs we needSam Adler-Bell, March 30, 2020 [The Outline]

One (yes, one) month ago, on February 24, during a CNN town hall, Chris Cuomo asked Sen. Bernie Sanders how he planned to pay for his free college plan. At this point, Bernie was the frontrunner in the Democratic presidential primary (yes, that was one month ago). He had been asked dozens of times, over and over and over, how he would pay for his ambitious agenda: Medicare for All, the Green New Deal, free childcare, cancelling medical and student debt. You could set your watch to it; some portion of every debate would involve 10 to 15 minutes of inane back-and-forth about how to finance Bernie’s agenda (often with former Vice President Joe Biden leading the charge.) The question — how will you pay for it? — was effectively the only substantive criticism of Sanders offered by his democratic opponents, debate moderators, and cable news pundits during the course of the campaign. And they were never satisfied with his answers.

Now, as Congress prepares to pass a $2 trillion aid package, the largest in modern U.S. history, one question no one is asking is: “How are we going to pay for it?” It has disappeared from the discourse entirely.... Reasonable readers might ask: If the deficit was a problem two months ago, why isn’t it a problem now? If there wasn’t money for Bernie’s agenda in February, why is there two trillion dollars available now to fund precisely the sort of working-class relief Bernie has been advocating for years?The Coronavirus Depression Requires A New Approach to Budgeting: Congress Needs to Let Go of its Illusion of Control

....the government doesn’t really pay for stuff with tax revenue. This is one of the central insights of Modern Monetary Theory (MMT), of which Kelton is a proponent. Instead of raising taxes to pay for government spending, the order of operations is flipped. The government spends money by creating it — in our day and age, with the click of a button — and it taxes it out of circulation. When Congress passes a bill, it sends instructions to the Federal Reserve (our central bank), and the Federal Reserve makes payments on behalf of the Treasury, crediting whichever accounts are beneficiaries of the spending—whether or not the spending is offset by taxes. “You write a bill, you pass the bill, you send instructions to the Fed, the Fed carries out the payments,” says Kelton. “That’s how it works. In war time, in peace time. That’s just how it works.”

Nathan Tankus, April 1, 2020

The size of the forgivable loans in the Small Business Association program certainly wasn’t picked based on the enormous need small businesses have to make payroll and rent. What exactly is the purpose of capping the program at a specific dollar amount? When they run out of funds, is the need for small businesses to make payroll any less? Are those who get in their applications after the funds appropriated run out any less deserving of the funding to make payroll payments than the small businesses who got funds?

The reality, of course, is this program is likely to be extended. But when? And by how much money? Will the small businesses who need it now be able to wait for the extended negotiations over extending it?

In the best of times the federal government budgeting in specific dollar amounts was silly. Congress is attracted to this kind of budgeting because it suggests their capacity to exactly control how much the federal government is spending and thus (in theory) the deficit.

The Big Unanswered Questions about the Federal Reserve's Coronavirus Response

Nathan Tankus, , April 2

[LehighValleyLive, via Naked Capitalism Water Cooler 3-31-20]

[New York Times 3-29-20]

How the GOP’s War on Government Paved the Way for Trump’s Deadly Incompetence

David Corn, March 13, 2020 [Mother Jones]

[Twitter, via Naked Capitalism 4-4-20]

David Begnaud @DavidBegnaud

Replying to @DavidBegnaud @BinderFaith1 and @POTUS

The missing six weeks: how Trump failed the biggest test of his life

[The Guardian, March 28, 2020]

The worst element of the Federal Reserve’s response to date has unquestionably been its failure to respond to the fiscal crises Coronavirus has created for state and local governments. The excellent New York Times Federal Reserve reporter Jeanna Smialek wrote a piece which recounts in infuriating detail why the Federal Reserve has been so slow to “intervene” into municipal debt markets. They are worried about picking winners and losers (which apparently is only a concern with this market and no others…), taking losses and the idiosyncratic nature of the municipal and state debt markets. These concerns are not very compelling. The most powerful thing the Federal Reserve can do in this moment is prevent state and local government austerity. The distributional consequences of letting high unemployment and collapsed social services (especially healthcare spending) accrue is far higher than “subsidized” interest rates to governmental organizations. Finally, if they do primary market purchases than it doesn’t matter how the overall market is structured. Municipalities themselves can buy back their own debt.

Michael Hudson [Marketplace, via Naked Capitalism 4-3-20]

[New York Magazine, via Naked Capitalism Water Cooler 4-2-20]

“[A]s an extraordinary, exogenous shock to a badly broken status quo order, the COVID-19 pandemic has also expanded the spectrum of imaginable futures and political possibilities. And some of those possibilities have been a sight for sore socialists’ eyes…. [T]he prospect of mass un-insurance in the middle of a pandemic has thrown a spotlight onto the perversity of our nation’s employer-based health-care system. The deepening economic crisis has also exposed the inescapably political foundations of the market economy…. Finally, the pandemic has raised awareness of the profound social value that grocery-store clerks, warehouse workers, and deliver drivers create — and the failure of markets, as currently structured, to adequately compensate such labor….Bailing Out the Bailout: It will take years to sort through the details, but Trump’s $2 trillion COVID-19 response looks like a double-down on the last disaster

Matt Taibbi, March 32, 2020 [Rolling Stone]

Richard C. Cook, April 4, 2020 [Public Banking Institute]

Congress needed a year of intense infighting to approve a $4.7 trillion budget, but just a single week to draft this $2 trillion deal. Although members quibbled over numbers before the vote — Bernie Sanders insisted on more unemployment insurance.... Like 2008, only more so, the new mega-rescue is a bipartisan effort. Lawmakers sold this as a good thing….

As happened in the run-up to September 2008, Wall Street in recent weeks warned of Armageddon if the Fed did not immediately start spending billions per minute to buy every conceivable kind of financial product. The Fed responded by dusting off emergency lending facilities like the Term Asset-Backed Securities Loan Facility, the Commercial Paper Funding Facility, the Money Market Mutual Fund Liquidity Facility, the Primary Dealer Credit Facility, the Secondary Market Corporate Credit Facility, and the Primary Market Corporate Credit Facility, all of which saw action after the crash of 2008. Each would be used to step in and buy financial products in the various markets frozen due to virus panic....

The problem? A lot of these markets were already overinflated thanks to post-2008 bailouts and interventions like Quantitative Easing. We’re about to find out that the American economy has been living off dying, dysfunctional, or hyper-leveraged markets for more than a decade. The Trump administration just bought this undead economy at retail prices and committed the Fed and the Treasury to sustaining it. A major issue with the post-2008 bailout programs is that they tended to increase rather than decrease the risk in the system. A decade-plus of zero-to-low interest rates and massive central-bank buying programs like QE made traditional safe havens unattractive and pushed investors to chase returns in a variety of not-so-healthy ways.…

Short-term loans to make payroll and keep tenants in storefronts are only a part of the rescue. The coronavirus emergency is probably temporary. The bailout looks like forever.”Former U.S. Treasury analyst: Solution to coronavirus crisis is to reconstitute the Federal Reserve as a public utility

Richard C. Cook, April 4, 2020 [Public Banking Institute]

Capitalism in the time of COVID

‘Swamp Creatures’ Attack Effort To Make Medicines American Again

[American Conservative 3-28-20]

According to Peter Navarro, Trump’s top trade representative, Big Pharma has been the main obstacle to getting an executive order that he crafted signed by President Trump. At a time when the country is experiencing mounting shortages of medicine and supplies and a bill has come due for all of the off-shoring of our pharmaceuticals, particularly our generic medicines, the order would endeavor to begin re-balance the supply channels by streamlining regulatory approvals for “American-made” products and encourage the U.S. government, including the Department of Defense, Department of Health and Human Services, and Department of Veterans Affairs, to only buy American-made medical products.

But in a fear campaign launched over the last two weeks, Big Pharma has seeded doubts by insinuating that the EO would obstruct the flow of much needed medicines and equipment right now during the current public health crisis. Spectator USA Washington Editor Amber Athey obtained a letter sent to the president by the Big Pharma trade group,the Association for Accessible Medicines (AAM), which has 40 signatories. In it, the group says that the current supply chains have “been built over decades and include appropriate safeguards to ensure safety and efficacy of products.” (We know from excellent reporting by Rosemary Gibson that this is wholly untrue.)“‘Seize It’: Progressives Urge Philadelphia City Govt. to Take Hahnemann Hospital After Owner Demands $1 Million a Month in Rent”

[Common Dreams, via Naked Capitalism Water Cooler 3-31-20]

“Sen. Bernie Sanders on Monday joined a rising chorus of progressives demanding the city of Philadelphia seize the shuttered 500-bed Hahnemann hospital from its owner, investment banker Joel Freedman, and reopen the facility to handle the coming peak infections of the coronavirus in the city.” [Lambert Strether: "Isn’t this why we have eminent doman? Pennsylvania seems unlucky in its rentiers:"]Thanks to taxpayer bailout, Easton Hospital still in the COVID-19 fight

[LehighValleyLive, via Naked Capitalism Water Cooler 3-31-20]

In February alone the hospital lost $5 million, Steward officials said.... Steward threatened to close the hospital at midnight Friday, alleging that Gov. Tom Wolf had backtracked on a promise of $8 million a month to keep Easton running for up to three months. Steward wanted a firm guarantee of funding beyond the first month if the state insisted on Easton staying open at least until June 30.The U.S. Tried to Build a New Fleet of Ventilators. The Mission Failed.

[New York Times 3-29-20]

In 2006, the Department of Health and Human Services established a new division, the Biomedical Advanced Research and Development Authority, with a mandate to prepare medical responses to chemical, biological and nuclear attacks, as well as infectious diseases.

In its first year in operation, the research agency considered how to expand the number of ventilators. It estimated that an additional 70,000 machines would be required in a moderate influenza pandemic....

The medical device industry was undergoing rapid consolidation, with one company after another merging with or acquiring other makers. Manufacturers wanted to pitch themselves as one-stop shops for hospitals, which were getting bigger, and that meant offering a broader suite of products. In May 2012, Covidien, a large medical device manufacturer, agreed to buy Newport for just over $100 million.Lambert Strether added: This is very much “sabotage” as Veblen would have understood it: “a deliberate restriction of the productivity of capital and labor in order to keep prices and profits higher.”

How the GOP’s War on Government Paved the Way for Trump’s Deadly Incompetence

David Corn, March 13, 2020 [Mother Jones]

[Axios, via Naked Capitalism 3-30-20]

A plane from Shanghai arrived at John F. Kennedy International Airport in New York Sunday morning carrying an extraordinary load: 12 million gloves, 130,000 N95 masks, 1.7 million surgical masks, 50,000 gowns, 130,000 hand sanitizer units, and 36,000 thermometers....

The airlift is the most dramatic part of the Trump administration's frantic attempts to catch up with a nationwide medical equipment crisis.... The federal government bought 60% of the total load and all of the N95 masks carried on the plane from Shanghai, according to Devin O'Malley, an official on the White House's coronavirus task force.

Of 60% the government bought, roughly half the supplies are going to New York, a third to New Jersey and one-fifth to Connecticut, he said. O'Malley said it's up to the governors to distribute the supplies they receive. The remaining 40% from the flight is going to the private market in the tri-state area, where the distributor had already lined up buyers, he added.

[Twitter, via Naked Capitalism 4-4-20]

David Begnaud @DavidBegnaud

This is so important for everyone to understand. This explains why Governors say: I'm not getting the supplies I need - yet @POTUS says we are sending tons of supplies: It's going from the federal govt to commercial distributors who then deliver to the highest bidder: states!AmeliaRose @AmysandersonAmy Apr 3

Replying to @DavidBegnaud @BinderFaith1 and @POTUS

- Old Way: FEMA gives to HOSPITALS For FREE.

- New Way: FEMA sells it to WHOLESALERS who sells it to RETAILERS who sell it to HOSPITALS in a bidding war with other hospitals

- Did I Get that right?

[WCVB, via Naked Capitalism 4-4-20]

After losing that initial order, Baker said his administration landed on a cooperative effort involving New England Patriots owner Robert Kraft, Ambassador Huang Ping, Dr. Jason Li, Gene Hartigan and the state's COVID-19 Command Center. The coalition arranged a purchase of the masks in China, which were flown back to Massachusetts Thursday aboard a New England Patriots private plane.

This is what neo-confederate conservatism / libertarianism has led us to in this crisis: state governments have been forced to negotiate on their own with foreign governments.

[Immigrants as a weapon 3-28-20]

‘Swamp Creatures’ Attack Effort To Make Medicines American Again

[The American Conservative, via Naked Capitalism 3-30-20] More sabotage.

Private equity eyes industries crippled by coronavirus: ‘They have been waiting for this’ CNBC, via Naked Capitalism 3-30-20]Because of course.

Charles Koch Network Pushed $1 Billion Cut To CDC, Now Attacks Shelter-In-Place Policies For Harming Business The Intercept, via Naked Capitalism 3-30-20]

Bonanza for Rich Real Estate Investors, Tucked Into Stimulus Package

[New York Times 3-26-20, via Naked Capitalism 3-29-20]

A small change to tax policy could hand $170 billion in tax savings to real estate tycoons.

Senate Republicans inserted an easy-to-overlook provision on page 203 of the 880-page bill that would permit wealthy investors to use losses generated by real estate to minimize their taxes on profits from things like investments in the stock market. The estimated cost of the change over 10 years is $170 billion.

Under the existing tax code, when real estate investors generate losses from gradually writing down the value of their properties, a process known as depreciation, they can use some of those losses to offset other taxes. The result is that people can enjoy big tax breaks stemming from only-on-paper losses, even if they enjoy big cash profits in the real world.

After losing that initial order, Baker said his administration landed on a cooperative effort involving New England Patriots owner Robert Kraft, Ambassador Huang Ping, Dr. Jason Li, Gene Hartigan and the state's COVID-19 Command Center. The coalition arranged a purchase of the masks in China, which were flown back to Massachusetts Thursday aboard a New England Patriots private plane.This is what neo-confederate conservatism / libertarianism has led us to in this crisis: state governments have been forced to negotiate on their own with foreign governments.

[Immigrants as a weapon 3-28-20]

‘Swamp Creatures’ Attack Effort To Make Medicines American Again

[The American Conservative, via Naked Capitalism 3-30-20] More sabotage.

Private equity eyes industries crippled by coronavirus: ‘They have been waiting for this’ CNBC, via Naked Capitalism 3-30-20]Because of course.

Charles Koch Network Pushed $1 Billion Cut To CDC, Now Attacks Shelter-In-Place Policies For Harming Business The Intercept, via Naked Capitalism 3-30-20]

Bonanza for Rich Real Estate Investors, Tucked Into Stimulus Package

[New York Times 3-26-20, via Naked Capitalism 3-29-20]

‘Swamp Creatures’ Attack Effort To Make Medicines American Again

[The American Conservative, via Naked Capitalism 3-30-20] More sabotage.

Private equity eyes industries crippled by coronavirus: ‘They have been waiting for this’ CNBC, via Naked Capitalism 3-30-20]Because of course.

Charles Koch Network Pushed $1 Billion Cut To CDC, Now Attacks Shelter-In-Place Policies For Harming Business The Intercept, via Naked Capitalism 3-30-20]

Bonanza for Rich Real Estate Investors, Tucked Into Stimulus Package

[New York Times 3-26-20, via Naked Capitalism 3-29-20]

A small change to tax policy could hand $170 billion in tax savings to real estate tycoons.

Senate Republicans inserted an easy-to-overlook provision on page 203 of the 880-page bill that would permit wealthy investors to use losses generated by real estate to minimize their taxes on profits from things like investments in the stock market. The estimated cost of the change over 10 years is $170 billion.

Under the existing tax code, when real estate investors generate losses from gradually writing down the value of their properties, a process known as depreciation, they can use some of those losses to offset other taxes. The result is that people can enjoy big tax breaks stemming from only-on-paper losses, even if they enjoy big cash profits in the real world.

The Pandemic

[Twitter, via Naked Capitalism 4-1-20]

Map Reveals Hidden U.S. Hotspots of Coronavirus Infection

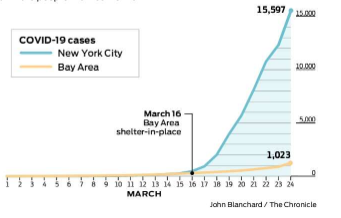

Alan Cole @AlanMCole Mar 30It's very hard to look at this and tell any other story besides the obvious one about the one key local governance decision. https://sfchronicle.com/health/article/NY-has-10-times-the-coronavirus-cases-CA-has-Why-15154692.php

Map Reveals Hidden U.S. Hotspots of Coronavirus Infection

[Scientific American, via Naked Capitalism 4-3-20]

...a team from the University of Chicago has mapped confirmed COVID-19 infections per county—and has adjusted for population sizes. The researchers’ findings reveal significant clusters in parts of Georgia, Arkansas and Mississippi, among other areas. Even though the involved populations may be smaller than those of New York or Seattle, they could be disproportionally hit by the disease.

“When you flip from just state-level data to county-level data, you get a lot more information,” says Marynia Kolak, assistant director of health informatics at the University of Chicago’s Center for Spatial Data Science, who co-led the team that created the maps. “For example, there are a lot of areas in the South where the population is a lot smaller, but the proportion of people who have [COVID-19] is a lot greater.

The missing six weeks: how Trump failed the biggest test of his life

[The Guardian, March 28, 2020]

20 January 2020 is certain to feature prominently. It was on that day that a 35-year-old man in Washington state, recently returned from visiting family in Wuhan in China, became the first person in the US to be diagnosed with the virus. On the very same day, 5,000 miles away in Asia, the first confirmed case of Covid-19 was reported in South Korea. The confluence was striking, but there the similarities ended.How to set up an ICU

[London Review of Books, via Naked Capitalism 4-4-20]

California once had mobile hospitals and a ventilator stockpile. But it dismantled them

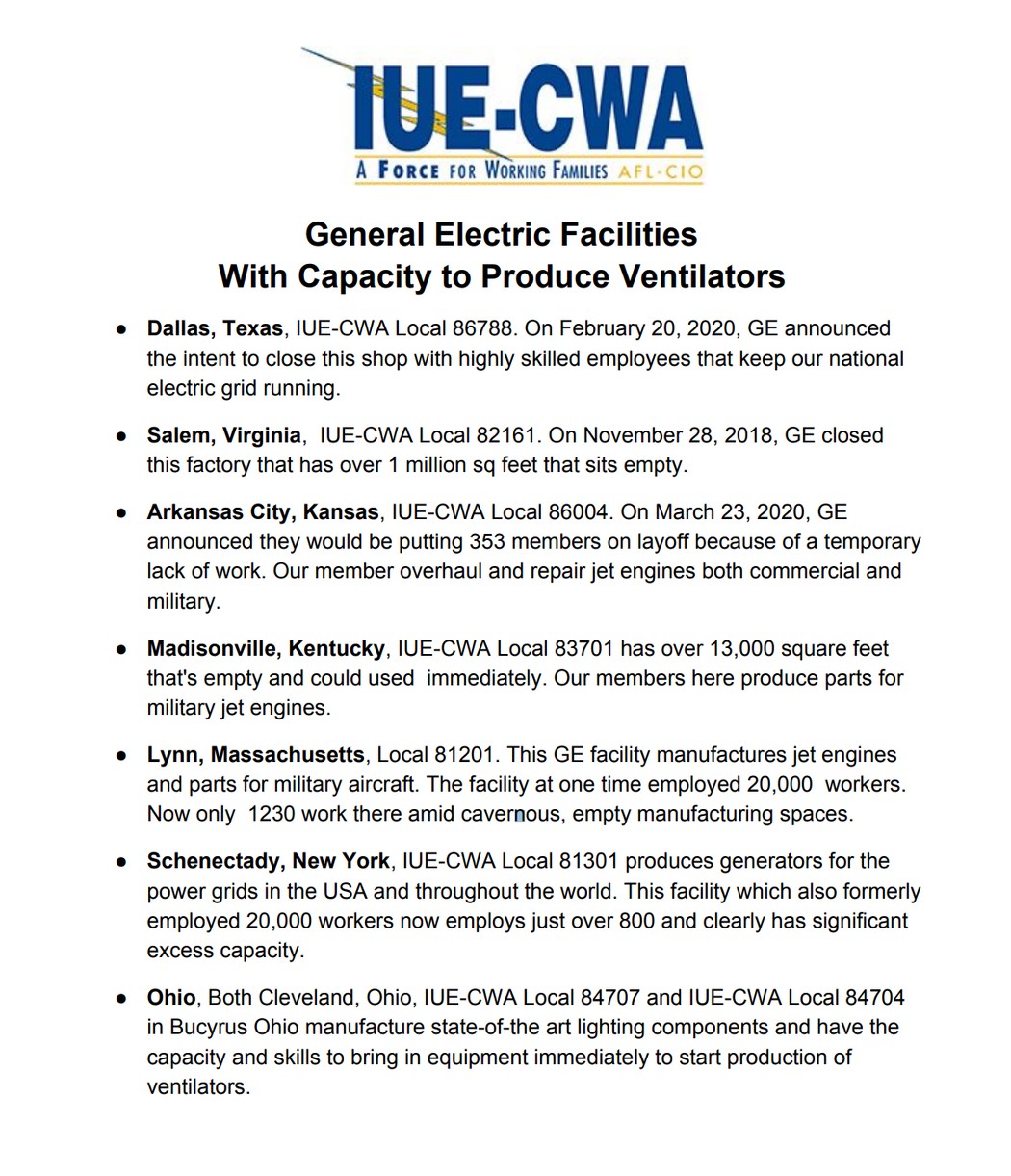

General Electric Workers Launch Protest, Demand to Make Ventilators

California once had mobile hospitals and a ventilator stockpile. But it dismantled them

[Los Angeles Times, via Naked Capitalism 3-29-20]

Creating new economic potential - science and technology

Abbott Launches 5-Minute Virus Test for Use Almost Anywhere

[Bloomberg, via Naked Capitalism 3-29-20]

[Vice, via Naked Capitalism 3-31-20]

[MIT News, via Naked Capitalism 3-30-20]

The new device is designed to hold an Ambu bag (blue), which hospitals already have on hand in abundance. Ambu bags are designed to be squeezed by hand to administer anesthetic. In this design, the Ambu bag squeezed by mechanical paddles (center) driven by a small motor. This directs air through a tube which is placed in the patient's airway.

The new device is designed to hold an Ambu bag (blue), which hospitals already have on hand in abundance. Ambu bags are designed to be squeezed by hand to administer anesthetic. In this design, the Ambu bag squeezed by mechanical paddles (center) driven by a small motor. This directs air through a tube which is placed in the patient's airway.

[New Atlas, via Naked Capitalism 4-2-20]

.png)

No comments:

Post a Comment